Automation & Cybersecurity: Enhancing efficiency and security in Fund Operations

As the fund industry grows more complex and regulations tighten, hedge funds, private equity and alternative investments continue to develop. Consequently, key fund operational functions—such as regulatory compliance, fund accounting, audits, investor reporting and tax requirements—are also evolving rapidly.

Fund managers and financial institutions are progressively adopting automation to improve efficiency, minimise errors and streamline operations. However, cybersecurity risks grow increasingly complex with the rise of automation, requiring innovative solutions to protect financial data.

We’ll discuss further in this article how automation is transforming fund operations, the associated cybersecurity risks and the strategies that financial institutions can employ to comply with this digital shift.

How automation helps optimise fund operations

Through leveraging data management and automation, fund administrators may enhance fund operational efficiency by:

- Using AI-powered data processing to reduce manual errors

- Managing investor equity calculations accurately

- Improving workflow through automated trade reconciliation and reporting

- Initiating, managing, and monitoring investor payments efficiently

- Improving compliance through streamlined regulatory filings and due diligence

- Expanding scalability to manage high-volume transactions with ease

Two major firms, AXA Investment Managers and HSBC Asset Management, adopted automation to streamline operations, reduce costs and improve overall efficiency. AXA IM successfully onboarded new automated processes, while HSBC focused on integrating data across multiple locations to improve reporting and strengthen risk management.

Cybersecurity in Fund Management

From a regulatory standpoint, cybersecurity remains the most important. Fund managers must safeguard sensitive information and prevent cyberattacks on investor and fund data, as well as their reputation as service providers.

Some of the cybersecurity threats that fund managers face include phishing, ransomware attacks and AI-driven cyber threats. According to Statista, roughly 65 per cent of financial organisations worldwide reported experiencing a ransomware attack in 2024. Cybercriminals frequently use these attacks to encrypt important financial data and demand large ransom payments for decryption. For this reason, employing top-tier encryption, data security and authentication may mitigate investor concerns and ensure the protection of sensitive information.

Laws such as the General Data Protection Regulation (GDPR) enforce stringent cybersecurity standards, while the Digital Operational Resilience Act (DORA) enhances the financial sector’s resilience against cyberattacks to ensure robust protection for all participants. Failure to comply with these regulations can lead to financial penalties, regulatory enforcement and reputational damage.

Cybersecurity Strategy for Fund Managers

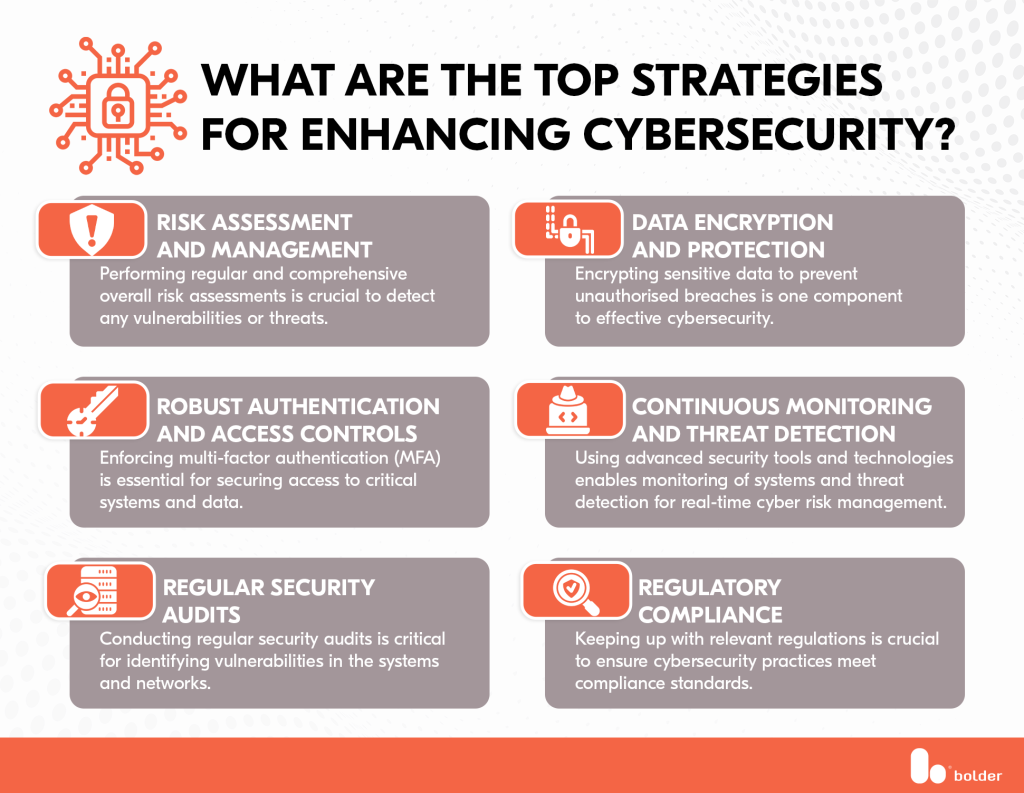

A strong cybersecurity framework requires proactive risk mitigation. Below, we outline some of the best cybersecurity strategy practices for investment firms to maintain best-in-class security management.

Key takeaways

Automation improves fund operations by increasing efficiency, while cybersecurity protects financial integrity. According to Bolder’s Global Head of Funds, Neco Dusseldorp, automation is absolutely key in our industry, where fund managers face significant competition. While differentiation often comes through stronger returns, automation also plays a crucial role in fund management and administration.

Integrating automation and cybersecurity has a significant impact on funds and their managers. Some of the primary implications involve employee training and re-skilling, enhancements to infrastructure and adjustments to compliance regulations. Despite that, combining both strategies results in a more resilient, streamlined and secure approach to fund management. Financial institutions that successfully integrate automation with robust cybersecurity will maintain a strategic advantage in the rapidly evolving financial landscape.

Secure and streamline your fund operations with Bolder

As a qualified fund administration service provider, Bolder Group helps institutions enhance efficiency, reduce risk and ensure compliance through our comprehensive fund management services. Our bespoke solutions are supported by in-house technology that continues to evolve alongside your needs and the industry’s demands.

We can help you optimise workflows, protect sensitive data and stay compliant with evolving financial regulations. Partner with us to future-proof your fund operations! Get in touch with our team today to learn more about our services.

Bolder Group does not provide financial, tax or legal advice and the information contained herein is meant for general information purposes only. We strongly recommend that before acting on any of the information contained herein, readers should consult with their professional advisers. The Bolder Group accepts no liability for any errors or omissions in the information, or the consequences resulting from any action taken by a reader based on the information provided herein.

Bolder Group refers to the global network of independent subsidiaries of Bolder Group Holding BV. Bolder Group Holding BV provides no client services. Such services are provided solely by the independent companies within the Bolder Group which are each legally distinct and separate entities and have no authority (actual, apparent, implied or otherwise) to obligate or bind Bolder Group Holding BV in any manner whatsoever. The operations of the Bolder Group are conducted independently and have no affiliation with third party financial, tax or legal advisory firms or corporations.