A deeper look into the AML rules covering the EU luxury market

DISCLAIMER: This post was last modified on 26 March 2024. Some information in this article may not be updated.

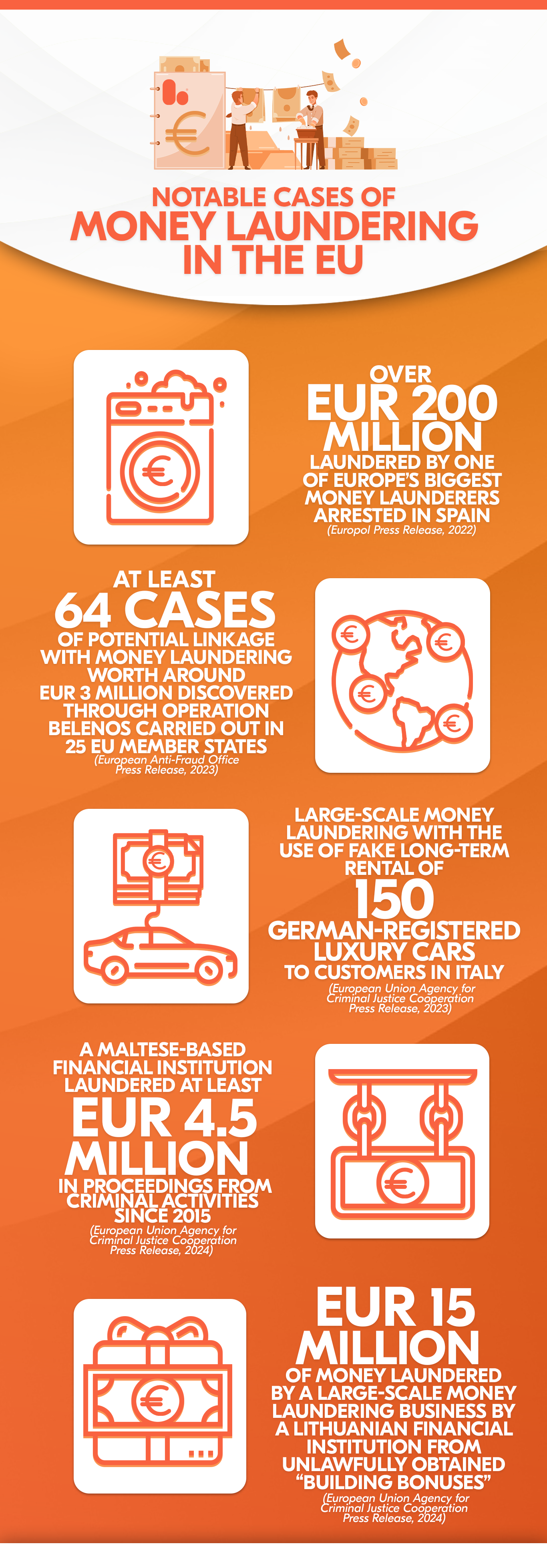

Money laundering has been a continuing threat in society and global economies, especially with the advancement of globalisation and digitalisation in the financial landscape. It is an integral component in the accomplishment of other larger-scale and organised crimes across numerous sectors and jurisdictions – the EU’s luxury sector is no exception.

In this multi-part series, we dive into money laundering in the EU luxury market with some insights from our Bolder experts.

Money laundering – an ongoing challenge in the EU

According to Europol’s European Financial and Economic Crime Threat Assessment report for 2023, 70 per cent of criminal networks in the EU employ basic money laundering techniques to carry out their illicit activities. Moreover, it was found that 30 per cent of criminal networks engage with professional money laundering networks and underground banking systems.

The challenging task of mitigating and tackling money laundering is becoming more intensified with the advancement of such money laundering techniques, as well as the exploitation of technology in finance.

Stricter EU AML Rules for the Luxury Sector

In January 2024, the EU Council and Parliament agreed upon the 2021 AML package, introducing a more stringent approach to protect EU citizens and the EU financial system against money laundering and terrorist financing.

The key changes brought upon the preliminary agreement are as follows:

- New anti-money laundering regulation (“AMLR”);

- Revision of the existing anti-money laundering directive (“AMLD6”);

- Extended scope of obliged entities (e.g., crypto asset service providers, luxury goods traders, professional football clubs);

- Enhanced due diligence (“EDD”) measures for cross-border obliged entities, especially when dealing with high-net-worth individuals (“HNWIs”) and high-risk third countries;

- Harmonised beneficial ownership rules with a 25 per cent threshold; and

- Limit on the use of large cash transactions, with a limit of EUR 10,000, among others.

Additionally, businesses must exercise vigilance in smaller transactions between EUR 3,000 and EUR 10,000 by acquainting themselves with their customers to ascertain the origin of funds.

EU’s luxury market

The European personal high-end goods (e.g., jewellery, watches, accessories) account for 74 per cent of the global value of all products in the category. In addition, European high-end exports are estimated to be valued at EUR 260 billion, according to the European Commission.

However, the luxury market is highly susceptible to illicit activities, as criminal networks invest in high-value movable goods that can offer potential anonymity and concealment. Moreover, investments in luxury assets may be a way to re-integrate laundered profits into the legitimate economy.

Accordingly, regulatory supervision is increasing to address the challenges associated with money laundering through luxury goods. However, the new AML rules may herald challenges for corporations and individuals in the EU luxury market. Before this stricter AML rule, luxury market participants were accustomed to greater privacy. Now, they must comply with the new regulations, which also present an opportunity to show they operate with transparency and integrity and within the bounds of the law.

Meanwhile, for obliged entities, this entails a deeper understanding of the financial activities of wealthy clients, where their money comes from and where it is going. Ultimately, the objective is to ensure that such transactions are not linked to illegal activities.

Some examples of the obliged entities in the luxury market include, but are not limited to:

- Traders of luxury goods such as precious metals, precious stones, jewellers, horologists and goldsmiths;

- Sellers of luxury cars, airplanes, jets and yachts;

- Traders of cultural goods and artworks

For a more detailed discussion on the EU Council and Parliament’s provisional agreement, read our previous article here: EU Parliament, Council push stricter EU AML rules | Bolder Group

Compliance and Governance with Bolder Group

Money laundering within the luxury market is just one of the many segments constituting the EU’s complex spectrum of financial and economic crimes. Nonetheless, it capitalises on the vulnerabilities of financial systems and plays a significant role in weakening the EU and global economies.

It is of utmost importance to stay vigilant and up-to-date in the fight against money laundering. In the next part of this series, we discuss the indicators of fraudulent activities and money laundering in the luxury market.

We recognise the need to keep our stakeholders informed, involved and in control at all times. Especially with today’s fast-paced economies and increasing regulatory scrutiny posing significant challenges of ensuring organisational sustainability and compliance.

Our tailor-made solutions and team of compliance experts across 18 jurisdictions enable us to provide solutions relevant to your compliance needs.

Contact our governance team to learn more about our solutions or visit a Bolder office near you.

Disclaimer. Bolder Group does not provide financial, tax or legal advice and the information contained herein is meant for general information purposes only. We strongly recommend that before acting on any of the information contained herein, readers should consult with their professional advisers. The Bolder Group accepts no liability for any errors or omissions in the information, or the consequences resulting from any action taken by a reader based on the information provided herein.

Bolder Group refers to the global network of independent subsidiaries of Bolder Group Holding BV. Bolder Group Holding BV provides no client services. Such services are provided solely by the independent companies within the Bolder Group which are each legally distinct and separate entities and have no authority (actual, apparent, implied or otherwise) to obligate or bind Bolder Group Holding BV in any manner whatsoever. The operations of the Bolder Group are conducted independently and have no affiliation with third party financial, tax or legal advisory firms or corporations.

Feature Image from Envato.