CREATE MORE Law to push economic growth in PH

On 11 November 2024, the Corporate Recovery and Tax Incentives for Enterprises to Maximize Opportunities for Reinvigorating the Economy (CREATE MORE) Act or Republic Act (RA) 12066 was signed into law to drive global and domestic investments in the Philippines.

The law aims to make the country’s tax incentives regime more globally competitive, investment-friendly, predictable and accountable. It aims to boost the country’s status as an attractive investment destination and generate more jobs for Filipinos.

This article will discuss the significant tax incentives and regulatory reforms under the CREATE MORE Law and its benefits for foreign investors doing business in the Philippines and those looking to set up a company here.

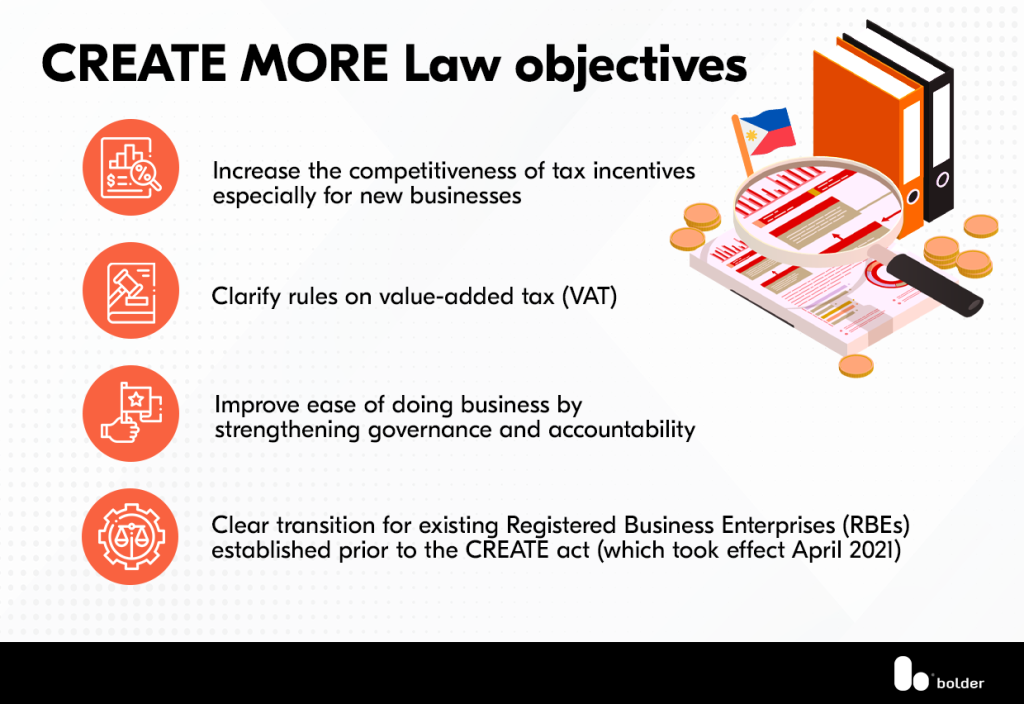

CREATE MORE Law objectives

The main objectives that govern the enactment of the CREATE MORE Law are as follows:

Additionally, it builds on gray areas from the CREATE Act, providing clarity to the RBEs on the benefits to be expected on local taxation during the periods of Income Tax Holiday (ITH) and the Enhanced Deductions Regime (EDR).

Some salient points from the new law includes:

- More options for Business Registration: Increase from Php 1B to 15B in the investment capital threshold for Investment Promotion Agencies (IPAs) such as Clark and PEZA to grant incentives to new RBEs. (RBEs exceeding Php 15b investment capital will be granted incentives by the Foreign Investment Review Board (FIRB).

- Income Tax holidays (ITH): Continuation of ITH for new RBEs for durations of 4-7 years

- Longer incentive periods post ITH: Special Corp Income Tax (SCIT) and Enhanced Deduction Regime (EDR) from 10-17 years for IPA registered RBEs and 20-27 years for RBEs registered by the FIRB.

- SCIT and EDR enhancements: Wider coverage of the application of SCIT and further reduction on the tax rate of RBEs under the EDR.

- Additional 100-percent deductibles for power expenses and additional 50% deduction for Exhibitions, Trade Missions and Trade Fairs.

- Reduced documentary requirements and clarified time frames to streamline the value-added tax (VAT) refund process

- Rationalisation and streamlining of incentives-related processes along with the integration of the electronic invoices and electronic sales reporting systems

- Simplified local taxation on RBEs

- Adoption of the flexible work arrangements as a business model for RBEs operating within economic zones and freeports (50% in the office)

- Continuation of National and local incentives previously granted to pre-CREATE RBEs until 31 December 2034

In conclusion, the passage of the CREATE MORE Law aims to create a favorable business climate for both domestic and foreign investors in the Philippines. Its objective is to also make the country more competitive internationally, spur better economic opportunities and attract a broader range of job-creating investments, enabling more Filipinos to find gainful employment.

The law aims to establish a fair and equal local tax structure seeks to provide businesses with more assurance while ensuring that their presence benefits the community.

Working with Bolder Group

Bolder Group is a licensed corporate service provider with an active presence in major Asian countries, including the Philippines. With our tailor-fit company formation services and global entity management solutions, we can help you navigate the newly enacted CREATE MORE Law and maximize the benefits it offers to your business.

If you’re planning to enter the Philippine market, our team of experts is ready to help you comply with all local and international regulations. We also offer directorship services to ensure your company is properly managed and controlled by a trusted partner.

Contact Bolder Group Philippines today for more information.

Bolder Group does not provide financial, tax or legal advice and the information contained herein is meant for general information purposes only. We strongly recommend that before acting on any of the information contained herein, readers should consult with their professional advisers. The Bolder Group accepts no liability for any errors or omissions in the information, or the consequences resulting from any action taken by a reader based on the information provided herein.

Bolder Group refers to the global network of independent subsidiaries of Bolder Group Holding BV. Bolder Group Holding BV provides no client services. Such services are provided solely by the independent companies within the Bolder Group which are each legally distinct and separate entities and have no authority (actual, apparent, implied or otherwise) to obligate or bind Bolder Group Holding BV in any manner whatsoever. The operations of the Bolder Group are conducted independently and have no affiliation with third party financial, tax or legal advisory firms or corporations.