An Introduction to Virtual Family Offices: Setup, Benefits, Services

DISCLAIMER: This post was last modified on 30 July 2024. Some information in this article may not be updated.

What are Virtual Family Offices?

The concept of a family office has been evolving due to digitalisation and changes in corporate financial trends, leading to the emergence of Virtual Family Offices (VFOs), a modern and technological alternative to traditional family offices.

Traditionally, family offices are limited to in-house experts in physical office spaces. They provide high-net-worth families with various solutions to help them manage, diversify and preserve their wealth.

VFOs, on the other hand, enable affluent families to partially outsource these services while reducing office space costs, streamlining administrative and operational tasks and adapting to industry trends.

In this article, we explore VFOs, their benefits, the setup process and bespoke solutions we can design for you.

Traditional SFOs and MFOs: the challenges

Recently, a report by the Economist Intelligence Unit and DBS shared that there is a ‘family office boom’ globally, with around 10,000 offices established just in the past decade. This growth is brought upon by an increase in wealth in families across the globe. However, family offices, particularly in Asia, where industries investing in technology and healthcare have gained significant wealth, are still an emerging trend.

The number of family offices is growing, but they may be moving away from the traditional structure due to the challenges of setting one up. A Single-Family Office (SFO) can be costly, requiring physical space, in-house employees and a certain level of assets under management (AuM) to operate fully.

Eventually, when families branch out or their demands become complex, a Multi-Family Office (MFO) is created. Unlike SFOs, MFOs are not exclusive to a single family. This can also be an option for families to seek more complex services that SFOs may not be able to offer.

A study on family offices revealed that successors have reservations about working with management teams who have served a family head or first generation for too long. The complicated relationship between family office members, both family and non-family members, may often lead to the absence of trust, oversight-related expenses and conflicts of interest. Some SFO founders expressed privacy concerns about managers who might divulge company secrets to other families.

Moreover, the next-of-kin successors might not be from the same jurisdiction, country or generation, which makes it challenging for long-time in-house family office staff to cater to their specific needs. According to the same report from DBS, new money families in Asia are tech-savvy and prefer family offices that can meet their needs for technology-driven alternatives.

These challenges collectively led experts to conclude that the family office concept is bound to adjust to meet the evolving needs of wealthy families. The emerging alternative structures, such as Virtual Family Offices (VFOs), fill in the gaps that traditional structures have and can become the future of family offices.

The VFO Setup

Family offices are essentially established to support the needs of the founding family and often focus on managing wealth. The study mentioned above shares that setting up a family office is typically triggered by events related to families’ sources of liquidised wealth, such as succession planning, selling or listing of business, separating private wealth from business, and changes in tax regulations.

Criteria for selecting which family office structure to establish vary across cultures, motivations, and needs that cater to the family’s unique demands. A VFO setup may have a designated professional who can be a family or non-family member, coordinating outsourced professionals, consultants, and advisors from specific fields in a remote setting.

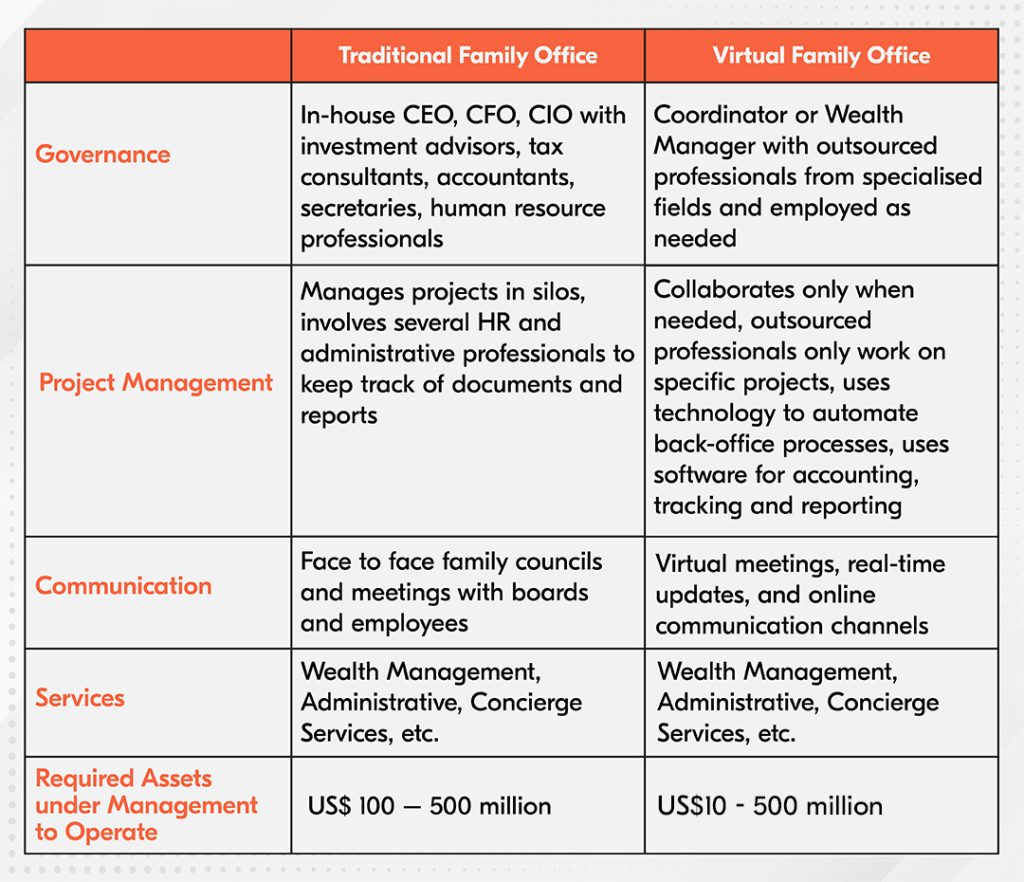

Here’s a comparison between the core functions of traditional and virtual family offices:

The Benefits of using VFOs

VFOs are separate legal entities that operate without the need for physical office space and in-house employees. Here are some of the benefits wealthy families may consider when choosing VFOs.

Cost Efficient

Industry experts estimate that an SFO requires 1.5%—2% of AUM. This option may only be accessible to UHNW families who can cover the operational costs since total costs could be independent from the family’s overall wealth. The percentages also decrease when AUM increases. This is due to the in-house expenses of employees, from salary to benefits and other administrative fees. When operating VFOs, the family only plays for consultation, making it the more cost-effective option. Plus, it streamlines the process through automation, accounting and document software that can reduce operational costs.

Flexibility

The key advantage of VFOs is that most of their core services are outsourced, which makes the structure flexible and sustainable. It can adapt to any industry change and market conditions. VFOs provide the flexibility to add and remove experts, as the structure is already designed to operate in this way.

Accessibility

Outsourcing services through a VFO provide access to a diverse set of experts to meet specific needs, such as educating an heir from a different jurisdiction or employing an expert who has no ties to the previous family head. It also allows families to easily access real-time information about their portfolios, investments and accounts. VFOs leverage technology for easy and secure access to information.

Security

Privacy has been a concern when using traditional family offices, especially large enterprises that employ several in-house human resources. Although scenarios may vary, VFOs may offer clients secure communication channels through automated processes and robust cybersecurity systems.

Services offered by VFOs

Historically, family office structures typically often mainly focus on financial services; however, changes in generational perception of wealth, investment trends and technological advancements gave rise to other non-financial services. This research categorises the activities of family offices into investments, administrative and family. Traditional and VFOs offer these services both; however, VFOs leverage technology to carry out these services efficiently.

Under our VFO solutions, Bolder Group offers the following:

Wealth Monitoring

The goal of a family office is to ensure wealth is diversified, portfolios are managed by the best in-class managers and ensure wealth is transferred in an effective manner. Our wealth monitoring process helps create and sustain wealth lasting several generations. Specifically, here are the ways in which VFOs can help manage family wealth:

- Asset Allocation – Traditional family offices usually have an in-house CEO and CIO to help advise how to diversify the family’s portfolio. This could include allocations to real estate investments, company governance, and private equity.

- Estate Planning—Studies on family enterprises say most wealthy families lose their wealth during the succession period. Planning multigenerational wealth is crucial for families to build and sustain their wealth over the years. VFOs offer comprehensive estate planning, from planning to educating the next generation to help preserve wealth.

- Tax Planning – VFOs can also provide a stable platform for tax-efficient solutions when structuring companies and trusts, transferring wealth, and managing assets.

Administrative Support

Operational and administrative support is crucial when managing family offices, but it can also be costly and time-consuming. VFOs can reduce both operational costs and time spent conducting these activities using software technologies.

- Document Management – VFOs utilise tech for document management to automate filing, tracking and reporting of important documents.

- Bill Payment Services – Bill payment through VFOs is quick and secure with automated software for on-time payment and easier tracking of financial activities

Lifestyle and Concierge Services

VFOs also offer tailor-fit solutions for a family’s various lifestyle choices. They can offer both concierge and philanthropic services that can be crucial to maintaining family cohesion and harmony.

- Personalised Concierge— This ranges from planning business trips to assisting in daily personal tasks, to choosing educational institutions for their children and attending impactful private and corporate events.

- Philanthropic Advisory – Financial trends show that the next generation cares more about corporate and social responsibility. VFOs can help advise families to invest in philanthropic causes that can extend the activities in which the family is involved.

Our VFO solutions

We understand the challenges of establishing a family office structure that caters to the specific needs of wealthy families. Bolder Group offers an elevated private wealth solution and can assist with establishing traditional family offices as well as virtual family offices. We provide comprehensive wealth structuring consulting, administrative support, and concierge services that meet your personal and financial goals. We leverage technology and security to ensure your family’s wealth and legacy will always remain fully protected over time.

Contact our team to learn more.

Disclaimer: Bolder Group does not provide financial, tax or legal advice and the information contained herein is meant for general information purposes only. We strongly recommend that before acting on any of the information contained herein, readers should consult with their professional advisers. The Bolder Group accepts no liability for any errors or omissions in the information, or the consequences resulting from any action taken by a reader based on the information provided herein.

Bolder Group refers to the global network of independent subsidiaries of Bolder Group Holding BV. Bolder Group Holding BV provides no client services. Such services are provided solely by the independent companies within the Bolder Group which are each legally distinct and separate entities and have no authority (actual, apparent, implied or otherwise) to obligate or bind Bolder Group Holding BV in any manner whatsoever. The operations of the Bolder Group are conducted independently and have no affiliation with third party financial, tax or legal advisory firms or corporations.