PE investment funds: a focus on Asia

DISCLAIMER: This post was last modified on 29 May 2023. Some information in this article may not be updated.

Private equity (PE) funds in the Asia-Pacific region have been facing a significant shift since last year. While this alternative investment asset class showed continuous growth this past decade and resiliency during the first two years of the COVID-19 pandemic, the same cannot be said for 2022 and the rest of 2023.

A look back to Asia-Pacific PE funds in 2022

PEs sustained high levels of deals, exit values and fundraising during the pandemic; however, factors including inflation, geopolitical tensions and sluggish economic growth, to name a few, led to a slowdown in 2022 and is expected to continue throughout 2023.

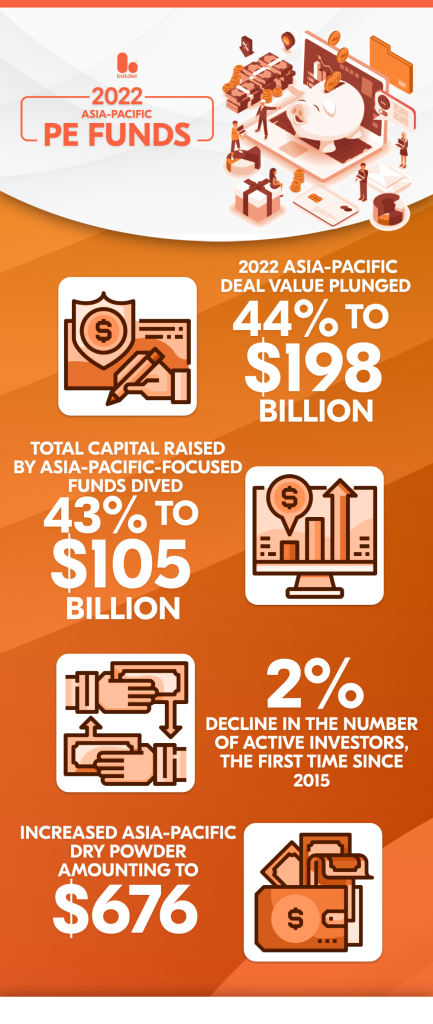

Asia-Pacific PE investment funds also confronted the same challenge as it ended two years of record dealmaking in 2022. Bain & Company’s 2023 Asia Pacific Private Equity Report showed that Asia-Pacific deal values hit a slump as they fell 44 per cent to USD 198 billion compared to 2021 figures. Moreover, fund-raising in the region significantly declined 43 per cent to USD 105 billion.

For the first time since 2015, the number of active investors fell 2 per cent – with investors especially wary of the macroeconomic environment in the region. Less-competitive investors found themselves on the sidelines, while some turned to defensive sectors for lower investment risks. Aside from the factors mentioned earlier that contributed to investment slowdown in 2022, a decline in manufacturing output and consumer confidence also added to investor fall off, according to Bain & Company.

Overall, fewer and smaller-sized deals prompted the fall of Asia-Pacific PE deal values. Greater China, the most significant contributor to the region’s private equity activity, experienced a substantial decline of 53 per cent in deal volume from 2021. South Korea experienced the same deal volume decline with a 39 per cent contraction.

Meanwhile, the smaller average size of deals resulted in the decrease of other Asia-Pacific countries’ deal value, namely: Australia-New Zealand with –48 percent, Japan with –28 per cent, India with –25 per cent and the whole of Southeast Asia with –52 per cent, respectively.

On a positive note, Asia-Pacific dry powder increased to USD 676 billion. In addition, despite the slump in fundraising and investment performance in the private markets, the industry outperformed public markets.

Moving forward

In the first half of 2023, private equity investments in the Asia-Pacific region continued to slump amid a global economic downturn. As indicated by data from S&P Global Market Intelligence, the accumulated transaction value of private equity and venture capital investments for the first quarter of 2023 in the region (excluding Japan) went down 45 per cent at USD 8.09 billion from USD 14.70 billion in the same period in 2022.

A report from S&P Global Market Intelligence found that general partners (GPs) have more pessimistic expectations for global PE/VC deal activity for this year with 24 per cent, compared to last year’s 7 per cent. In a regional view, however, Asia-Pacific, Middle East and Africa-based PE professionals generally have a more optimistic outlook for 2023 regarding deal activity than other regions.

Overall, the private equity deal activity in the Asia-Pacific region is seen to hit a turbulent year, continuing the trends seen in its first quarter.

Opportunities for Asia-Pacific PE funds

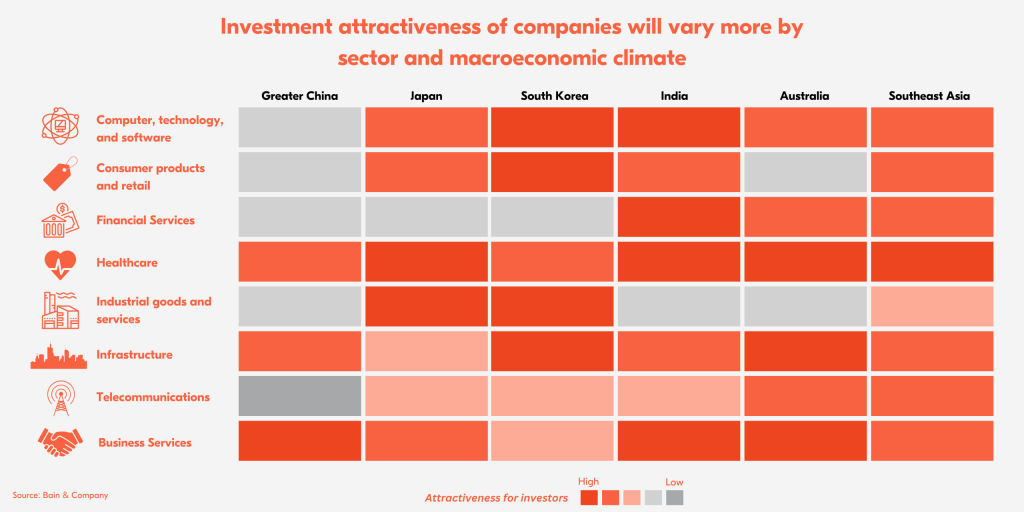

Despite the challenging environment facing Asia-Pacific PE investment funds, key investment opportunities are still present in many regional sectors. PE managers can look to recession-proof sectors, corresponding high-performing companies and the country-specific performance of each industry.

The top sectors with attractive investment opportunities in the Asia-Pacific region include healthcare, technology, infrastructure and business services. The internet and technology sector still holds the largest share of private equity investments in the region; however, it recorded a decline (33 per cent from 41 per cent) in its share of deal value primarily due to the fewer and smaller deals in China and India. As mentioned in a section above, investors resorted to defensive sectors for lower risks and a more secure cash flow.

Want to know more about opportunities in PE funds outside the US?

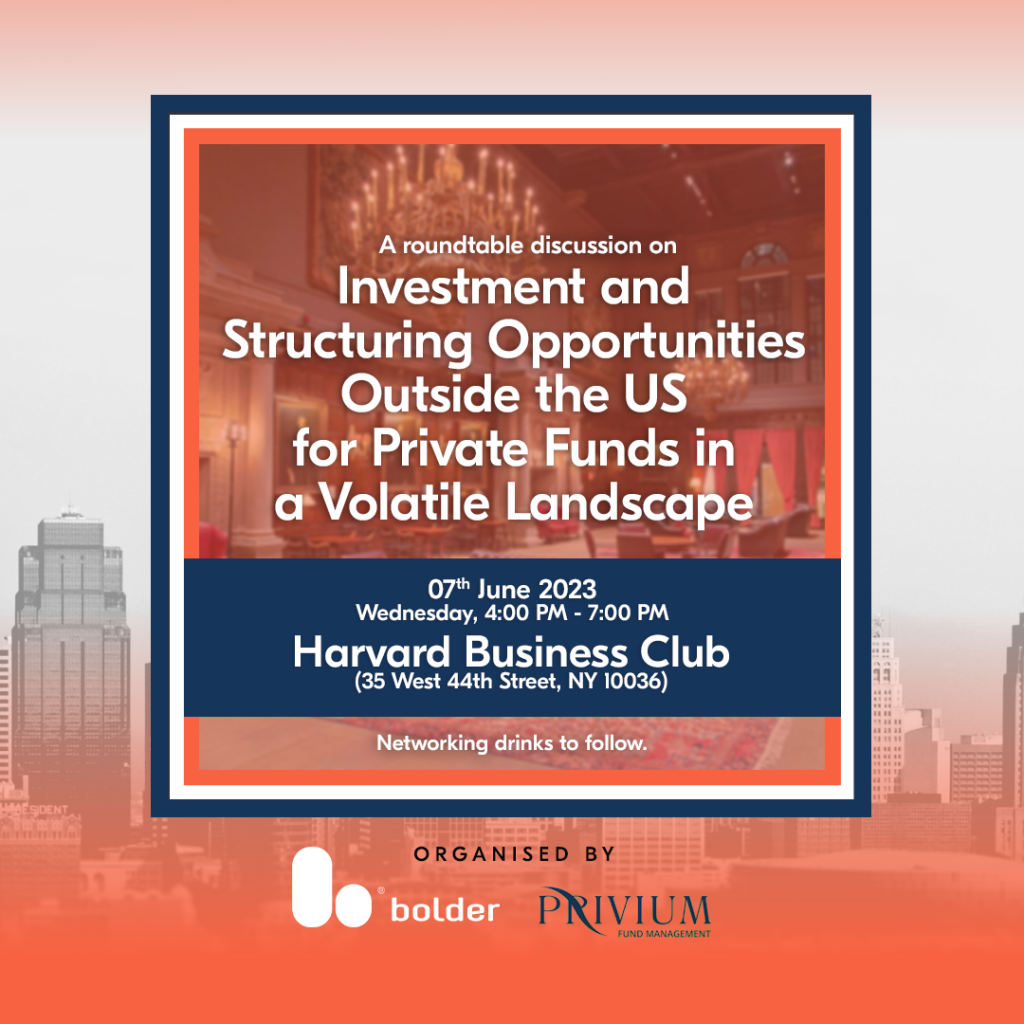

Bolder Group and Privium Fund Management will be hosting an exclusive roundtable discussion on the investment and structuring opportunities for private funds outside the United States on 7 June 2023.

One of the speakers will be Bolder’s Vice President of Business Development Americas, Nick Neri. With more than 25 years of industry experience in traditional and alternative financial markets, Nick will share his insights on the opportunities awaiting private funds amidst a volatile PE landscape.

Joining Nick for the discussion will be Baker McKenzie LLP Partner Karl Egbert, Privium Fund Management Group CEO and Director Clayton Heijman as co-speakers, and Privium Fund Management Director Vanessa Hemavathi serving as the moderator for the panel.

Learn more about the speakers here and join us on Wednesday, 7 June 2023, at the Harvard Business Club, 35 West 44th Street, New York, 4:00 PM – 7:00 PM.

For more information and an exclusive invite to the roundtable discussion, contact Nick at nick.neri@boldergroup.com.

How Bolder can help

As an experienced PE funds administrator in Asia-Pacific and the global markets, Bolder Group can assist in navigating the challenges present in the private investment funds market.

We recognise our clients’ need to alleviate the additional burden of administrative functions to focus on managing their funds. Our comprehensive list of funds services enables us to successfully administer the numerous middle- and back-office associated with:

- hedge funds;

- private equity and venture capital funds;

- cryptocurrencies;

- real estate funds;

- fund of funds; and

- managed accounts.

Contact a Bolder representative now to learn more about our funds solutions.

Bolder Group does not provide financial, tax or legal advice and the information contained herein is meant for general information purposes only. We strongly recommend that before acting on any of the information contained herein, readers should consult with their professional advisers. The Bolder Group accepts no liability for any errors or omissions in the information, or the consequences resulting from any action taken by a reader based on the information provided herein.

Bolder Group refers to the global network of independent subsidiaries of Bolder Group Holding BV. Bolder Group Holding BV provides no client services. Such services are provided solely by the independent companies within the Bolder Group which are each legally distinct and separate entities and have no authority (actual, apparent, implied or otherwise) to obligate or bind Bolder Group Holding BV in any manner whatsoever. The operations of the Bolder Group are conducted independently and have no affiliation with third party financial, tax or legal advisory firms or corporations.