Managing digital assets: What’s in it for traditional asset managers

DISCLAIMER: This post was last modified on 19 July 2024. Some information in this article may not be updated.

The emergence of the first blockchain, Bitcoin, sparked a new wave of innovation in the global financial market, leading to the development of the digital asset market and digital asset management. As early adopters increasingly invested in digital assets, this market has become more integrated into traditional financial systems over time, heightening its exposure and relevance in the broader economic landscape, thanks to digital asset investment and tokenization of Real-World Assets (RWA).

The market structure of the digital asset space evolved with the inclusion of digital assets in traditional investors’ portfolios. Introduced by the Financial Accounting Standards Board, the Accounting Standards Update 2023-08 for certain cryptocurrency assets, such as bitcoin, seeks to increase transparency in the financial sector. For this reason, various jurisdictions and authorities acknowledge digital assets as a crucial element of the future growth of developing financial and investment landscapes.

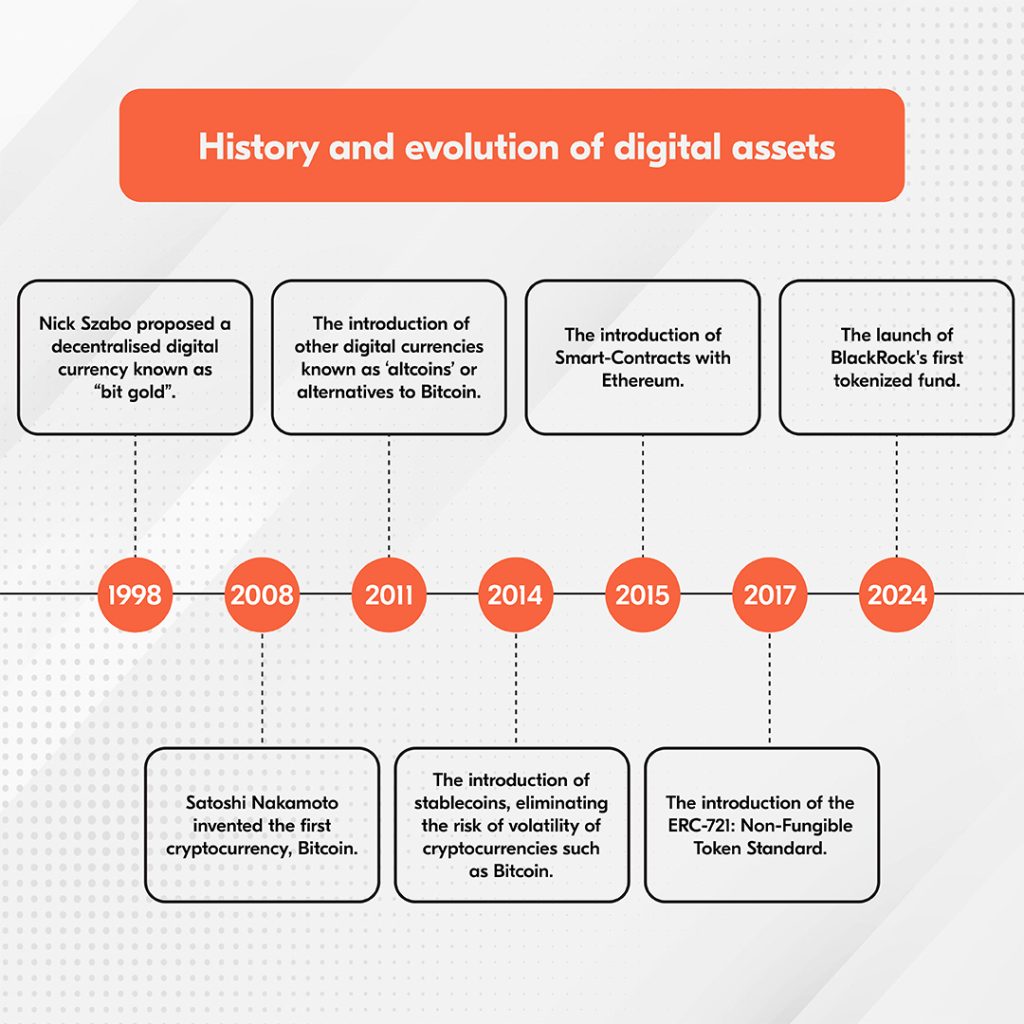

Digital assets: history and data

All items stored on the blockchain that represent perceived value can be classified as digital assets. This includes well-known cryptocurrencies that represent decentralised currencies, such as Bitcoin and Litecoin. Additionally, it is now possible to tokenize data, content, images or videos as NFTs on the blockchain. The invention of Bitcoin in 2008 marked the introduction of blockchain technology and brought about significant trends in the world of finance.

According to Digital Asset Research, the total value of the digital asset market doubled in 2023, growing from $830 billion to $1.6 trillion. During that year, the price of Bitcoin increased from $16,500 to $44,000. The asset class received broader institutional support as seen by the several spot Bitcoin ETF filings, changes in the regulatory environment and positive indicators from institutions venturing into or seeking to enter the market.

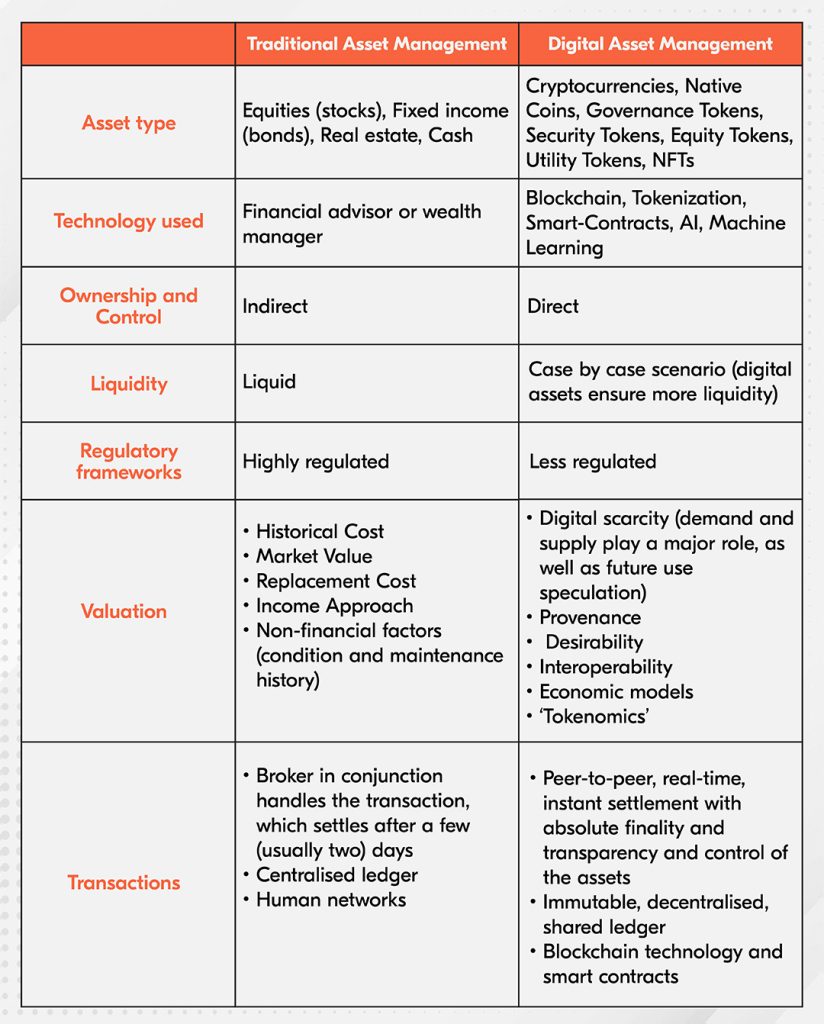

Traditional vs. Digital Asset Management

Considerations in managing digital assets

The volume of digital assets keeps growing as more crypto projects enter the space and more web data is tokenized. Asset tokenization is the process of converting an asset’s rights into a blockchain-based digital token, allowing the tokens to be traded on digital platforms. It is said to potentially change how asset managers operate and engage with their portfolios. In addition to streamlining asset management, this innovation could improve efficiency, accessibility and transparency.

One of the most important considerations an asset manager must make is partnering with the right fund administrator. As we enter a new era of digital transformation, fund administrators like Bolder Group are investing in technology and digital asset solutions to meet the requirements of their asset management clients and investors. Asset owners and management firms participating in alternative investment products have increased the demand for fund administration and accounting services related to these products. Fund administrators, along with other experts in asset servicing, can offer value by providing assistance for a growing range of product types and asset classes, such as digital assets, ETFs and private markets.

At Bolder, we possess unique expertise in setting up companies and SPVs tailored to our clients’ diverse digital asset strategies. We truly understand the decentralised nature and specific needs of these entities.

Regulatory framework

The Markets in Crypto-Assets (MiCA) Law, which came into force in June 2023, was adopted by the EU to harmonise the regulations governing the issuance and provision of digital assets, and it applies to both traditional financial institutions and new actors in the cryptocurrency industry.

Beginning 30 June 2024, the two types of stablecoins—asset-referenced and e-money tokens—are subject to the first set of rules under MiCA. Crypto-asset service providers will be subject to harmonised rules starting on 30 December 2024. MiCA is part of the EU’s larger digital financial package, including the Digital Operational Resilience Act (DORA).

What’s next

One of the many new factors that investors and private fund managers should consider due to the emergence of digital assets is the requirement for mandatory reporting.

The EU Directive DAC 8 on administrative cooperation in taxation, set to enter into force on 1 January 2026, will require the exchange of information and mandatory reporting for CASPs (crypto-asset service providers) and operators of digital assets. The directive aims to improve tax transparency and protect investors throughout the European Union.

With decentralisation growing in popularity, governance structures also significantly impact the regulatory framework and procedures related to digital assets and tokenization.

Bolder digital asset solutions

Bolder Group remains committed to fulfilling our responsibilities as a fund administrator for digital assets by staying well-informed of industry developments and sector-relevant matters. We lead in this industry by adopting innovative technologies that enhance connectivity with blockchain technology, enabling comprehensive capture and reconciliation of all transactions.

Businesses seeking to utilise the potential of blockchain-based assets may benefit from our robust and accessible platform. In the rapidly changing and developing world of digital assets, especially in the financial sector, our team of experts provides users with the tools and assistance they need to thrive.

Learn more about our digital asset solutions here.

If you have any questions, you can contact Mustafa Qadir (mustafa.qadir@boldergroup.com), Bolder’s Lead of Fund Solutions & Digital Assets or Devin Schoor (devin.schoor@boldergroup.com), Bolder’s Digital Assets & Technology Analyst.

Bolder Group does not provide financial, tax or legal advice and the information contained herein is meant for general information purposes only. We strongly recommend that before acting on any of the information contained herein, readers should consult with their professional advisers. The Bolder Group accepts no liability for any errors or omissions in the information, or the consequences resulting from any action taken by a reader based on the information provided herein.

Bolder Group refers to the global network of independent subsidiaries of Bolder Group Holding BV. Bolder Group Holding BV provides no client services. Such services are provided solely by the independent companies within the Bolder Group which are each legally distinct and separate entities and have no authority (actual, apparent, implied or otherwise) to obligate or bind Bolder Group Holding BV in any manner whatsoever. The operations of the Bolder Group are conducted independently and have no affiliation with third party financial, tax or legal advisory firms or corporations.