ADGM Funds Regime Explained: A Strategic Guide for Fund Managers

With USD 4.48 billion in FDI capital inflows in 2023, Abu Dhabi emerged as a key contributor to the UAE’s economic landscape. As a result, the emirate is regarded as a major investment hub in the MENA region. By offering sustainable investment opportunities and capital flow to growing industries, including the financial, insurance and industrial sectors, the capital city aims to expand its non-oil sectors further.

Situated at the heart of the MENA region and the East/West corridor, the Abu Dhabi Global Market (ADGM) is the perfect entry point for the Gulf Cooperation Council (GCC) markets, South Asia, and Africa. Established in October 2015, the ADGM is an international financial centre and an independent jurisdiction within Abu Dhabi’s Al Maryah Island. Its fund framework accommodates a wide range of fund structures, vehicles and management strategies to support diverse investment approaches, providing fund managers with a flexible and well-regulated environment.

Fund setup in the ADGM

ADGM offers fund managers a streamlined, globally compliant business environment. Its fund framework delivers highly competitive setup costs, swift market entry, flexible capital requirements and the absence of remuneration restrictions. It also offers high standards of governance and investor protection.

Access to various investment structures, including funds, special purpose vehicles (SPVs) and trusts, allows managers and investors to manage sophisticated portfolios effectively. Additionally, the wide reach of ADGM funds across the UAE has fostered a thriving landscape for local and international firms. Due to its advantageous tax climate and the UAE’s robust network of Double Taxation Treaties, ADGM is an ideal location to manage both regional and foreign portfolios.

ADGM also offers tailored frameworks for emerging fund managers including start-ups, boutique firms and venture capitalists, to support the growth of a diverse and innovative fund sector.

Type of Funds

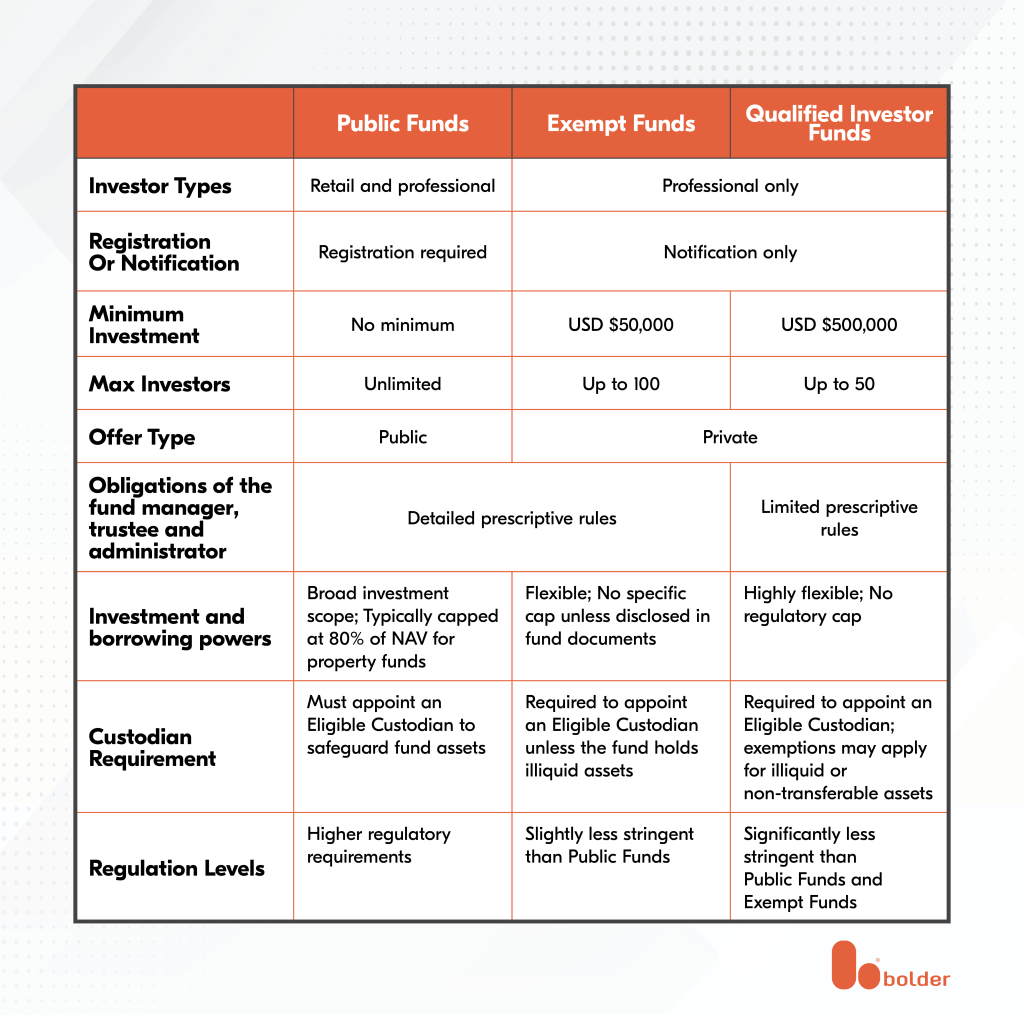

Domestic investment funds are classified in the ADGM according to their structure, regulatory restrictions and investor eligibility. Below is a summary of their key differences:

Fund Vehicles

ADGM’s comprehensive fund framework offers fund managers a wide range of options when choosing fund vehicles and structures.

- Open or Closed-ended Investment Companies: Open-ended structures allow ongoing subscriptions and redemptions for traditional funds, while closed-ended funds are used for listed fund entities.

- Investment Trusts: Fund managers can use investment trusts for their funds by appointing an eligible trustee through a deed.

- Limited Partnerships: Commonly used in other lending fund markets, limited partnerships are also permitted as fund structures in ADGM.

- Protected Cell Companies & Incorporated Cell Companies: Fund managers may utilise PCCs and ICCs to legally segregate the assets and liabilities of each cell while operating under common management.

For fund structuring purposes, ADGM offers fund managers several options, including SPVs, Restricted Scope Companies, General Partner SPVs, Master/Feeder Structures and Umbrella Funds.

What are the processes and requirements for setting up funds in the ADGM?

Below are some of the general processes and requirements for setting up funds in the ADGM.

- Determine the fund type

- Submit a completed application form and any required documentation with the application fee to the ADGM Financial Services Regulatory Authority (FSRA).

- Obtain a Commercial Licence.

- Decide on the legal fund vehicle and draft its constitutional documents.

- Launch the fund and comply with ongoing regulatory requirements.

The requirements for setting up a fund in the ADGM would vary depending on the chosen fund structure. In general, the requirements include:

- Private Placement Memorandum (“PPM”);

- Subscription Agreement (for investors);

- Limited Partnership Agreement (only applicable to funds structured through partnerships);

- Investment Management Agreement; and

- Fund Constitution (only applicable to investment companies).

Why our Bolder fund services?

As a global fund administrator providing corporate, funds, governance and private solutions to asset managers, corporations, multinationals, as well as high net-worth individuals, Bolder Group is your trusted partner in administering your funds. With an active presence in major jurisdictions, we offer customised and comprehensive fund solutions to meet your goals and ensure long-term success.

Our partnership with Levari Law allows us to provide a unique and comprehensive suite of corporate, funds and legal services to asset managers, investors, corporations and private individuals across the globe, specifically in the MENA region.

Ready to structure your fund or investment vehicle? Contact your nearest Bolder office for expert assistance and kickstart the process.

Bolder Group does not provide financial, tax or legal advice and the information contained herein is meant for general information purposes only. We strongly recommend that before acting on any of the information contained herein, readers should consult with their professional advisers. The Bolder Group accepts no liability for any errors or omissions in the information, or the consequences resulting from any action taken by a reader based on the information provided herein.

Bolder Group refers to the global network of independent subsidiaries of Bolder Group Holding BV. Bolder Group Holding BV provides no client services. Such services are provided solely by the independent companies within the Bolder Group which are each legally distinct and separate entities and have no authority (actual, apparent, implied or otherwise) to obligate or bind Bolder Group Holding BV in any manner whatsoever. The operations of the Bolder Group are conducted independently and have no affiliation with third party financial, tax or legal advisory firms or corporations.