Why set up a VCC in Singapore: key features

Since its official launch in January 2020, over 400 Variable Capital Companies (VCCs) have been set up or re-domiciled in Singapore. The relatively new corporate structure is still expected to grow further in the city-state.

The VCC Pilot Programme was initiated in September 2019 by the Monetary Authority of Singapore (MAS) and the Accounting and Corporate Regulatory Authority (ACRA). About 18 fund managers were able to re-domicile or set up 20 investment funds as VCCs in Singapore during the pilot programme. These investment funds comprise private equity, venture capital, hedge fund, and ESG strategies, illustrating the viability of the VCC structure in terms of fund and portfolio diversity.

So what makes the structure ideal, and what should fund and investment managers keep in mind if they intend to set up a VCC in Singapore?

VCC framework

Proposed by the MAS, the Variable Capital Companies Act of 2018 was officially launched in January 2020. This corporate structure allows for the establishment of a corporate entity specifically tailored for investment fund activities. With this framework, Singapore’s value offering as an international fund management and domiciliation centre is strengthened with this framework.

Fund managers who set up VCC in Singapore benefit from an additional corporate structure option that allows for greater operational flexibility. For instance, flexibility in the issuance and redemption of shares, along with the payment of dividends out of capital instead of paying out of profits, are possible, reducing operation costs.

According to Second Minister for Finance Indranee Raja, Singapore-based fund managers who set up funds as a VCC may expect “significant cost economies and fewer cross-border administrative and compliance hurdles.” In contrast, funds that were domiciled overseas would incur higher expenses due to the need for miscellaneous service providers in different countries. Aside from this, VCCs that were set up in the city-state may benefit from Singapore’s competitive tax regime. Existing foreign corporate entities also have the option to re-domicile their investment funds to Singapore as VCCs.

A VCC can be used to create investment fund schemes, such as a stand-alone fund or an umbrella fund with various sub-funds. The VCC structure can also be used for traditional and alternative investment fund strategies and as an open-end or closed-end fund.

Set up a Singapore VCC: the key features

Here are some other key features of VCCs:

- It is owned by the shareholders. A minimum of one shareholder is allowed, while there is no maximum number of shareholders specified. Shares in the VCC would give rights to shareholders as mandated in the constitution of the VCC.

- It is a separate legal entity. This means it can hold property in its own name, and its rights and obligations are separate from its shareholders and directors.

- It benefits from perpetual existence in accordance with the VCC Act of 2018. An umbrella VCC and each sub-fund would continue to exist until its dissolution. A sub-fund may be dissolved without affecting the existence of the VCC or other sub-funds under it.

- It is governed by its board of directors. A VCC should have at least one director. However, if it is comprised of at least one MAS-authorised scheme, then it must have at least three directors, one of whom should be independent. An authorised scheme refers to a collective investment scheme (CIS). The VCC should also have a fund manager who holds a Capital Markets Services (CMS) Licence for fund management.

- It is treated as a company and a single entity for tax filing purposes. Only one set of income tax returns is required to be filed with the Inland Revenue Authority of Singapore. No tax is levied upon shareholders’ dividends.

Things to know before setting up a VCC in Singapore

| Basic Requirements | Overview |

|---|---|

| VCC name | As with every other business, this will serve as the VCC’s unique identifier. A proposed business name will be rejected if it is identical to an existing or reserved business name, undesirable (i.e., offensive, vulgar) and contrary to public policy. |

| VCC type | Generally, it can be set up in two ways: non-umbrella VCC or an umbrella VCC. An umbrella VCC can have two or more sub-funds which will hold each of their own segregated assets and liabilities. |

| Appointment of officers | |

| Director | A VCC should have a director who is a Singapore resident, with a local residential address. The director can either be a ‘Qualified Representative’ or a director of its fund manager. On the other hand, VCCs with Authorised Schemes should have at least three directors including one independent director. |

| Managing Director | The Managing Director should also be a director of the VCC. However, the position is optional. |

| Fund Manager | The VCC should appoint a Permissible Fund Manager to manage property or operate the CIS of the VCC. |

| Registered Office Address and Constitution | All notices and communication letters will be addressed to the VCC’s registered office. ACRA requires a copy of the VCC’s constitution upon its registration. This serves as the legal document describing the key characteristics and operations of the VCC, detailing the rules and regulations of its governance and laying out the rights and responsibilities of its officers and shareholders. |

| Incorporating a new VCC | A Singapore VCC can be set up through: – an application for incorporation from a subscriber of the VCC’s constitution in the VCC Portal; – the services of a registered filing agent or corporate service provider (CSP). The processing time of an application takes between 14 to 60 days. |

| Registration of Sub-funds for an Umbrella VCC | Sub-funds may only be registered under an Umbrella VCC. A non-umbrella VCC may be changed into an umbrella VCC through the VCC Portal within 14 days. |

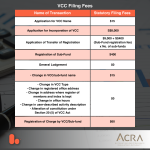

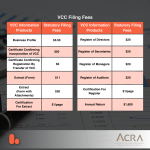

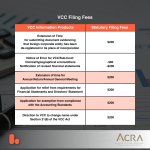

| VCC Filing Fees | Several statutory fees are imposed in filing a VCC. See the complete list below. |

The future of VCC in Singapore

In an effort to further advance the set-up and success of VCC in Singapore, the MAS revised the VCC fund structure, also known as VCC 2.0, just a few months after its launch. The MAS prioritised the expansion of the roster of fund managers viable to utilise the scheme, as well as simplifying fund re-domiciliation.

Continuing such an effort, the central bank also launched the Variable Capital Companies Grant Scheme which will be available until January 2023. The grant scheme, funded by the Financial Sector Development Fund, assists in covering the costs associated with the set-up or incorporation of a VCC in Singapore.

Benny Chey, Assistant Managing Director at the MAS noted that the adoption of the VCC structure in Singapore is seen to boost, not only the investment fund industry in the city-state but also the demand for fund service providers. Legal and tax advisors, accountants, fund administrators and fund custodians are expected to have new opportunities in Singapore with the expanding use of the VCC structure.

Market leader

Thanks to the success of the VCC structure, greater opportunities for development remain for its fund management industry.

Bolder Fund Services Singapore is among the market leaders in the set-up of VCC. Our team is well-prepared to take up the challenge in Singapore’s fast-growing market

If you are looking to penetrate the Singapore market and set up a VCC, get in touch with our team today.