How to set up a foundation company in the Cayman Islands

DISCLAIMER: This post was last modified on 19 October 2023. Some information in this article may not be updated.

The enactment of the Foundation Companies Act, 2017 introduced a new form of corporate vehicle in the Cayman Islands – the foundation company, a type of exempted company. The Act operates as an addition to the Cayman Islands’ Companies Act (As Revised), with some modifications and excluded provisions which were inconsistent with the Foundation Companies Act.

Since its launch in 2017, various private entities used the foundation company as a:

- Holding vehicle for higher-risk assets (e.g., shares) in a private trust company (“PTC”);

- Protector or enforcer of a trust;

- Crypto or blockchain related projects;

- Special purpose vehicle (“SPV”) in finance or commercial transactions; and

- Traditional succession planning and asset protection vehicle.

What are the key features of foundation companies

Foundation companies are ideal vehicles for corporate entities, especially for those with offshore interests.

In general, foundation companies have similar features with traditional private trusts and a Cayman company. For instance, a foundation company can be used to hold assets for beneficiaries (similar to a private trust) but exists as a separate legal person (like a company). Below are the features and additional attributes of foundation companies.

- Distinct legal personality. A foundation company is a corporate body registered with the Registrar of Companies in the Cayman Islands. It retains a separate legal personality from its members and directors and benefits from limited liability. As such, a foundation company, unlike trusts, can hold property in its own name and can sue and be sued.

- Flexibility. Foundation companies adapt the features of companies while being able to function like a civil law foundation or a common law trust. The operational and management flexibility of foundation companies authorise any rights, powers and duties to be granted for the benefit of the foundation company, founder or any other purpose.

- Tax liability exemptions. An exempted foundation company is not subject to income, withholding or capital gains taxes. In addition, its members and beneficiaries will not be subject to income, withholding or capital gains taxes with respect to their shares and dividends, or estate and inheritance taxes in the Cayman Islands.

- Can cease to have members. A foundation company does not need to have members following its incorporation if its memorandum of association permits. It can exist as an orphan entity, which makes the foundation company suitable for holding shares in a PTC and other corporate transactions (e.g., securitisation).

Setting up a foundation company

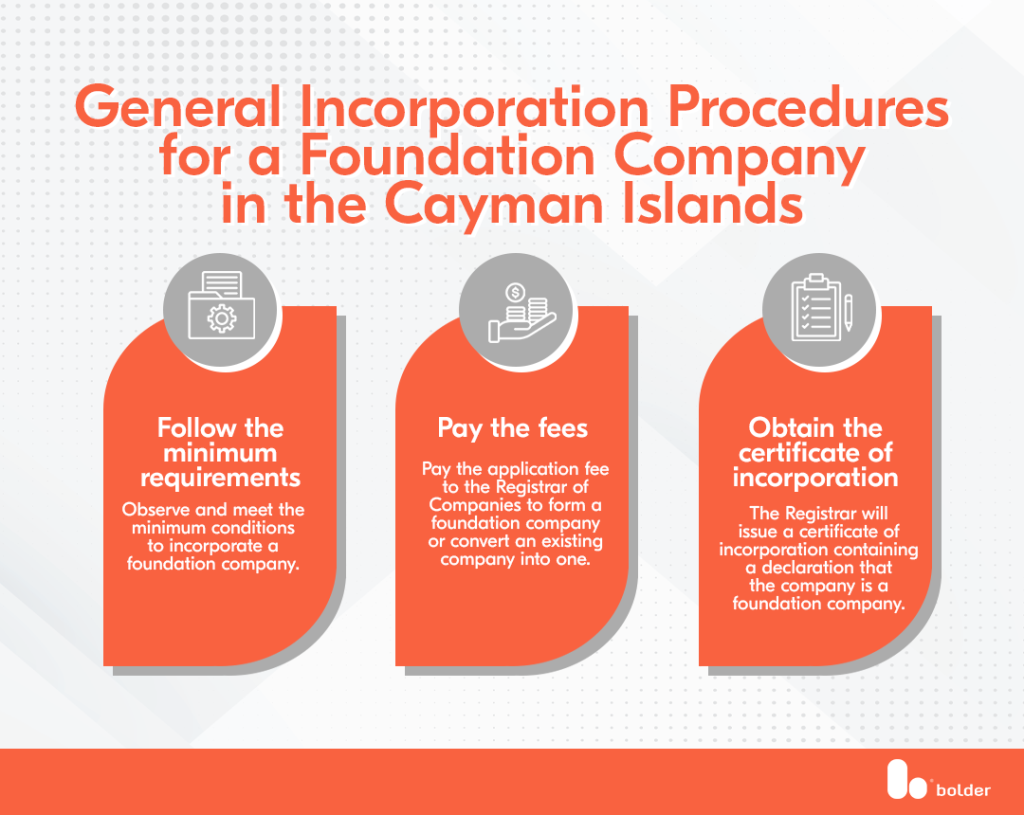

Generally, the procedures involved in establishing and registering a foundation company are similar to those associated with a Cayman exempted company. However, a new or existing company must fulfill certain conditions to apply with the Registrar successfully.

The conditions that allow new or existing Cayman companies incorporated under the Companies Act (As Revised) to apply as a foundation company are as follows:

- It is limited by shares or guarantee, with or without share capital;

- It has a memorandum that:

- states that the company is a foundation company;

- generally or specifically describes its objects (may include beneficiaries);

- provides for the disposal of any surplus assets that the company may have on winding up; and

- prohibits dividends or other distribution of profits to its members.

- It has adopted articles; and

- Its Secretary is a qualified person (i.e., licensed by the Companies Management Act (As Revised) to provide company management services in the Cayman Islands), such as Bolder Group.

Below are additional requirements for foundation companies in the Cayman Islands.

| Requirements | Description |

|---|---|

| Capital requirements and assets | There is no minimum capital requirement. However, a foundation company may add or transfer assets at any time. |

| Constitutive documents | A foundation company’s constitutive documents comprise its memorandum and articles of association. It can also adopt a separate and private constitution, which will outline the management and operations of the company; the company’s constitution does not need to be filed with the Registrar. |

| Registered office | A foundation company must have a registered office, which must also be provided by the same Companies Manager that acts as the Secretary. |

| Registers | In addition to the statutory registers of members and directors, a foundation company must keep a register of its supervisors at its registered office and with the Registrar. Such register of supervisors should contain the following information: – names and addresses of supervisors; – the date on which each supervisor was appointed; and – the date on which a supervisor’s appointment ceased. |

| Fees | Foundation companies may be subject to the following prescribed fees: – Application fee for the registration of a foundation company; – Annual registry fee; – Fee for altering the foundation company’s memorandum; and – Fees for any changes of directors, secretary, supervisors or registered office. |

Bolder Group in the Cayman Islands

Keeping track of and fulfilling the various requirements associated with the different types of corporate vehicles in the Cayman Islands can be a challenge without the guidance of experienced professionals.

As a CIMA-licensed Companies Manager in the Cayman Islands, Bolder Group can assist in successfully incorporating and managing a Cayman foundation company. Our team of experts is knowledgeable in numerous aspects of the set-up, management and ongoing compliance of companies in the Cayman Islands and other international jurisdictions.

Contact the Bolder Group Cayman Islands team now to set up your foundation company in the Cayman Islands.

Bolder Group does not provide financial, tax or legal advice and the information contained herein is meant for general information purposes only. We strongly recommend that before acting on any of the information contained herein, readers should consult with their professional advisers. The Bolder Group accepts no liability for any errors or omissions in the information, or the consequences resulting from any action taken by a reader based on the information provided herein.

Bolder Group refers to the global network of independent subsidiaries of Bolder Group Holding BV. Bolder Group Holding BV provides no client services. Such services are provided solely by the independent companies within the Bolder Group which are each legally distinct and separate entities and have no authority (actual, apparent, implied or otherwise) to obligate or bind Bolder Group Holding BV in any manner whatsoever. The operations of the Bolder Group are conducted independently and have no affiliation with third party financial, tax or legal advisory firms or corporations.