AML, KYC regulations in the EU: The Union’s war vs. illicit finance

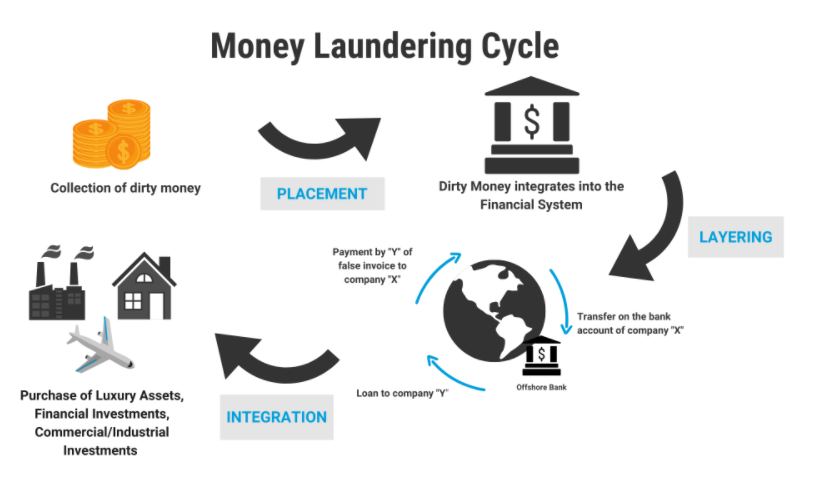

Money laundering, in itself, is straightforward. It’s when money sourced from illegal activities is invested in legitimate businesses, funds or properties—this is how the dirty cash is cleaned or laundered. The end result? Illicit money injected and circulated into the economy. It’s one way for organised criminal groups and suspicious individuals to hide their true source of wealth, as well as their activities.

Often, these activities are against the law; in some cases, it’s funding terrorism. That is why financial watchdogs and governments are committed to combating money laundering, implementing Know Your Customer or KYC regulations, Customer Due Diligence or CDD and Anti-Money Laundering or AML policies. These are implemented not only to preserve the economic standing of a jurisdiction or ensure that correct taxes are paid but, more importantly, to fight crime and terrorism.

Between €715 billion and €1.87 trillion are attributed to money laundering globally every year, according to reports by the United Nations Office on Drugs and Crime (UNODC). The organisation explains here the cycles of money laundering.

EU Directives

In Europe, government bodies have been, for decades, attempting to rid dirty money of their nations. The European Union, in particular, has various legislations that track down and prevent illicit financial flow involving individual investors, potential money mules and questionable institutions, amongst others. These legislations are continually being amended and reformed as the financial system evolves over time, especially amidst the Covid-19 pandemic when more transactions have migrated to the digital space.

Quoted in a DW news report, the EU Commission Executive Vice President Valdis Dombrovskis said: ‘The rules we have in place to prevent money laundering are amongst the toughest in the world, but they must also now be systematically applied’. Dombrovskis was referring to the CTF, AML, KYC regulations in the EU.

AMLD 6

In 2021, the EU Commission’s proposed sixth amendment to its union-wide Anti-Money Laundering Directive—AMLD 6—came into effect. Financial institutions within the jurisdiction of all member states were required to adhere to the AMLD 6 by June 2021. AMLD 6 takes up the existing regulations under its predecessor, AMLD 5 and has established a more consistent definition of ‘money laundering’ and ‘financial terrorism’. Under Article 4 of the AMLD 6, regulation, aiding, abetting, inciting and attempting to launder money are now criminal offences.

What’s more, the sixth directive has expanded the involvement of supervisors and financial intelligence units or FIU, when speaking of AML and KYC regulations. Here are some of the amendments implemented under the new EU legislation:

- A more harmonised approach in supervising financial entities and individuals that are obligated to undergo AML and CTF measures,

- Member states have the prerogative to detail the responsibilities of FIUs and authorised bodies that carry out AML and CTF procedures

- Consistent legal framework with other union policies, such as regulations that subject crypto asset service providers and crowdfunding service providers to AML, CTF and CDD policies (RELATED: What is the Directive on Administrative Cooperation or DAC 8?)

- Amendments to CDD rules in relation to digital or electronic onboarding process of clients of financial institutions

In a 2018 press release, the EU Commission stated ‘The aim of this package is to improve the detection of suspicious transactions and activities, and to close loopholes used by criminals to launder illicit proceeds or finance terrorist activities through the financial system’.

Mairead McGuinness of the Commission added ‘The scale of the problem cannot be underestimated and the loopholes that criminals can exploit need to be closed’.

As an AML and KYC solutions provider, Bolder Group keeps up with the latest compliance regulations that may affect its clients. To help you learn more about AML and KYC policies, we have gathered key information that may impact businesses in the locations we serve:

(READ ALSO: AML and KYC policies in the Americas)

AML, KYC policies in the Netherlands

Data from the Basel AML Index shows that between 2016 and 2021, the Netherlands has the highest risk of money laundering in the Benelux region (Belgium, the Netherlands, Luxembourg). The index looks into ML risk indicators, such as corruption, financial standards and legislation involving the finance industry.

The De Nederlandsche Bank (DNB), the country’s central bank, is responsible for supervising the integrity of the nation’s financial system by making sure the following are complying with the AML, KYC regulations in the EU and Netherlands itself:

- Banks

- Life insurance providers

- Payment service providers

- E-money institutions

- ForEx institutions

- Trust offices

- Pension funds

Specifically, the DNB enforces rules and regulations under the, amongst others, Financial Supervision Act (Wet op het financieel toezicht – WFT), Anti-Money Laundering and Anti-Terrorist Financing Act (Wet ter voorkoming van witwassen en financieren van terrorisme -WWFT) and existing EU Directives. The DNB has the ‘Guideline’, a set of policies derived from existing AML, KYC laws in the country. The ‘Guideline’ is not a legally binding document. It provides for:

- Training of staff and policymakers on identifying and mitigating the risks of money laundering and terrorist financing through the application of proper customer due diligence and KYC procedures. The awareness aspect also includes a ‘whistleblower’ scheme, which requires institutions to design an internal reporting system of potential money laundering activities. The scheme must protect the ‘whistleblower’ and retain their anonymity for their own safety. Individuals may go directly to the DNB to file official reports.

- A system designed to identify and evaluate the institution’s inherent risks and vulnerabilities to be used as money laundering channels through their services. This implies that the institution should periodically assess its risks and protocols. The Guideline suggests following these steps: risk identification, risk analysis, risk control and risk monitoring and review.

- The institution is responsible for categorising its clients based on their risk factors, so they may be able to perform a comprehensive risk analysis and evaluation during the onboarding process. This is a crucial part of establishing the provenance of a client’s source of funds.

- The financial institution must notify the FIU-Netherlands about any indication of money laundering activities involving its client/s.

The Netherlands has a list of clients’ ‘unacceptable risks’ which may be the basis of business relationship termination or rejection of application

- Problems in verifying the ultimate beneficial owner or UBO

- Anonymous or fictitious identity details or customers unwilling to provide full information

- Involvement in shell banks

- Customers on the sanctions list

- Customers unwilling to provide tax or cash flow information

- Relationships with parties that lack the required licence

- Customers involved in companies that lack transparency and have questionable transaction patterns

According to the DNB, ‘Combating [financial and economic] crimes is one of our key priorities … As ‘gatekeepers’ to the financial system, financial institutions play a crucial role in detecting and preventing criminal cash flows.’

AML, KYC policies in Luxembourg

In February 2021, French paper Le Monde, in cooperation with other media outlets and the Organized Crime and Corruption Reporting Project (OCCRP), released the first OpenLux investigation, which scrutinised millions of publicly-available financial documents from the Luxembourg government itself. The investigation delved deeper into the secrets of one of the world’s top tax havens.

In February 2021, the OCCRP reported that nearly 300 minors own or control a major stake in Luxembourg companies after the government made available a list of UBOs. The report states: ‘While it is not illegal for children to own companies in Luxembourg, some of the names identified by OCCRP and its partners should have raised red flags’. According to the OCCRP, there should be questions

Since the first OpenLux report, the Grand Duchy government has defended its tax framework and anti-money laundering regulations. Part of Luxembourg’s official statement reads: ‘Luxembourg provides no favourable tax regime for multinational firms, nor digital companies, which have to abide by the same rules and legislation as any other company in Luxembourg’. It furthered that the state is a ‘triple-A rated country with a diversified economy’ and that it ‘continues to assess its AML and CTF efforts’ as an international financial centre. It emphasised that its new generation Registry of Business Owners (RBE), created in 2018, is largely based on the AMLD 5, which tackled the money laundering problems in the EU.

Following the OpenLux investigations, the Ministry of Justice told the OCCRP that it would draft a bill addressing violations or abuse of Luxembourg’s financial system, allowing the Luxembourg Business Register to impose sanctions.

How does the Grand Duchy keep track of its trillions-dollar financial industry to fight, from the border, attempts of money laundering?

- The Commission de Surveillance du Secteur Financier (CSSF) is authorised to implement AML, KYC and CTF regulations in Luxembourg. Financial institutions, as well as individual investors or clients, are subject to KYC and CDD measures to ensure they are fully compliant with the law.

- Financial service providers must carry out a risk-based approach in applying appropriate AML/CTF/KYC/CDD measures in all steps of the onboarding process.

- The financial sector must closely coordinate with the governing authority in providing reports related to suspicious clients and activities.

- In 2020, the CSSF amended its Regulation No 12-02 of 14 December 2012, which provides for the identification of risks relating to intermediaries, financial activities and business relationships of the clients.

- In terms of CDD, customers or applicants are required to submit:

- For natural persons: full legal name, place and date of birth, nationality, customer’s residential address, national identification number;

- For legal persons: denomination, legal form, registered office and/or place of business, directors of company or persons with business relationships with the client, provisions for legal person arrangements

- The financial institution shall verify the indicated UBO

AML, KYC policies in Slovakia

The Ministry of Finance of the Slovak Republic is in charge of ensuring all financial entities and professionals are implementing AML/CTF/KYC/CDD measures when dealing with corporations and individual investors. These institutions must report to the Slovak FIU any unusual financial activity and transaction pattern involving their client/s or beneficial owners of funds/assets. Here are the key provisions of the Republic related to the implementation of AML, KYC procedures.

- Under the National Bank of Slovakia Act 483/2001, banks and foreign bank branches must provide the Finance Ministry with a list of their clients appearing on lists of persons with international sanctions, as well as the clients’ account numbers and account balance. The same may, at any time, be requested to provide information regarding the identity of a client, along with their transaction history, to the Ministry, without the client’s consent.

- As a way to combat money laundering, the Republic also restricts cash payments amounting to more than €5000. Only sole traders who are natural persons are allowed to transact through cash payments worth up to €15000. The same prohibition is applied when transferring money abroad from Slovakia or when the receiving party has a permanent or business address in the Republic.

- All natural persons applying to open their financial accounts or do business in the Republic must undergo a verification process carried out by obliged entities (banks, financial institutions, etc.). These persons include beneficial owners, minors and persons represented on the basis of a Power of Attorney. This is provided in the Slovak AML Act.

- The same act also provides for the assessment of the client’s business intentions, as well as if a client is considered a politically exposed person (PEP).

- Financial institutions are also obliged to measure if the registered client acts in their own name; otherwise, the client shall be required to confirm, through a written declaration, in whose name they are transacting.

- Enhanced CDD is carried out by requiring additional identity documents, certification from other banks and publicly-available information regarding the client’s reputation, amongst others. PEPs and clients considered high-risk are subject to enhanced CDD.

As an AML and KYC compliance services provider …

Bolder Group keeps up with the latest regulatory requirements that our clients need to know and apply. With locations all over the world, the Bolder team near you has the expertise and knowledge when it comes to your jurisdiction’s KYC policies, AML regulations and CDD procedures. We provide our clients with the appropriate information they need to know about regulations and offer them KYC and AML compliance solutions to protect their investments and businesses.

To know more about your local KYC policies and our KYC and AML compliance services, get in touch with our Bolder team today.

Bolder | At the base of business