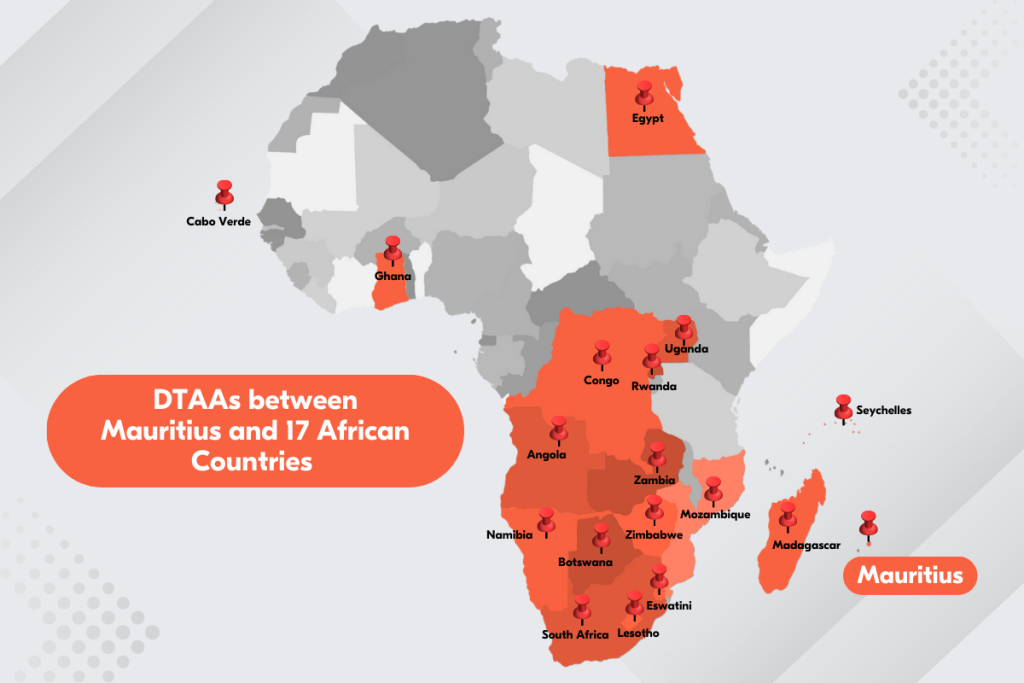

Mauritius and its tax treaties with 17 African countries

Mauritius, a small island country along the eastern coast of Africa, is globally known as one of the leading financial and business hubs in the African region. Its strategic geographic location and highly qualified workforce provides for a conducive environment for business and investment activities. Moreover, Mauritius’ tax treaties with other African countries provide notable advantages for interested market entrants and investors.

The reasons countries enter a tax treaty between other countries are likely to vary based on the country’s economic and political position, as well as its connections with the potential treaty partner countries. Tax treaties are meant to lower tax rates and in some situations, give exemption for revenue earned in another nation and avoid international double taxation in property or income of an individual. Treaties may stimulate regional development and be an effective tool in reducing cross-border tax avoidance and evasion.

In this article, we briefly discuss the existing tax treaties between Mauritius and other African countries.

Mauritius’ bilateral tax agreements

Bilateral tax agreements serve as an incentive for existing and prospective investors and businesses between two signing countries. According to the Mauritius Revenue Authority (MRA), the country has been able to conclude a total of 45 tax treaties with countries all over the world. Meanwhile, there are 17 tax treaties signed and are currently in force between Mauritius and other African countries.

- Angola

On 30 August 2022, the government of Mauritius ratified a new Double Taxation Agreement (DTA) with Angola. The tax treaty was signed on 25 May 2022 and is awaiting the requisite notification of the agreements’ entry into effect, as specified in the DTAA’s article. It will become effective once ratified by the government of Angola. By granting tax benefits, the DTA will provide tax certainty to both nations’ investors and provide a favourable environment for increased investment flows from the Mauritius global business sector to Angola.

- Botswana

Mauritius and Botswana signed a double taxation avoidance agreement on 26 September 1995 and was entered into force on 13 March 1996. The treaty covers the prevention of fiscal evasion as to the taxes on the income and capital gains on Mauritius and Botswana. A tax credit is granted for the elimination of double taxation. The initial treaty was then amended in 2017 through protocol.

- Cabo Verde

The income tax treaty between Mauritius and the Republic of Cabo Verde entered into force on 5 March 2018, in pursuant to section 76 of Mauritius’ Income Tax Act of 1995. The DTA between the two countries would apply to the single income tax and surcharge for fire brigade services in the case of the Republic of Cabo Verde. Meanwhile, the treaty would apply to the income taxes in Mauritius.

- Congo

Mauritius and the Republic of Congo entered into a double taxation avoidance agreement on 20 December 2010. The DTAA entered into force on 8 October 2014, which covers the prevention of fiscal evasion as to the taxes on personal income and company tax in Congo and the income tax in Mauritius.

- Egypt

The DTAA between Mauritius and the Arab Republic of Egypt entered into force on 10 March 2014. The taxes to which the tax treaty would apply would be the income tax for Mauritius. On the other hand, the taxes covered in Egypt are as follows:

- Income taxes, including:

- Income from commercial and industrial activities;

- Income from salaries and wages;

- Income from professional activities;

- Income derived from immovable property.

- Taxes on profits of legal entities (i.e., corporations and partnerships)

- Duty for the development of the financial resources of Egypt

- Tax withheld at source

- Supplementary taxes imposed as percentages of abovementioned taxes or otherwise

The treaty between the two countries was amended in 2017 by the Multilateral Instrument (MLI) implementing the Tax Treaty Related Measures to prevent Base Erosion and Profit Shifting. The amended treaty was effective starting on 2021.

- Eswatini

On 29 June 1994, Mauritius and Eswatini (previously known as the “Kingdom of Swaziland”) entered a double taxation avoidance agreement, which was entered into force 8 November 1994. The treaty covers the prevention of fiscal evasion with the aim of promoting and strengthening the economic relations between the countries.

This agreement would apply to income tax in Mauritius, while in Eswatini:

- Normal tax

- Non-resident shareholders’ tax

- Non-residents’ tax on interest

- Non-residents’ tax on entertainments and sports

- Ghana

A DTA agreement was signed between Mauritius and the Republic of Ghana on 11 March 2017, which entered into force on 22 January 2019. The treaty covers the prevention of fiscal evasion as to the taxes on the income of both countries.

- Lesotho

Mauritius and the Kingdom of Lesotho originally signed a double taxation avoidance agreement on 29 August 1997, which eventually entered into force on 09 September 2004. However, Lesotho and Mauritius recently entered and signed a new DTA treaty last 2 March 2021 which was effective by 7 June 2021. The said treaty covers the prevention of fiscal evasion as to the taxes on the income of both countries. The former DTA’s maximum withholding tax rates on dividends, interest and royalties were retained, but the current DTA included a maximum withholding tax rate of 7.5 per cent on technical services.

- Madagascar

On 30 September 1994, Mauritius and the Madagascar entered a double taxation avoidance agreement. The DTAA entered into force on 4 December 1995. The treaty covers the prevention of fiscal evasion as to the taxes on the income of both countries. For Mauritius, the taxes to which the tax treaty would apply would be the income tax. As for Madagascar, the taxes covered in are as follows:

- Corporate Income Tax (IBS)

- General Personal Income Tax (IGR)

- Income Tax on Movable Capital (IRCM)

- Including all deductions at source, all prepayments and advances deducted from the taxes referred to above

- Mozambique

On 14 February 1997, Mozambique and Mauritius signed a double taxation avoidance agreement and was in force on 8 May 1999. The agreement was made effective in Mauritius from 1 July 1999 while 01 January 2000 in Mozambique. The treaty covers the taxes on income in Mauritius, while it applies to the business profits tax, labour income tax and complementary tax for Mozambique.

- Namibia

The double taxation avoidance agreement of Namibia and Mauritius was signed on 4 March 1995 and was enforced on 26 July 1996, with the aim of promoting and strengthening the economic ties between the two countries. The agreement shall apply in particular: the income tax in Mauritius, and the income tax, the non-resident shareholders’ tax, and the petroleum income tax in Namibia.

- Rwanda

Rwanda and Mauritius signed a double taxation avoidance agreement on 30 July 2001 and put into force on 14 April 2003, however this treaty was terminated in June 2012. A new tax treaty between the two countries entered into force on 4 August 2014. The agreement concludes a prevention of fiscal evasion with respect to taxes on income. The taxes that the agreement applies to in Mauritius is the income tax, while for Rwanda:

- Personal income tax

- Corporate income tax

- Withholding taxes

- Tax on the rent of immovable property

- Seychelles

The Mauritius and Seychelles’ double taxation avoidance agreement was signed on 11 March 2003 and successfully entered into force on 22 June 2005. In 2011, an amendment protocol was raised to rewrite Article 26 of the agreement which touches on exchange of information. The tax treaty exempts dividends, interests and royalties from withholding taxes. Moreover, the agreement applies to the business tax and petroleum income tax in Seychelles, while in Mauritius, the income tax.

- South Africa

The initial DTA agreement between Mauritius and South Africa was signed on 16 July 1996 and entered into force on 20 June 1997. In November 2009, South Africa and Mauritius started renegotiations for the new DTAA. Mauritius notified South Africa of its ratification of the new DTA treaty on 28 May 2015.

The main changes to the tax treaty includes:

- Revised test for dual residence for persons other than individuals

- Withholding taxes on interest and royalties

- Capital gains tax

- Removal of tax sparing provision and assistance in tax collection

The new tax treaty reflects the changes in tax policies of the two countries and in conformity with international best practises to counter tax abuse.

- Tunisia

The double taxation avoidance agreement between Tunisia and Mauritius was signed on 12 February 2008 and entered into force on 28 October 2008. The DTA agreement applies to income taxes in Mauritius and personal and corporate income taxes in Tunisia. However, the tax treaty concludes an exemption for dividends on withholding taxes.

- Uganda

Uganda and Mauritius signed their double taxation avoidance agreement on 19 September 2003, which was enter into force on 21 July 2004. The agreement of the two countries concludes a prevention of fiscal evasion to taxes on income of both countries; the Mauritius tax and Uganda tax.

- Zimbabwe

On 6 March 1992, the country Zimbabwe and Mauritius signed a DTAA which resolves the prevention of fiscal evasion in relation with the taxes on income, capital and capital gains. The agreement was put into force on 5 November 1992. The existing taxes to which the agreement applies is the income tax for Mauritius tax, while for Zimbabwe:

- Income tax

- Branch profit tax

- Non-residents’ shareholders’ tax

- Non-residents’ tax on interest

- Non-residents’ tax on fees

- Non-residents’ tax on royalties

- Capital gains

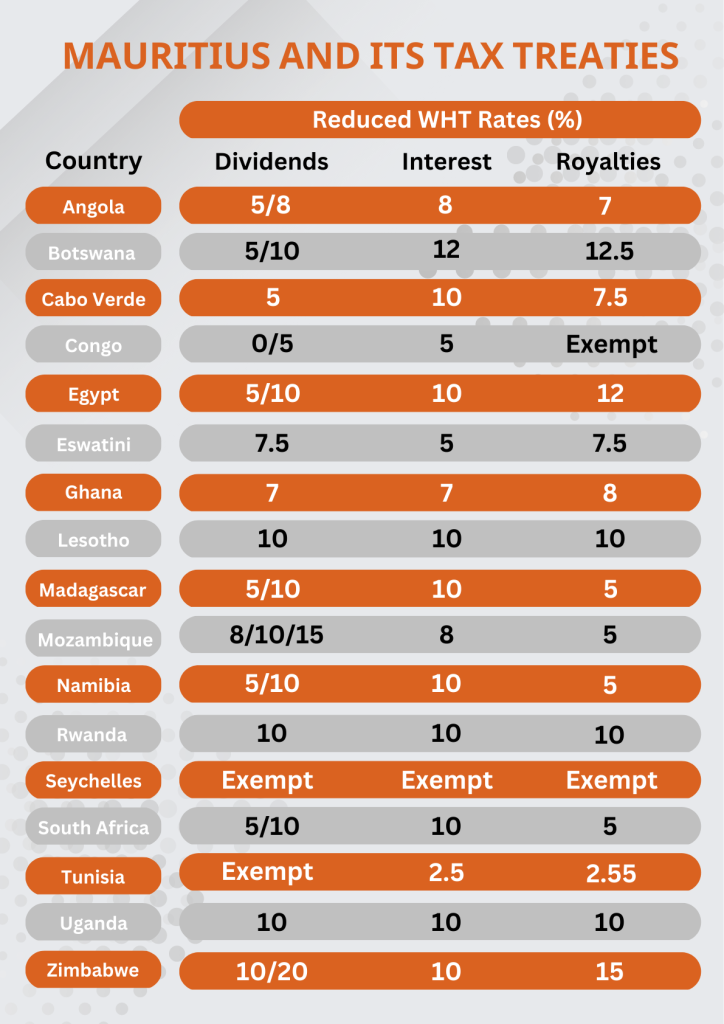

Here is a summarised table of the reduced withholding tax rates of dividends, interest and royalties imposed on the contracting states with the concluded tax treaties.

Bolder Group as your partner in Mauritius

The interconnectedness of Mauritius and other African countries share a progressive vision for economic and regional integration through the double taxation avoidance agreement. These agreements benefit both contracting states by working towards the reduction and prevention of cross-border tax avoidance and evasion. Moreover, the tax treaty agreements deliver a positive impact for investment and trade between the African countries.

With Bolder Group’s presence in the African market through Mauritius, our experts can assist Mauritian clients in expanding within other African jurisdictions.

Contact our Mauritius team now.

Bolder Group does not provide financial, tax or legal advice and the information contained herein is meant for general information purposes only. We strongly recommend that before acting on any of the information contained herein, readers should consult with their professional advisers. The Bolder Group accepts no liability for any errors or omissions in the information, or the consequences resulting from any action taken by a reader based on the information provided herein.

Bolder Group refers to the global network of independent subsidiaries of Bolder Group Holding BV. Bolder Group Holding BV provides no client services. Such services are provided solely by the independent companies within the Bolder Group which are each legally distinct and separate entities and have no authority (actual, apparent, implied or otherwise) to obligate or bind Bolder Group Holding BV in any manner whatsoever. The operations of the Bolder Group are conducted independently and have no affiliation with third party financial, tax or legal advisory firms or corporations.