New EU Sustainability Rules – what awaits EU and non-EU Companies

DISCLAIMER: This post was last modified on 23 May 2023. Some information in this article may not be updated.

As part of its efforts to promote sustainability and environmental, social and governance (ESG) and combat greenwashing, the European Union modified the last Directive 2014/95/EU or the Non-Financial Reporting Directive (NFRD).

The Directive (EU) 2022/2464, also known as the Corporate Sustainability Reporting Directive (CSRD), entered into force on 5 January 2023. It extends the scope and reporting requirements introduced by Directive 2014/95/EU. The new rules aim to enhance data accessibility for stakeholders, referring to those who have a connection with a company in such a way that any of the firm’s strategic decisions may affect them directly or indirectly. These stakeholders are:

- Investors and asset managers. To have a better understanding of the sustainability risks and opportunities associated with their investments, as well as the impact of those investments on people and the environment;

- Consumers. To be aware of their risks and impacts on their value chains;

- Policymakers and environmental agencies. To monitor trends and inform public policy; and

- Other key stakeholders.

What should companies within and outside the EU expect with the new ESG and sustainability regulation? Bolder’s ESG and compliance experts provide their insights.

EU Sustainability Rules – what’s new?

As mentioned above, the CSRD builds upon the NFDR and modernises the rules concerning reporting obligations for social and environmental information and its accessibility to a company’s key stakeholders.

A significant impact made by the CSRD is expanding the scope of companies obligated to report on their sustainability information. Approximately 50,000 large, medium and small companies in the EU are mandated to report from 2024 to 2029. Previous regulations have only covered 11,700 EU companies.

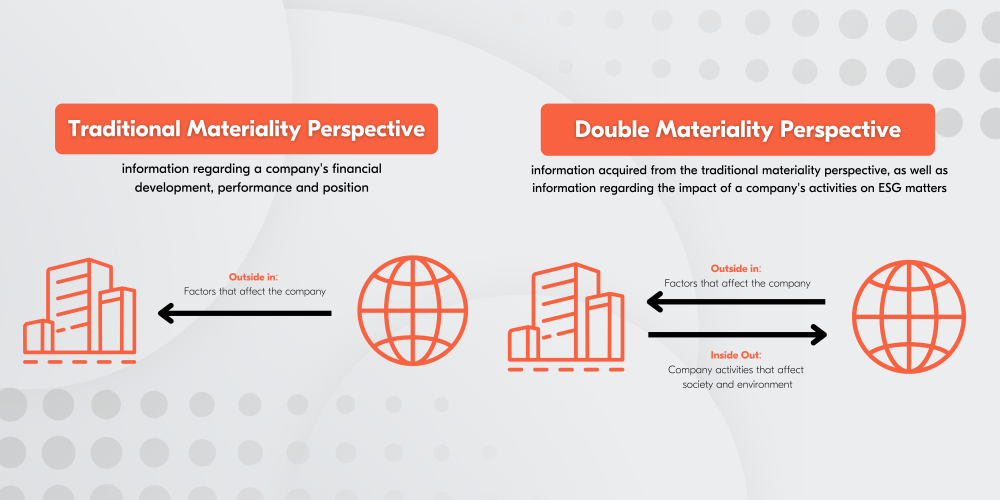

On the other hand, a double materiality perspective is also a vital aspect of the CSRD, encompassing traditional materiality reporting, which only provides information about sustainable factors impacting a company’s financial value. However, a double materiality perspective also incorporates information on how a company’s activities and actions impact society and the environment.

Another notable aspect of the CSRD is the Scope 3 reporting requirement, which imposes the collection of sustainability information across a company’s full value chain or supply chain.

Moreover, the reporting requirements must be aligned with key EU regulations in force, such as the SFDR and EU Taxonomy Regulation, to avoid over-regulation and confusion due to other relevant reporting initiatives.

Under the CSRD, companies must also receive verification from an accredited third party (i.e., an independent assurance service provider). This entails assessing and verifying the elements of a company’s sustainability reporting and data-gathering processes.

Bolder Group can assist in determining and accomplishing your company’s compliance obligations with our governance services.

Who will it apply to?

As noted in the section above, the new sustainability rules will now cover nearly 50,000 companies in the EU. The CSRD extended the scope of companies subject to additional sustainability reporting requirements as follows:

- All large companies incorporated in the EU, including those EU subsidiaries of non-EU companies, whether listed on the stock market or not. The CSRD defines a large company as companies meeting two out of the three criteria below:

- Net turnover of more than EUR 40 million;

- Assets of EUR 20 million; or

- At least 250 employees.

- Non-EU companies with substantial activities in the EU and a turnover of over EUR 150 million and at least one subsidiary or branch in the EU.

- Listed SMEs on an EU-regulated market, excluding micro companies.

- Non-listed EU companies.

Expanding the scope of companies under the directive aims to promote transparency and accountability toward the company’s impact on society and the environment within the region.

What to expect

Organisations are expected to have more knowledge about ESG as stakeholder demands for risk management, control and results increase. Higher ESG standards among stakeholders will force oganisations to aligne their corporate strategy accordingly.

Timeline of the CSRD

Reporting requirements begin in 2024 up to 2029, depending on the size and scope of the company.

- 1 January 2024, with reports due in 2025 for large companies listed in the EU with over 500 employees already subject to the NFDR.

- 1 January 2025, with reports due in 2026 for large companies not subject to the NFDR directive (with more than EUR 40 million in turnover and/or EUR 20 million in total assets and/or 250 employees).

- 1 January 2026, with reports due in 2027 for listed SMEs and other undertakings. SMEs can opt-out until 2028.

Non-EU companies not listed in the EU (but subject to the CSRD) will start to submit their disclosures in 2029.

The benefits and challenges of the EU’s sustainability rules

The added reporting obligations under the CSRD will bring the need for digitalisation and additional costs. Companies will be obliged to prepare reports following the XHTML format in accordance with the European Single Electronic Format (ESEF). Moreover, companies must ‘tag’ sustainability information in their reports following a digital categorisation system developed with the European Sustainability Reporting Standards (ESRS).

Companies subject to the CSRD will have to report according to the ESRS. The specific information to be reported will be described in several ESRS to be adopted by the European Commission over the coming years, which will help to unify reporting criteria. The CSRD itself sets out the high-level reporting requirements that apply to companies.

These reporting requirements will come at a cost, which are seen to reflect only in the short term. But with a more digital approach to sustainability reporting, more harmonised and efficient reporting requirements are expected in the long run. Moreover, digitalisation provides better accessibility of data for investors and other key stakeholders.

Lastly, US-based and other international companies have only reported on Scope 1 and 2 until the CSRD. The new sustainability rules’ Scope 3 reporting requirements would require these foreign companies to adjust their reporting considerations accordingly. Moreover, international companies are advised to aptly prepare for other future reporting requirements in their respective jurisdictions, as the EU’s CSRD is seen to lead the way for other authorities (e.g., the US Securities and Exchange Commission) to adopt similar reporting standards.

Bolder Insights

Bolder Group’s ESG Specialist Ana Prada highlighted the importance and urgency of complying with the new directive and preparing for the necessary steps for organisations to move forward.

According to Prada, the regulatory framework can guide organisations to define an ESG strategy, measure associated progress and development, as well as determine and prevent risks. It also allows organisations to strategically move towards the path of sustainability by raising their standards against competitors who are not aware of the regulation or are still waiting to implement it at a later stage.

The expert also noted that the CSRD seeks to prevent greenwashing through quantifiable means, as with many other EU regulations. They claim, therefore, that “[T]he great challenge is to be able to measure the sustainability of an organisation through ESG criteria. For this, companies must begin to measure and collect data, [as well as to] establish objectives, and for that, it is important that all departments are part of this activity and are aware of these new regulations.”

Bolder’s industry expert recommend organisations to start identifying their stakeholders, in addition to determining potential risks in their ESG and materiality analysis. By doing so, Prada stated that “[T]hey can define a clear strategy and begin to set clear objectives in [the] short, medium and long term in accordance with the requirements of the CSDR.”

Moreover, she recommended that organisations must also work hand in hand with experts that can guide them on the numerous aspects and nuances covered by ESG matters.

Bolder Group’s compliance services

The rollout of the new EU sustainability rules imposes more significant compliance obligations for companies in and outside the region. Entities unfamiliar with the new reporting obligations, especially non-EU companies, may need help keeping track of the complexities concerning sustainability regulations within the EU.

Bolder Group’s ESG and compliance experts are well informed of the legal and regulatory developments in the local and international markets. Our compliance specialists are ready to provide expert guidance on your compliance and ESG obligations with our extensive list of compliance services.

Contact a Bolder representative to know more about how we can assist you or reach us at info@boldergroup.com.

Bolder Group does not provide financial, tax or legal advice and the information contained herein is meant for general information purposes only. We strongly recommend that before acting on any of the information contained herein, readers should consult with their professional advisers. The Bolder Group accepts no liability for any errors or omissions in the information, or the consequences resulting from any action taken by a reader based on the information provided herein.

Bolder Group refers to the global network of independent subsidiaries of Bolder Group Holding BV. Bolder Group Holding BV provides no client services. Such services are provided solely by the independent companies within the Bolder Group which are each legally distinct and separate entities and have no authority (actual, apparent, implied or otherwise) to obligate or bind Bolder Group Holding BV in any manner whatsoever. The operations of the Bolder Group are conducted independently and have no affiliation with third party financial, tax or legal advisory firms or corporations.