Why the Ultrawealthy Invests in Mauritius

DISCLAIMER: This post was last modified on 10 October 2024. Some information in this article may not be updated.

Mauritius is often celebrated for its idyllic island lifestyle, warm tropical climate and stunning landscapes. More than these, the country is also one of Africa’s most remarkable success stories. Since gaining independence in 1968, the government has harnessed the country’s strategic position in the Indian Ocean—linking Asia, Europe and Africa—to expand and diversify its economy, particularly by developing a highly regarded financial hub. By 2024, Mauritius has emerged as a top destination for millionaires globally, with over 5,000 millionaires choosing to make the island their home.

The 2024 global wealth migration report by Henley & Partners highlights Mauritius as a stable and secure sovereign state, largely insulated from global political and economic turmoil. With its strong governance and advanced financial system, the island is attracting the ultrawealthy, with projections that its millionaire population will nearly double in the next decade. High-net-worth individuals are drawn to Mauritius for its safety, living standards and wealth preservation potential, especially as geopolitical tensions and less favourable tax policies affect traditional markets. Wealth managers are also increasingly eyeing the island as a secure platform for asset growth.

Mauritius has become a popular jurisdiction due to its business-friendly tax environment, including no capital gains, estate duty or inheritance tax. Ranked 13th globally in the World Bank’s Ease of Doing Business report, it offers tax exemptions for non-residents and allows tax-free repatriation of profits. Additionally, its extensive double tax treaties make it an appealing base for wealth managers seeking to invest in emerging markets across Africa and Asia.

In addition, with a financial sector contributing 14% to its GDP, Mauritius is focusing on private banking, family offices and digital finance. The Mauritius International Financial Centre (IFC) and the Economic Development Board (EDB) have highlighted private banking and family offices as central to their growth strategy. Their aim is to present the diverse investment vehicles Mauritius IFC offers to global investors interested in business prospects across Africa and beyond.

Investment options further include trusts, special purpose funds, Variable Capital Company (VCC) structures, family office and treasury services, and digital finance opportunities facilitated by the VAITOS Act. Mauritius also offers various residency programs for high-net-worth individuals (HNWIs) who wish to live, work or retire on the island.

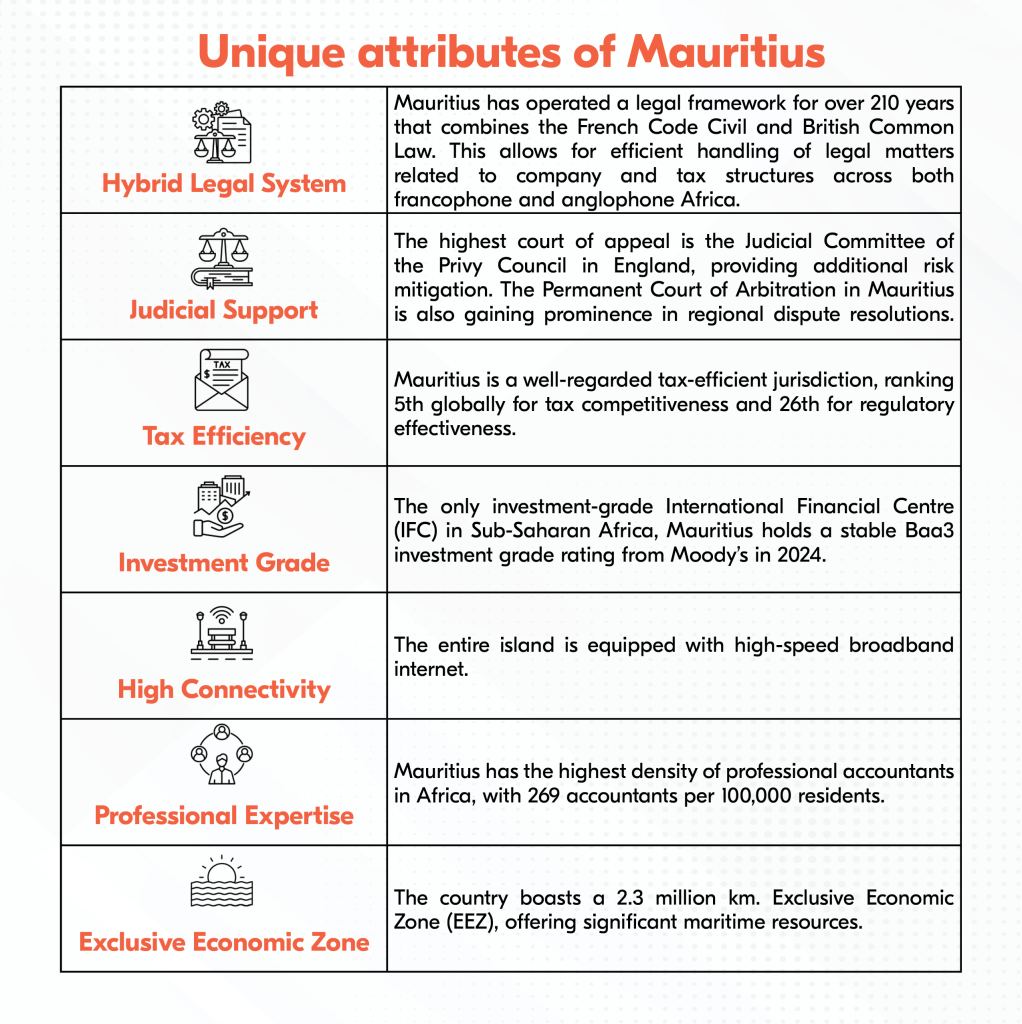

Advantages

Investment Opportunities

The Mauritius International Financial Centre (IFC) is a hub of opportunity with over 30 years of expertise in cross-border investment and finance. It provides a highly regulated and transparent platform, acting as a key gateway for international investments into Africa and Asia. Mauritius hosts a wide range of global institutions, including international banks, audit and legal firms, corporate services, investment and private equity funds, making it a prime jurisdiction for global investors.

The Mauritius IFC offers a broad selection of competitive financial products and services, such as private banking, global business solutions, insurance and reinsurance, limited and protected cell companies, trusts and foundations, investment banking and global headquarters administration.

Reputation

Mauritius has consistently implemented reforms to strengthen its legal and regulatory framework, maintaining its status as a reputable International Financial Centre (IFC). The country aligns with international standards, such as the EU Tax Good Governance Principles set by the EU’s Economic and Financial Affairs Council and those of the OECD.

Mauritius is also a member of prestigious international organizations, including the Eastern and Southern African Anti-Money Laundering Group (ESAAMLG), which represents the Financial Action Task Force (FATF), the World Alliance of International Financial Centres (WAIFC), the International Association of Insurance Supervisors (IAIS), the International Organisation of Pension Supervisors, IOSCO and the Islamic Financial Services Board.

Geographic Location

Mauritius, strategically positioned in the Indian Ocean with a GMT+4 time zone, offers businesses preferential access to 70% of the world’s population. This access is facilitated by agreements with organizations such as COMESA, SADC, the IOC, EPA, AGOA, AfCFTA, FTA, and CECPA. While its domestic market is modest, Mauritius provides significant advantages for companies aiming to reach both emerging and established markets, making it a prime hub for global expansion

Ready to invest in the Mauritius market?

Mauritius offers a compelling blend of political stability, economic prosperity and tax advantages. Its unique combination of investment opportunities and a high quality of life has drawn the attention of high-net-worth individuals seeking to grow their wealth while enjoying a luxurious lifestyle.

To explore Mauritius’s potential, Bolder Group can assist you in navigating the complexities of the Mauritian market. Our team of experts is dedicated to providing tailored solutions to meet your business and market entry needs. Download our guide to learn all about doing business in Mauritius. If you have any more questions, contact our Mauritius team today.

Bolder Group does not provide financial, tax or legal advice and the information contained herein is meant for general information purposes only. We strongly recommend that before acting on any of the information contained herein, readers should consult with their professional advisers. The Bolder Group accepts no liability for any errors or omissions in the information, or the consequences resulting from any action taken by a reader based on the information provided herein.

Bolder Group refers to the global network of independent subsidiaries of Bolder Group Holding BV. Bolder Group Holding BV provides no client services. Such services are provided solely by the independent companies within the Bolder Group which are each legally distinct and separate entities and have no authority (actual, apparent, implied or otherwise) to obligate or bind Bolder Group Holding BV in any manner whatsoever. The operations of the Bolder Group are conducted independently and have no affiliation with third party financial, tax or legal advisory firms or corporations.