What is the Corporate Transparency Act and its impact on US entities

DISCLAIMER: This post was last modified on 04 July 2023. Some information in this article may not be updated.

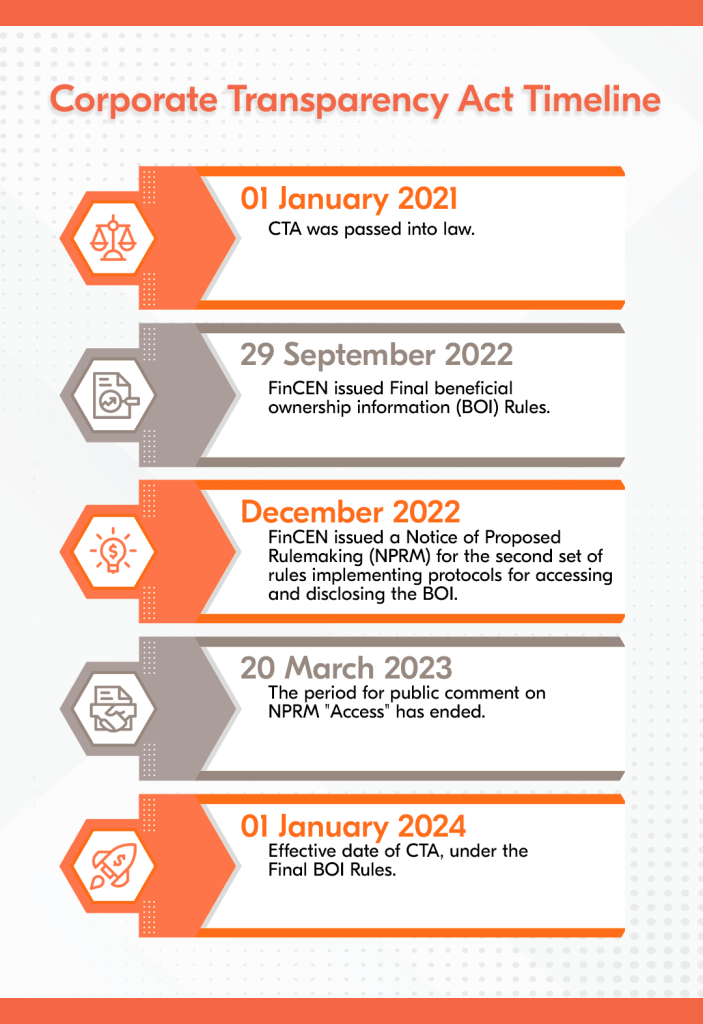

In January 2021, the United States Corporate Transparency Act (CTA) was passed into law as part of the National Defense Authorization Act. It requires corporations and limited liability companies to report their beneficial ownership information (BOI) to the Financial Crimes Enforcement Network (FinCEN), a branch of the U.S. Department of the Treasury. The names, birthdates, addresses and identification numbers of the individuals who own or control the corporation—often referred to as Ultimate Beneficial Owners (UBOs)—are included in this information. The primary goal of the CTA is to increase business transparency and fight against crimes like tax evasion, money laundering and other types of illicit activity.

The CTA covers foreign companies registered to conduct business in the United States and companies formed or registered in the jurisdiction. This indicates that while the CTA primarily focuses on US firms, it also applies to foreign entities in the country. The entities formed before 1 January 2024 must file their initial BOI report with FinCEN by 31 December 2024.

Meanwhile, the Establishing New Authorities for Businesses Laundering and Enabling Risks to Security (ENABLERS) Act focuses on extending anti-money laundering requirements to professional service providers, such as lawyers, accountants and third-party payment services, to increase the efficiency and scope of AML regulations.

With the enactment of the CTA and the ENABLERS Act, there is now more scrutiny and a need for compliance, which has caused some family offices to reassess their business models and implement more transparent procedures.

Key points of the CTA

Reporting companies and exemptions

Most of the reporting companies will be corporations, limited liability companies or entities formed by filing a document with the secretary of state or similar office per applicable state law. However, there are 23 types of exempt entities outlined in CTA.

An entity is considered a large operating company if it (a) employs more than 20 full-time employees in the US, (b) operates at a physical office in the US and (c) has filed a US tax return for the previous year showing more than $5 million in gross receipts, excluding gross receipts or income from sources outside the US.

What information must be reported?

The reporting company itself must provide the FinCEN with the following information:

- full legal name;

- any trade name;

- business address;

- jurisdiction of formation or registration; and

- Taxpayer Identification Number (TIN)

For each beneficial owner or a company applicant, a reporting company will have to report the following:

- full legal name;

- date of birth;

- residential address;

- unique identifying number from an acceptable identification document;

- name of the state or jurisdiction that issued the identification document; and

- image of the document with identifying number

The requirements apply to both domestic and foreign reporting companies.

Who is considered a beneficial owner of a reporting company?

The US CTA defines a beneficial owner as a natural person who, directly or indirectly:

- Exercises substantial control over a corporation or limited liability company;

- Owns 25% or more of the ownership interests of a corporation or limited liability company; or

- Receives substantial economic benefits from the assets of a corporation or limited liability company.

An individual has “substantial control” over a company if the individual (a) is a senior officer of the company; (b) has authority over the appointment or removal of any senior officer or a majority of the board of directors (or similar body); or (c) directs, determines or has substantial influence over important matters affecting the reporting company.

Meanwhile, an ownership interest can be directly or indirectly controlled or owned by any contract, arrangement, understanding or other means. Ownership interests also include convertible instruments. On the other hand, options and derivatives that a company is unaware of are not subject to reporting requirements.

Who will have access to the beneficial owner information?

Beneficial owner information will only be used for legally authorized purposes. Under certain conditions, the CTA allows FinCEN to disclose beneficial ownership information to the following types of requesters:

- Federal agencies engaged in national security, intelligence or law enforcement;

- State, local and tribal law enforcement agencies;

- The U.S. Department of the Treasury;

- Foreign law enforcement agencies;

- Financial institutions subject to CDD obligations; and

- Federal and state regulators assessing financial institutions.

Penalties for non-compliance

The UBO information will not be made public, and any serious breach of the UBO reporting requirements will result in sanctions. The CTA imposes severe civil and criminal penalties, including civil fines of $500 per day up to a maximum of $10,000 for failure to report on time and possible imprisonment for up to two years for willful failure to report or for willfully including false information in a report.

Bolder Insights

The enactment of the CTA will certainly impact company formation and compliance. Alaiana Monteiro, Corporate and Governance Representative for Bolder USA, says that the best way to stay compliant with the CTA, is to have internal Compliance policies, and by keeping all entities and persons with updated and accurate records.

“It is also important to enhance the internal due diligence procedures before engaging in other businesses, and even relationships with other entities that might be considered high-risk,” she added. In addition, Alaiana highlighted the importance of getting support from professionals such as Registered Agents, Attorneys, CPAs and other corporate professionals that will keep you informed about regulatory changes, have the best practices and comply with all reports by the due date.

Impact on trusts and family offices

Alaiana states that the Corporate Transparency Act will impact all reporting companies, reporting trusts, family offices and foreign companies registered to do business in the United States, consequently bringing significant shifts in the way these entities run their day-to-day business. “It is important to know that the regulatory authorities, and those with access to the submitted personal information, have an obligation to keep such information confidential, under penalty for violation in case otherwise,” she continued.

Bolder Solutions

Bolder Group provides comprehensive governance and compliance solutions, from UBO screening to full regulatory reporting, in all major jurisdictions, including the United States. Working with our governance team, our clients can reduce the time they spend on administrative tasks related to complying with local requirements.

We offer a tailored approach to meet your specific needs and can help you stay compliant to avoid costly penalties and legal repercussions. Get in touch with our team today to learn more about our services.

Bolder Group does not provide financial, tax or legal advice and the information contained herein is meant for general information purposes only. We strongly recommend that before acting on any of the information contained herein, readers should consult with their professional advisers. The Bolder Group accepts no liability for any errors or omissions in the information, or the consequences resulting from any action taken by a reader based on the information provided herein.

Bolder Group refers to the global network of independent subsidiaries of Bolder Group Holding BV. Bolder Group Holding BV provides no client services. Such services are provided solely by the independent companies within the Bolder Group which are each legally distinct and separate entities and have no authority (actual, apparent, implied or otherwise) to obligate or bind Bolder Group Holding BV in any manner whatsoever. The operations of the Bolder Group are conducted independently and have no affiliation with third party financial, tax or legal advisory firms or corporations.