At a glance: Your options in starting a business in Malta

DISCLAIMER: This post was last modified on 9 August 2024. Some information in this article may not be updated.

Malta is a prime location to start a business in Europe. As a member of the European Union, Malta enjoys the privileges of the region’s strong economic and regulatory regime. Its modern corporate tax system, strategic positioning and highly educated workforce make Malta an ideal destination to start a business in.

Benefits of Doing Business in Malta

1. Strategic location — The European Union represented 15.2% of the world’s GDP in 2021, coming in third as the biggest economy in the world. Malta benefits from this economic growth since the EU operates as a single market. In 2023, Malta recorded the fastest-growing GDP in the EU.

2. Robust economic growth — Malta’s projected GDP growth in 2024 is 4.6%, which is significantly higher than that of its neighbouring EU countries. Additionally, the inflation rate in Malta also steadily declined from 5.6 % in 2023 to 2.8 % in 2024, showcasing Malta’s robust economic growth.

3. Attractive tax framework — Malta’s competitive tax regime operates a full imputation system. This system allows shareholders receive a credit for tax paid by the company when dividends out of profits are distributed. Malta also has a very attractive participation exemption regime. Income deriving from a participating holding or capital gains realized on the disposal of a participating holding are exempt from tax.

4. Dynamic and highly-skilled workforce – Malta’s government Iinitiatives is actively promoting workforce participation through youth development programs. Malta also attracts foreign labourers which allows Maltese citizens to opt for high skill career paths.

Types of Companies in Malta

1. Limited Liability Company

These are the most common companies in Malta. Malta law classifies them into private and public. Private LLCs restrict share transfers, limit membership to 50 and prohibit public subscription for shares or debentures. In contrast, Public LLCs are allowed to offer shares or debentures to the public and trade their shares on the Stock Exchange.

2. Partnerships

Commercial partnerships in Malta are either general or limited partnerships. General partnerships share the liability of the company with its members. Limited partnerships have general and limited partners. General partners share liabilities, while limited partners are not liable for any debts beyond their contributions.

3. Overseas Company

An overseas company is a ‘body corporate constituted or incorporated outside Malta.’ By law, company branches must register relevant documents about the company within one month of its establishment in the country. They can be registered as LLCs.

4. Trusts

A trust in Malta is established when a settlor transfers assets to a trustee for beneficiaries or charitable purposes. This obligates the trustee to manage the trust property. Malta regulates these entities through the Trust and Trustees Act, which provides for the establishment of trusts, authorisation and supervision of trustees.

5. Foundations

Setting up a foundation in Malta can be done in two ways: as private and purpose foundations. A private foundation benefits specific beneficiaries, while a purpose foundation fulfils a specific charitable, philanthropic or social purpose.

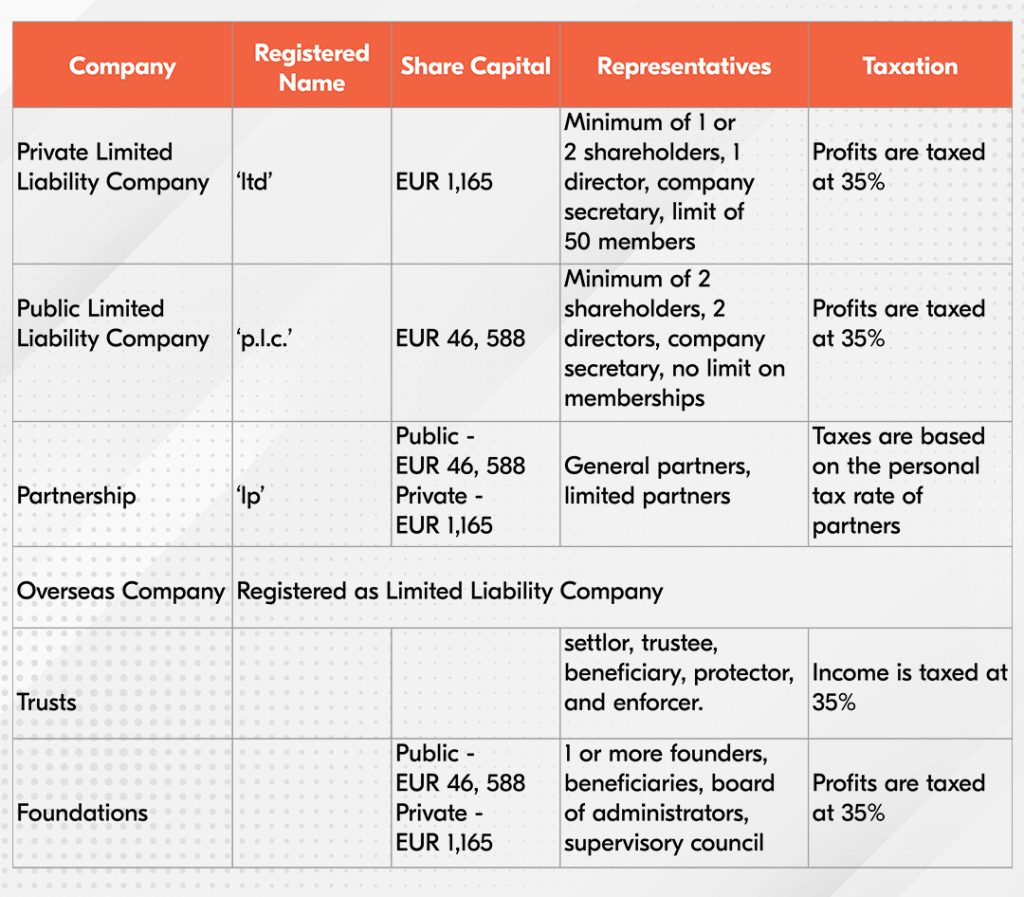

Starting a business in Malta: The differences of entities at a glance

Bolder Malta as your service provider

Choosing to start a business in Malta calls for an expert service provider who can help you seamlessly navigate the process and regulatory requirements suited for your business demands. Bolder Group offers services such as company formation and corporate administration to help form a company in Malta that fits your financial goals. We also provide trust & fund structuring and trustee services to help you take advantage of the robust tax regime of Malta.

Contact our team in Malta to help you get started.

Disclaimer: Bolder Group does not provide financial, tax or legal advice and the information contained herein is meant for general information purposes only. We strongly recommend that before acting on any of the information contained herein, readers should consult with their professional advisers. The Bolder Group accepts no liability for any errors or omissions in the information, or the consequences resulting from any action taken by a reader based on the information provided herein.

Bolder Group refers to the global network of independent subsidiaries of Bolder Group Holding BV. Bolder Group Holding BV provides no client services. Such services are provided solely by the independent companies within the Bolder Group which are each legally distinct and separate entities and have no authority (actual, apparent, implied or otherwise) to obligate or bind Bolder Group Holding BV in any manner whatsoever. The operations of the Bolder Group are conducted independently and have no affiliation with third party financial, tax or legal advisory firms or corporations.