Why you should start a fintech company and startup in Africa

DISCLAIMER: This post was last modified on 2 August 2024. Some information in this article may not be updated.

The financial services sector has experienced significant change in recent years due to the emergence of financial technology, or fintech. “Fintech” refers to a wide range of technical advancements intended to enhance and mechanise the delivery of financial services, benefiting individuals, businesses and global economies, particularly Africa.

Fintech solutions improve the efficiency, transparency and accessibility of the financial industry by utilising cutting-edge technology. These innovations are changing how individuals and organisations manage their finances, invest and conduct transactions. Examples of these breakthroughs include blockchain technology, artificial intelligence (AI), machine learning, alternative lending and digital payment systems.

In this article, we’ll explore the business opportunities for a fintech startup in Africa.

A focus on the fintech market in Africa

With fintech innovation seeing a remarkable upsurge, Africa is quickly becoming a continent with economic opportunities. Its fintech market, mainly driven by South Africa, Nigeria, Egypt and Kenya, is expected to be valued at US$65 billion by 2030.

According to Afridigest, fintech startups in Africa raised a total of US$1.55 billion in capital, with equity financing accounting for 58 per cent of that amount (US$900 million). Much of that amount went to rapidly expanding fintech startups, with MNT-Halan, TymeBank and Moove receiving the three largest rounds of the year.

Africa’s need for fintech

Africa is home to almost 1.4 billion people, and over half of them do not own a bank account. Conventional banking cannot access remote areas and adequately serve the needs of the financially marginalised.

Due to this, the fintech industry in Africa is experiencing rapid growth across the world and drawing interest from telecoms and global corporations. Since most citizens own a smartphone and a SIM card, there is a massive opportunity to offer digital wallet services for mobile money.

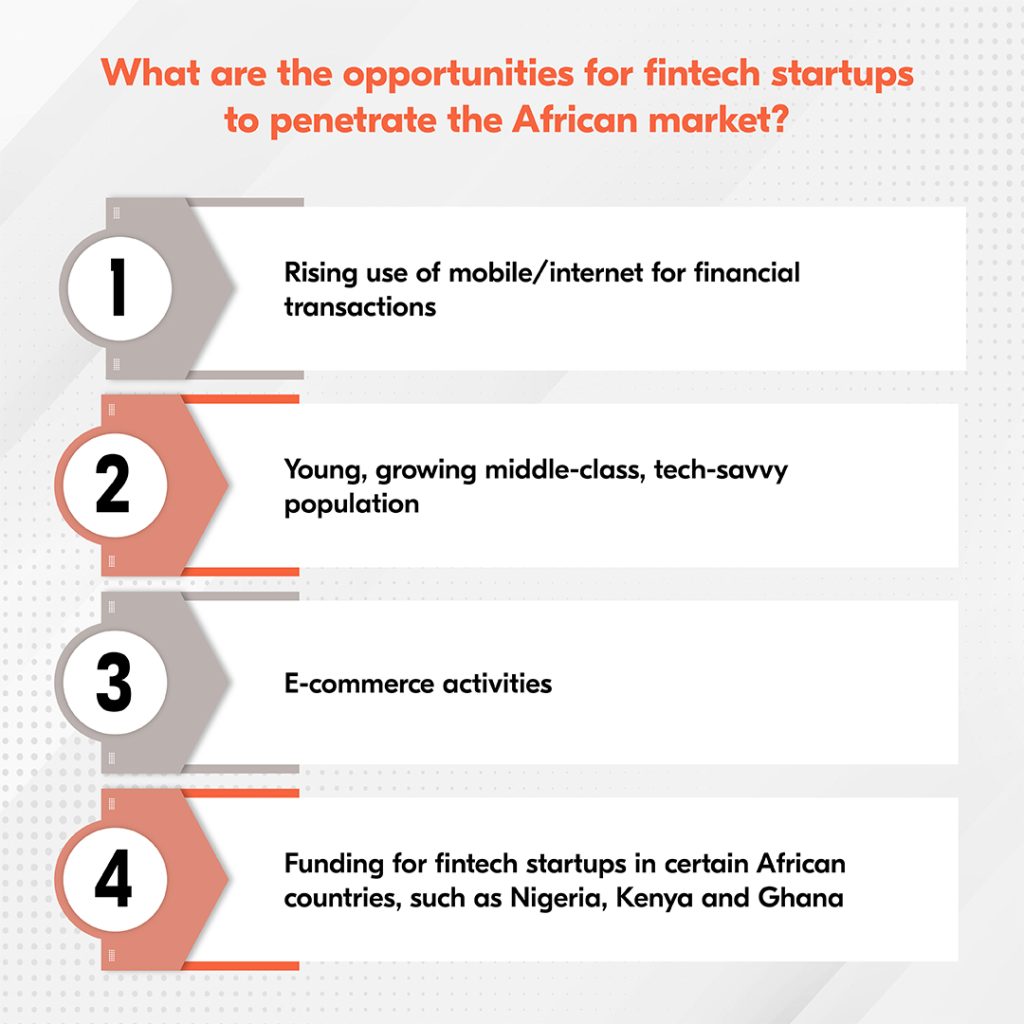

Opportunities for fintech companies to penetrate the African market

Due to the continent’s high mobile phone penetration rate and a young, growing middle-class, technologically inclined population, Fintech solutions are finding a home in Africa despite the continent’s largely unbanked population.

Fintech not only assists a young population that lacks access to banking but also supports small businesses and entrepreneurs. SMEs generate more than 70 per cent of Africa’s GDP. Funding and reliable ways of conducting business are essential for these small enterprises, particularly in remote parts of Africa. According to a McKinsey report in 2022, 90 per cent of African transactions involve cash, but the fintech sector is opening up financial services to millions of businesses.

Considerations for starting a fintech company in Africa

Market players must address regulatory compliance, resolve cybersecurity risks and embrace technology developments to maximise opportunities given by the evolution of the fintech ecosystem.

The target market of fintech companies in African countries

The vision of a financially integrated Africa has gained prominence as an increasing number of fintech companies enter the continent to close the gap between traditional banking services and the unbanked or underbanked population through digital banking and the adoption of digital payment solutions. For this reason, starting a fintech company in Africa is an excellent opportunity to provide accessible, cost-effective and customised financial solutions with the help of technology.

The rampant use of smartphones in Africa has led to a boom in digital financial services, enabling the unbanked to enjoy financial independence. These services include digital-only banks, digital wallets and contactless payments.

Regulatory compliance

African Fintech startups face challenges due to significant variations in regulations across different African countries. Furthermore, Fintech companies must be flexible because regulations are constantly changing, and data security and privacy are critical considerations.

Fintech companies are operating in a favourable environment thanks to the enhanced support of governments of African countries, through their regulatory frameworks. Examples are South Africa’s Intergovernmental Fintech Working Group (IFWG) and the Central Bank of Nigeria’s regulatory sandbox.

Cybersecurity risks

Cybersecurity and data privacy remain the primary concerns for fintech companies and their customers due to the increasing amount of sensitive financial data and digital transactions. Fighting against cyber-attacks and data breaches requires implementing robust security systems, enforcing encryption and complying with regulatory standards.

Conclusion

Several reasons are already driving fintech adoption in Africa, including expanding mobile phone usage, rising internet connection rates and increasing demand for digital financial services. Thus, starting a fintech company in Africa may present an opportunity to generate business and income in the African content, thanks to innovative tech solutions.

Bolder Group as your partner

Partnering with a qualified governance and corporate service provider like Bolder can help you achieve your business goals in various regions, including Africa, across various sectors, such as fintech. If you’re a fintech startup planning to penetrate the African market, we can provide support in structuring your vehicles or companies.

Our active presence in Mauritius makes our services available to African and global clients. In addition to boutique-style governance and corporate solutions, our team of experts also provides comprehensive funds and private wealth solutions. Ready to start your fintech company in Africa? Contact our Mauritius team today.

Bolder Group does not provide financial, tax or legal advice and the information contained herein is meant for general information purposes only. We strongly recommend that before acting on any of the information contained herein, readers should consult with their professional advisers. The Bolder Group accepts no liability for any errors or omissions in the information, or the consequences resulting from any action taken by a reader based on the information provided herein.

Bolder Group refers to the global network of independent subsidiaries of Bolder Group Holding BV. Bolder Group Holding BV provides no client services. Such services are provided solely by the independent companies within the Bolder Group which are each legally distinct and separate entities and have no authority (actual, apparent, implied or otherwise) to obligate or bind Bolder Group Holding BV in any manner whatsoever. The operations of the Bolder Group are conducted independently and have no affiliation with third party financial, tax or legal advisory firms or corporations.