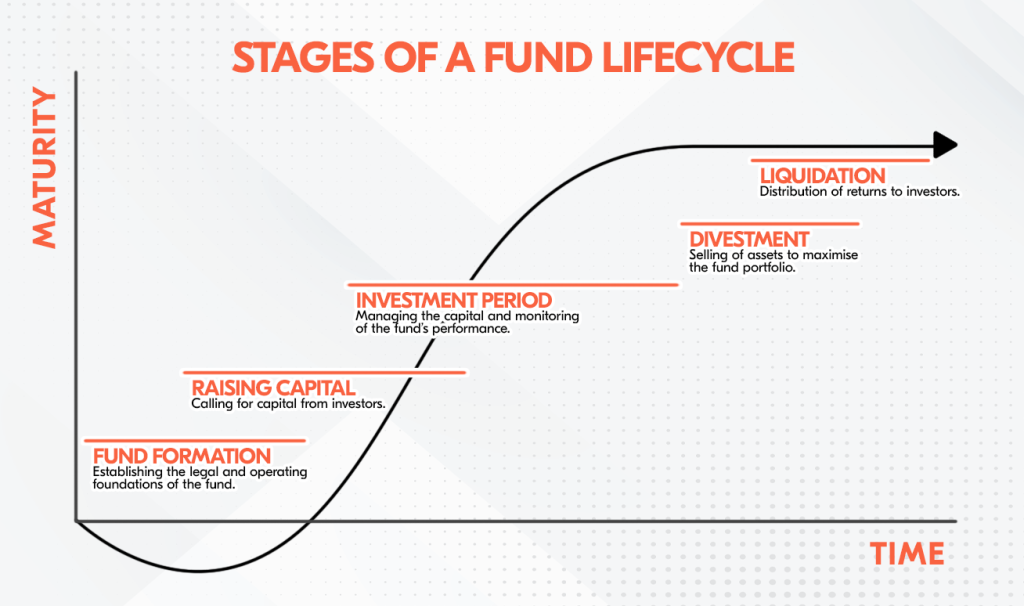

The stages of the fund life cycle

DISCLAIMER: This post was last modified on 9 August 2023. Some information in this article may not be updated.

Asset managers have diverse options when launching a fund, depending on their risk appetite, investment objectives and portfolio. Some examples are hedge funds, fund of funds, real estate funds, digital assets, private equity & venture capital funds and managed accounts, with managed accounts having the least risk associated (generally because of diversification) and digital assets, such as cryptocurrencies, having a higher risk level due to its volatility and (still) ongoing regulatory developments.

Aside from the abovementioned differences associated with various funds, they can also have varying life spans. For instance, private equity funds have an average term span of ten years. Meanwhile, most hedge funds have a life span of about six to seven years, according to Goldman Sachs’ Hedge Fund Survivorship 2020 report.

While the various investment funds have varying life spans, they commonly undergo similar life stages. Funds generally go through five stages in their life cycle, which comprise the consolidation of numerous funds, corporate and legal activities.

Fund formation

The fund formation stage creates the foundation of the numerous elements of a fund. The processes involved in the formation include:

- Determining the fund strategy;

- Navigating through the regulatory environment in which the fund will operate;

- Drafting the offering documents;

- Preparing and reviewing necessary documents for the fund;

- Overseeing the fund application process;

- Liaising with relevant legal authorities and service providers.

Moreover, setting up the fund’s investment structure will be accomplished at this stage. Overall, the fund formation phase will set up the fundamental aspects of the fund to be made operational.

To ensure a successful fund launch, fund managers can leverage the services of a fund service provider, like Bolder Group, in administering the middle- and back-office responsibilities to set up the fund successfully and in compliance with the laws.

Raising capital

At this stage, a fund’s operator will start to market and raise capital from investors in accordance with relevant regulations and the fund’s offering documents.

Procedures to ensure an efficient and secure entrance of funds must be set in place:

- Investor due diligence (e.g., Know-Your-Customer and Anti-Money-Laundering identification);

- Investor onboarding;

- Preparation of investor reporting structure;

- Coordination with other service providers (e.g., auditors, banks, public notaries, etc.).

The initial ‘call,’ also called the first closing, is often not the full amount the investors commit. Accordingly, it should be noted that further ‘calls’ for capital can be made at a later stage while the fund is still live. The fundraising period ends at the final closing, when the last investors in the fund commit to making their investments. Meanwhile, investment activities may already be entered between the first and final closing.

Our funds solutions also include investor relations services, making it easier for asset managers to onboard, communicate with and collect documents from investors.

Investment period

In general, this period is the most active in a fund’s life cycle as the capital is “put to work” and is composed of the following fund and governance activities:

- Recording and monitoring of investment activities;

- Preparation of financial statements;

- Provision of regulatory reports;

- Facilitating tax reports;

- Maintenance of registers and documents;

- Distribution of investor statements;

- Fund accounting and administration; and

- Periodic Net Asset Value (NAV) calculation and reporting, among others.

In the investment period, fund managers are also expected to execute portfolio management strategies to ensure the fund’s success. They typically seek new investment opportunities for the fund and call upon the capital that has been committed to by the investors in the previous stage.

Fund managers can focus on managing funds and other value-creating responsibilities, as well as ensuring effective oversight of the fund by taking on the services of fund administrators. Bolder Group offers customised fund services that guarantee timely and accurate fulfillment of ongoing requirements and activities in the investment period.

Divestment

In the divestment stage, the fund can no longer acquire additional capital and may only continue to operate the investments. The fund manager may sell some funds or assets that have grown to a point where it has achieved a satisfactory rate of return or those that are not core to their portfolio.

Following the sale of funds and investments, returns and profits are distributed to the investors, which carry over some reporting and accounting obligations, as well as other activities such as computation and disbursement of returns and distribution of dividends.

Ultimately, the divestment period will be the transition period to liquidate the fund.

Liquidation

Though some liquidations are possible during the investment period, the liquidation stage marks the end of a fund’s life cycle. In this period, all investments are sold off and all proceeds are distributed.

Fund managers are encouraged to take on the services of legal professionals to secure an orderly and compliant liquidation process. Some of the obligations to successfully close a fund include, but are not limited to:

- Filing of all statutory returns;

- Nomination of an external liquidator;

- Investor communication; and

- Book closure.

Bolder Solutions

As a global fund administrator, Bolder Group can facilitate the effective administration of a fund, regardless of where it is in its life cycle. Moreover, the professional assistance of an experienced fund administrator enables fund managers to focus on managing their funds, hence, providing opportunities for enhanced performance across the fund’s life cycle and the creation of effective portfolio return strategies.

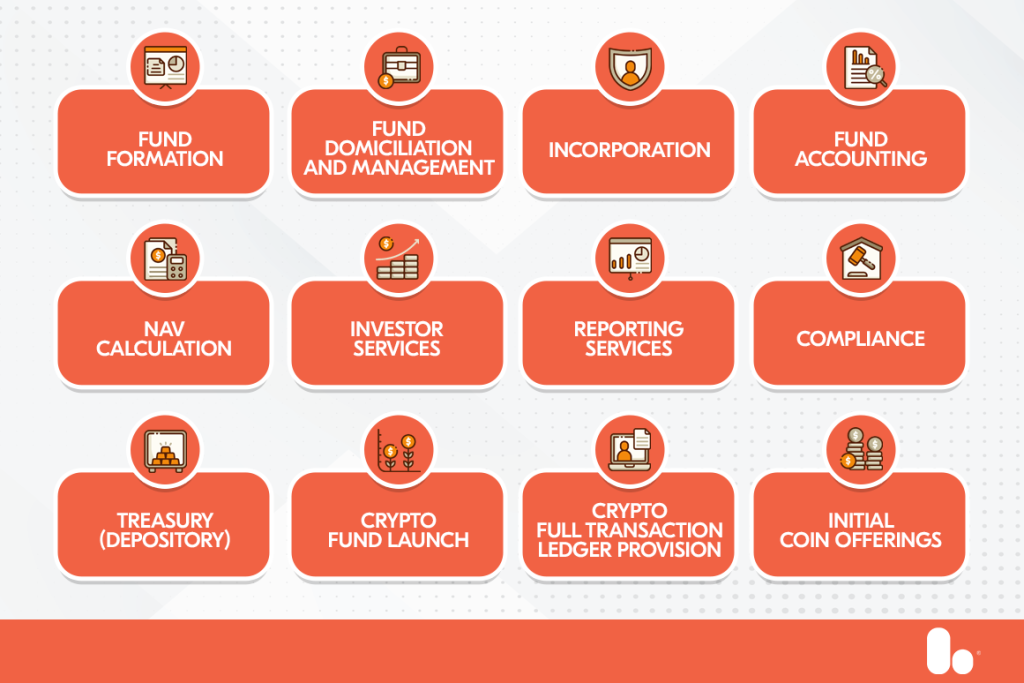

Bolder Group’s fund services are as follows:

To know more about our fund services, click here or contact a Bolder representative near you.

Bolder Group does not provide financial, tax or legal advice and the information contained herein is meant for general information purposes only. We strongly recommend that before acting on any of the information contained herein, readers should consult with their professional advisers. The Bolder Group accepts no liability for any errors or omissions in the information, or the consequences resulting from any action taken by a reader based on the information provided herein.

Bolder Group refers to the global network of independent subsidiaries of Bolder Group Holding BV. Bolder Group Holding BV provides no client services. Such services are provided solely by the independent companies within the Bolder Group which are each legally distinct and separate entities and have no authority (actual, apparent, implied or otherwise) to obligate or bind Bolder Group Holding BV in any manner whatsoever. The operations of the Bolder Group are conducted independently and have no affiliation with third party financial, tax or legal advisory firms or corporations.