ADGM Funds Regime Explained: A Strategic Guide for Fund Managers

ADGM’s fund framework supports a wide range of fund structures, vehicles and management strategies to support diverse investment approaches.

Q3 2025 Compliance Reporting: What You Need to Know

Explore key Q3 2025 regulatory compliance requirements across global financial jurisdictions with Bolder Group’s Compliance Calendar.

Navigating the AFM’s Light Regime: What are the key requirements?

The Dutch AFM released guidance for light regime fund managers to clarify reporting requirements and ensure AML compliance.

Step-by-Step Guide to Offshore Company Formation

Setting up an offshore company requires several steps to complete registration and incorporation. We discuss the process in this blog.

Why UBO Screening is Important for Financial Compliance

In today’s rapidly evolving landscape, financial institutions face increasing pressure to understand who they work with.

Choosing the right Fund Administrator: What to consider?

Choosing the right fund administrator plays a crucial role in a fund’s overall performance and effectiveness. Here are the key factors to consider.

Automation & Cybersecurity: Enhancing efficiency and security in Fund Operations

Automation improves fund operations by increasing efficiency, while cybersecurity protects financial integrity. We discuss more in this blog.

Understanding the Role of AML Officers in Anti-Money Laundering

AML Officers play a vital role in preventing financial crimes. Learn how they ensure compliance and protect institutions from money laundering.

Dutch STAK: A Key Wealth Management Tool for Global Families

Global families or businesses use Dutch STAKs to secure their assets, preserve their wealth and maintain control over their holdings.

Choosing a new Corporate Services Administrator: Make the Bolder Choice

The financial and geopolitical landscape is in constant flux, compelling companies to swiftly adapt to evolving regulatory requirements and the realities of a deglobalizing world.

Navigating Reporting Requirements: Q2 2025

Bolder Group’s 2025 Global Regulatory Compliance Calendar is designed to help companies stay ahead of the evolving regulatory compliance landscape.

A Year After Taiwan’s CFC Ruling: Alternative Trust Jurisdictions in Focus

Taiwan’s tax ruling brings more offshore trust reporting requirements, prompting entities to seek alternative trust jurisdictions.

Post-Incorporation Support: Setting Up Your Business for Long-Term Growth

Avoid common pitfalls after incorporation. Our support ensures smooth operations, legal compliance and long-term business growth.

Retail Investors on the Rise: Leveraging AML/KYC Processes for Compliance

Effective implementation of AML, KYC and CTF measures is crucial in dealing with all types of investors, including retail investors.

Unmasking Financial Crimes: Money Laundering vs. Terrorist Financing

What are the key differences between money laundering and terrorist financing — and how can these crimes be detected?

NAV calculation services: Benefits of outsourcing

Outsourcing NAV calculation services provide specialised knowledge, expertise and improved efficiency, with dedicated teams and advanced technology.

Overcoming the challenges of company formation

Using company set up services is vital in overcoming the challenges of forming a new entity.

How HNWIs benefit from lifestyle management services

The lifestyle management services market is expanding along with the rise in UHNWIs, filling a critical demand by offering tailored services.

Enhanced due diligence services: An overview

Enhanced due diligence services help financial institutions evaluate the potential risks of doing business with a particular customer or a partner.

Understanding Spain’s SOCIMIs framework proposed changes

The proposed changes for SOCIMIs in Spain may impact its real estate market, prompting investors to relocate to alternative investment locations.

New Dutch entity tax classification rules: What to expect in 2025

The new Dutch entity tax classification rules will classify foreign legal entities as either transparent or non-transparent for Dutch tax purposes starting in 2025.

Overview: Setting up a business in MENA

With the significant investment opportunities available in the region, setting up a business in MENA has become more attractive to foreign investors.

Global expansion: What are the challenges and solutions

Companies seek global expansion to benefit from favourable local market conditions and growth opportunities.

Why the Ultrawealthy Invests in Mauritius

Mauritius has emerged as a top investment destination for the ultrawealthy. Learn about the country’s economic advantages for businesses.

FATF’s grey list: What does this mean for Monaco family offices

FATF’s grey list may result in increased scrutiny for family offices in Monaco to mitigate risks and ensure full compliance with evolving regulations.

A quick guide to EuVECA fund regulation

The EU established the EuVECA fund regulation to foster growth and innovation for small and medium-sized enterprises (SMEs).

Why are firms co-sourcing fund administration?

Data management is a crucial issue when outsourcing service providers. Learn how co-sourcing alleviates this problem in fund administration.

Malta Tax Residence Programmes: An Overview

Malta offers residency opportunities for business owners seeking to relocate to the country. Learn more about your options here.

The investment opportunities in Spain’s Hospitality Industry

Spain’s hospitality sector offers diverse opportunities for investments. Learn more about this thriving industry here.

Why independent directors matter in a company

Independent directors provide objective insights into a company’s strategies. Learn more about their valuable role in corporate governance.

Swiss trustee: Understanding its functions and benefits

Swiss trustee services are tailored to cater to the broadest global network for multinational wealth management.

Business in Hong Kong: The top industries for Chinese investors

What are the leading industries that Chinese investors interested in doing business in Hong Kong should explore?

At a glance: Your options in starting a business in Malta

Malta is a top business hub in Europe. In this article, we explore the entities available for those seeking to start a business in Malta.

Compliance regulations in major fund hubs

As the alternative assets market grows, compliance regulations are likely to become more complex in the coming years.

Why you should start a fintech company and startup in Africa

Starting a fintech company in Africa is a great opportunity to provide innovative financial solutions to the continent’s unbanked population.

Navigating KYC/AML compliance in Family Offices

Family office industry have grown, making it a target for financial crimes. Here are the industry challenges of remaining KYC/AML compliant.

An Introduction to Virtual Family Offices: Setup, Benefits, Services

Virtual Family Offices have been rising as a cost-efficient and flexible alternative to traditional offices. Find out more about its setup, benefits, and services.

Managing digital assets: What’s in it for traditional asset managers

The integration of digital assets in traditional investors’ portfolios changed the digital asset market structure and financial landscape.

The allure of the Middle East to Asia’s wealthy families and individuals

In recent years, the Middle East has become a magnet for wealth managers from Asia, as well as an investment hotspot for Asian wealth.

KYC Compliance Checklist for EU Luxury Sector

The EU luxury sector is now subject to strict KYC/AML policies through the AMLD6. Check out our KYC checklist to ensure compliance.

A Guide to ESG Data Management

The importance of ESG data is growing significantly in the financial sector, affecting regulatory compliance and investment decision-making.

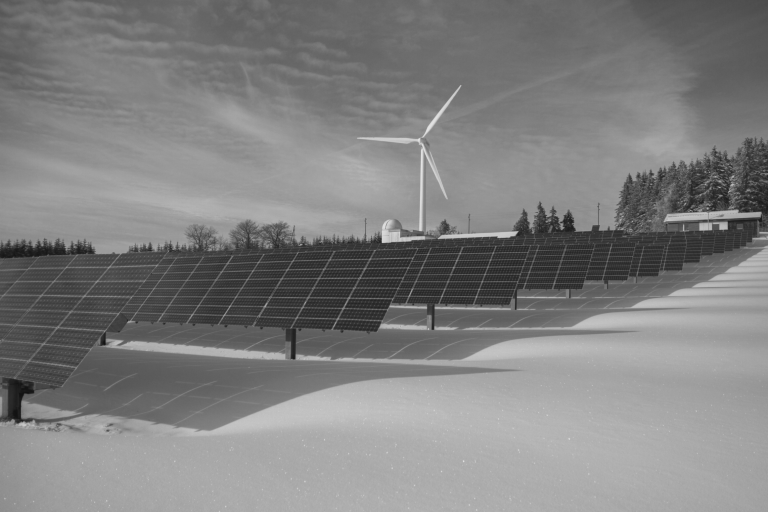

The benefits of using SPVs for renewable energy projects

As the world transitions to a more sustainable environment, SPVs may be crucial for their renewable energy projects.

EU Luxury Market: Compliance Challenges to Expect

What compliance challenges can market players in the EU luxury sector expect amidst the evolving regulatory landscape?

What attracts LATAM investors to Spain’s real estate market?

In this article, we discuss what makes Spain a hotspot for LATAM real estate investors.

Changes to Wtt 2018 proposed to the Dutch Congress

In May 2024, the Finance Committee of the Dutch Congress tackled a bill proposing changes to the Wtt 2018. Read our latest blog.

UBO register in the Netherlands: An overview

As of 01 March 2024, around 80% of companies and other legal entities in the Netherlands had registered with the UBO.

The advantages of doing business in Benelux

In this article, we discuss the benefits of doing business in Benelux and the investment opportunities in the region.

COSMIC: MAS’s new digital platform against money laundering

The MAS’s COSMIC platform will enable participating financial institutions to share customer information to combat money laundering.

A deeper look into the AML rules covering the EU luxury market

Recently, new EU AML Rules have been introduced to dampen money laundering activities in the EU, with more coverage for the luxury market.

What you need to know about the new Swiss Limited Qualified Investor Fund (“L-QIF”)

DISCLAIMER: This post was last modified on 5 March 2024.