Complying with the EU’s MiCA rule

DISCLAIMER: This post was last modified on 26 September 2024. Some information in this article may not be updated.

The EU crypto market has experienced explosive growth over the recent years. And with this growth comes increased regulatory scrutiny. In this article, we zoom in on the Markets in Crypto-Assets (MICA) Regulation of the EU and how to comply with the piece of legislation.

Brief History of MiCA

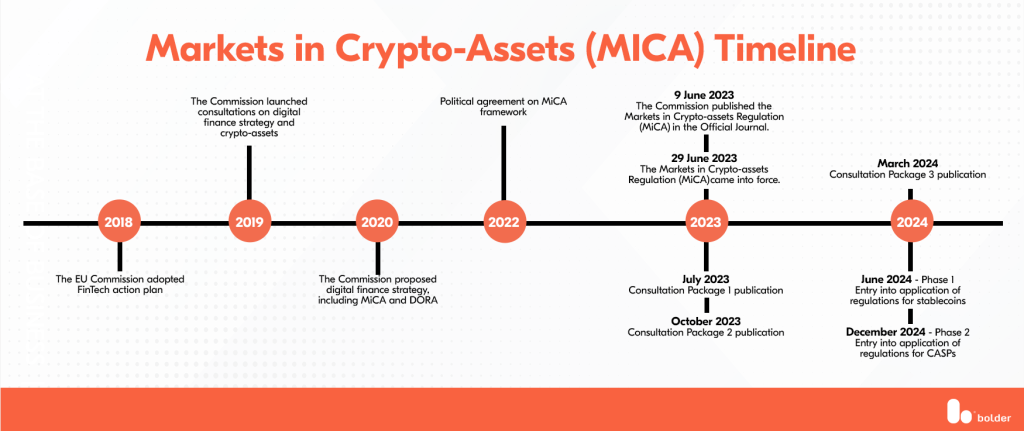

The European Commission introduced MiCA in 2020 to harmonise the frameworks regulating the crypto-assets industry. The initiative is part of the region’s larger digital finance package, which includes the Digital Operational Resilience Act. After a rigorous legislative review, MiCA was approved in 2023 and implemented in 2024.

What is the scope of MiCA?

As the first regulation in the region to track crypto transfers, MiCA’s primary objective is to create a more transparent, stable and secure crypto-asset ecosystem within the EU. The law aims to protect consumers, promote financial stability and foster digital finance innovation. It applies to various crypto-assets and market participants.

With the implementation of its second phase fast approaching, how can market participants ensure regulatory compliance? Let’s discuss the requirements for MiCA compliance.

Defining crypto-assets under MiCA

MiCA provides clear definitions and categorisations for various crypto-assets. The regulation outlines crypto assets’ characteristics and categorises them based on their associated risks.

Definitions of terms

- Crypto-asset – It is a digital representation of value or a right that can be transferred and stored electronically using blockchain or similar technology.

- Distributed ledger (DLT) – A shared database that records transactions and is synchronised across network nodes.

- Asset-referenced token (ART) – This maintains a stable value by referencing another asset or value.

- Electronic money token (EMT) – This crypto-asset is pegged to a single official currency for payment purposes.

- Utility token – This crypto-asset provides access to a good or service.

Categories of Crypto-assets

- Asset-referenced tokens (ARTs) – Crypto-assets linked to a traditional asset like a currency or commodity.

- Electronic money tokens (EMT) – Crypto-assets designed to represent a monetary value.

- Other crypto-assets: Crypto-assets that do not fall into the first two categories.

MiCA Compliance for Crypto-assets Service Providers (CASPs) in the EU

The law defines CASPs, or Crypto-Asset Service Providers as entities that offer services related to crypto assets, including trading, custody, platform operations, wallet services, issuance, investment advice and portfolio management.

Under MiCA, CASPs must meet the following requirements:

- Authorisation – Entities must obtain a license from the relevant national competent authority to operate within the EU to carry out their services.

- Capital requirements – They must maintain adequate capital reserves to ensure their financial stability. The capital depends on the nature and size of the operations.

- Risk management – CASPs must implement robust systems and procedures to identify and mitigate risks associated with their operations.

- Consumer protection – CASPs must provide clear information to their customers and protect their funds from unauthorised access.

- ML/CTF compliance – CASPs must have measures to prevent money laundering and terrorist financing.

- Preventing market abuse – They must also have systems to detect and deter market manipulation and insider trading.

- Record-keeping – They must maintain a detailed record of their transactions and activities.

- Cooperating with authorities – CASPs must cooperate with regulators and provide any information or assistance requested.

Rules for Issuance and Public Offering of Crypto-Assets

MiCA requires all crypto-asset issuers to comply with general requirements. To issue crypto-assets in the EU, an issuer must:

- Be a legal person established within the EU.

- Draw up, notify, and publish a crypto-asset white paper.

- Conduct fair and transparent marketing consistent with the white paper.

- Comply with trading platform rules if seeking admission to trading.

However, the specific requirements may vary depending on the type of crypto-asset. For example, issuers of certain crypto-assets may need to obtain authorisation, maintain reserve assets or comply with additional obligations. It’s essential for issuers to carefully review MiCA’s provisions and seek legal advice to ensure compliance.

Protection from Market Abuse

Title VI of MiCA specifically addresses these regulations related to insider information, public disclosure, insider dealing and market manipulation. It also includes dissemination of false or misleading information, spoofing and front-running. Compliance with these measures is crucial for maintaining a fair and orderly market for crypto-assets, protecting investors from fraudulent activities and ensuring the industry’s integrity.

Impact of the MiCA in Crypto-Assets

This research analysed stock market reactions to MiCA announcements and found significant changes in liquidity, variance and returns. It highlighted how market participants are dealing with uncertainty and varied interpretations of the law’s implications. This offers market players valuable insights into how regulatory intervention influences the cryptocurrency market. In a changing regulatory landscape, market players must stay informed and equipped with compliance solutions.

Compliance challenges for CASPs

MiCA is rapidly approaching its full implementation, with Phase 2 set to take effect soon. Entities dealing with crypto-assets must comply with legal requirements by December 2024. Additionally, EU member states can grant transitional measures, allowing compliance until July 2026.

As the deadline draws near, market players must address the compliance challenges they face to ensure a smooth transition.

MiCA compliance with Bolder Group

As the crypto-asset market matures, more stringent policies will likely be imposed. To effectively address compliance challenges, market players should invest in robust and sustainable compliance frameworks.

Bolder Group provides customised solutions to ensure compliance for CASPs operating in the EU. Our experts offer guidance on evaluating your current compliance needs and utilising technology to streamline compliance processes.

Let’s discuss how you can comply with the EU’s MiCA regulation. Contact our team today.

Bolder Group does not provide financial, tax or legal advice and the information contained herein is meant for general information purposes only. We strongly recommend that before acting on any of the information contained herein, readers should consult with their professional advisers. The Bolder Group accepts no liability for any errors or omissions in the information, or the consequences resulting from any action taken by a reader based on the information provided herein.

Bolder Group refers to the global network of independent subsidiaries of Bolder Group Holding BV. Bolder Group Holding BV provides no client services. Such services are provided solely by the independent companies within the Bolder Group which are each legally distinct and separate entities and have no authority (actual, apparent, implied or otherwise) to obligate or bind Bolder Group Holding BV in any manner whatsoever. The operations of the Bolder Group are conducted independently and have no affiliation with third party financial, tax or legal advisory firms or corporations.