Shariah-Compliant Global Private Markets Funds for Middle East Investors

The $4 trillion Islamic finance sector is seeking Shariah-compliant private investments with real growth potential. Global Private Markets, such as Private Equity, Private Credit and Infrastructure, offer attractive returns and portfolio diversification. For Muslim investors committed to Islamic finance, their conventional structures pose ethical and legal challenges. As a result, there is a growing demand for an institutionally structured Shariah-compliant solution that enables access to these asset classes and is fully aligned with ethical principles.

The Shariah Structure: What are the guidelines?

Grounded in the core principles of Islamic jurisprudence, the guidelines for a Shariah structure are implemented through a comprehensive compliance framework, overseen by an independent Shariah Supervisory Board that reviews all aspects of the investment solution. This framework governs business activities and financial transaction structures, ensuring full ethical alignment and a rigorous compliance process.

Core Principles: Risk-sharing and Prohibition of Interest (Riba)

Financing must be structured to share both the risk and return, commonly using Musharakah (Joint Venture) or Mudarabah (Profit-Sharing) contracts.

- Musharakah (Joint Venture): The investment structure creates a true partnership, with both the investor (through the fund) and the company sharing profits and losses in accordance with a pre-agreed ratio. It’s ideal for private equity as it aligns the investor’s financial return with real business activity rather than debt-driven profits.

- Mudarabah (Profit-Sharing): This contract governs the relationship between the capital provider and the fund manager, with only the investor providing capital. Profits are shared while any financial loss is borne solely by the capital provider (investor), unless the loss is due to the manager’s negligence or misconduct.

Exclusionary Screens

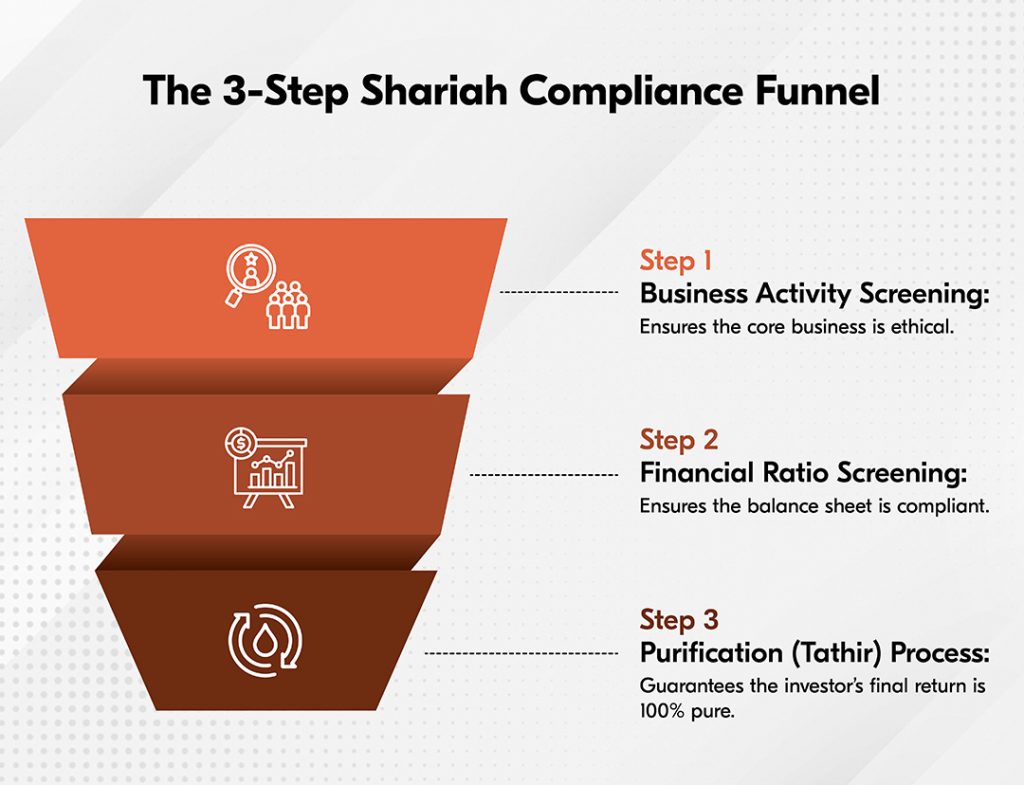

Exclusionary Screens, or Shariah Screening Criteria, are rules in Islamic finance that help to ensure that investments comply with Islamic principles. These rules assess whether a company’s operations and financial structure are acceptable for Muslim investors.

- Business Activity Screening: These screens exclude companies involved in business activities considered Haram (forbidden) under Shariah law, such as alcohol, gambling, tobacco, interest-based finance and pork-related products.

- Financial Ratios Screening: These screens assess a company’s financial exposure to prohibited activities, primarily interest-based debt. While its core business may be permissible (e.g., technology or manufacturing), it must meet strict limits (e.g., total debt to total assets should be less than 33%, or illiquid assets to total assets should be greater than 20%, etc.) for leverage and income derived from non-compliant sources.

Purification Process (Tathir)

The structure requires a Purification process (Tathir), the essential final step in cleansing an investment’s returns, given that some businesses may earn small amounts of non-permissible income, such as interest on cash deposits. This ensures that any minimal quantity of prohibited income that returns to the investment is identified, quantified, and designated for charitable contributions, guaranteeing that the investor’s net return is entirely Shariah-compliant.

Structure Your Wealth Ethically with Bolder Group

As a trusted provider of institutional financial services, Bolder specialises in the complex structuring and back-end efficiency required to administer investment frameworks globally. Middle Eastern Family Offices and ultra-high-net-worth individuals can gain access to high-quality, Shariah-compliant private market funds, structured with ethical integrity and strong financial performance, backed by top-tier global administration expertise.

Contact our team today at info@boldergroup.com to begin the due diligence process and discuss the governance, compliance and operational foundation for your investment structure.

Bolder Group does not provide financial, tax or legal advice and the information contained herein is meant for general information purposes only. We strongly recommend that before acting on any of the information contained herein, readers should consult with their professional advisers. The Bolder Group accepts no liability for any errors or omissions in the information, or the consequences resulting from any action taken by a reader based on the information provided herein.

Bolder Group refers to the global network of independent subsidiaries of Bolder Group Holding BV. Bolder Group Holding BV provides no client services. Such services are provided solely by the independent companies within the Bolder Group which are each legally distinct and separate entities and have no authority (actual, apparent, implied or otherwise) to obligate or bind Bolder Group Holding BV in any manner whatsoever. The operations of the Bolder Group are conducted independently and have no affiliation with third party financial, tax or legal advisory firms or corporations.