EU AML Regulations Package: 2025 Key Changes for Luxury Businesses

The new EU Anti-Money Laundering (AML) Package is causing a major regulatory transformation in the luxury sector. With the establishment of the Anti-Money Laundering Authority (AMLA) and the application of the Anti-Money Laundering Regulation (AMLR) and the Sixth Anti-Money Laundering Directive (AMLD6), this legislative reform directly impacts businesses involved in the trade of high-value goods. Previously subject to lighter scrutiny, these businesses are now officially categorised as “obliged entities” and must comply with stringent due diligence and reporting requirements. This measure aims to prevent illicit actors from laundering money through the trade of luxury assets such as artworks, jewelry and high-end vehicles.

Following our previous articles, KYC Compliance Checklist for EU Luxury Sector and AML Rules Covering the EU Luxury Market, this latest piece expands our ongoing series on AML in the luxury sector. It explores the EU anti-money laundering package affecting luxury businesses and outlines key steps luxury businesses can take to stay compliant.

What do luxury businesses need to know about the key changes in 2025?

Below are some of the key changes under the new EU Anti-Money Laundering (AML) Package and their implications for the luxury sector:

- New Supervisory Authority: The newly established EU-level Anti-Money Laundering Authority (AMLA), operational as of 1 July 2025, will directly supervise high-risk financial institutions and coordinate with national authorities and facilitate cross-border cooperation to ensure consistent application of AML rules across the EU. While AMLA is operational in 2025, it won’t start directly supervising selected entities until 2027, when the first round of selections begins.

- Expanded scope: The new AML Package expands the list of “obliged entities” that must comply with the same responsibilities as financial institutions. The regulations now explicitly include all crypto-asset service providers, crowdfunding platforms, professional football clubs and football agents and traders of high-value goods like precious metals and gemstones, luxury cars, airplanes, yachts, cultural goods and artworks.

- Harmonised Due Diligence Rules and Lowered Thresholds: As part of the AMLR, new, harmonised customer due diligence (CDD) rules come into effect. Luxury businesses will face stricter due diligence requirements, including customer identification and verification, especially High-Net-Worth Individuals (HNWIs) and their transactions, as well as Ultimate Beneficial Ownership (UBO) verification in complex corporate structures. The beneficial ownership threshold has been lowered from “more than 25%” to “25% or more” ownership, voting rights or other interests in a company. As a result, businesses must now thoroughly review and update their UBO data.

- Cash Payment Cap: The new package imposes a €10,000 Europe-wide cap for cash payments in the business sector. As of this year, any transaction above this threshold must be made via traceable methods such as bank transfers or credit cards.

- Beneficial Ownership Registers: The new package, which includes the 6th Anti-Money Laundering Directive (AMLD6), mandates obliged entities with enhanced transparency by verifying and submitting Ultimate Beneficial Ownership (UBO) data to centralised registers. These registers prevent illicit actors from concealing ownership behind complex networks of shell companies.

In essence, these changes under the new regulations, especially those taking effect in 2025, are pushing the luxury sector toward a new era of transparency, accountability and higher risk management standards. This shift means more than just policy updates for businesses; it reshapes daily operations, prompting businesses to implement more rigorous customer due diligence protocols and incorporate compliance into every aspect of their workflow.

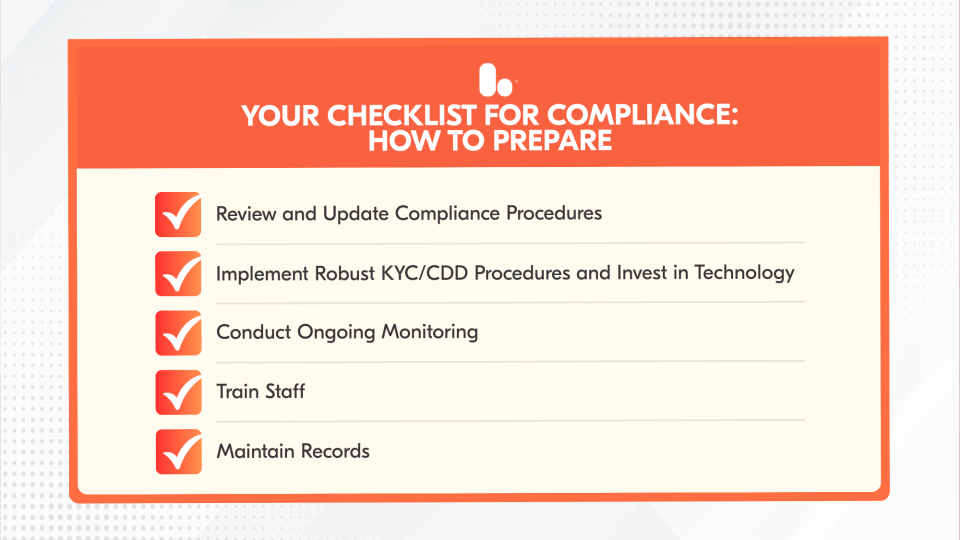

Compliance Checklist

Luxury businesses must implement robust compliance programs to thrive in this new environment. Here’s a helpful checklist to prepare your business:

- Review and Update Compliance Procedures: Update internal AML policies, controls and procedures to comply with the new regulations.

- Implement Robust KYC/CDD Procedures and Invest in Technology: Develop clear procedures for identifying and verifying clients. Adopt new technologies for customer due diligence, transaction monitoring and data management to ensure compliance with stricter reporting and record-keeping standards.

- Conduct Ongoing Monitoring: Maintain ongoing oversight of customer relationships and transactions to identify and address any suspicious activity.

- Train Staff: Provide comprehensive training to employees to ensure they understand their reporting obligations and recognise any red flags.

- Maintain Records: Keep accurate records of all due diligence activities and financial transactions for a minimum of five years.

These measures allow luxury businesses to safeguard their reputation while fulfilling their regulatory requirements and reinforcing their dedication to fighting financial crime.

Why choose Bolder as your AML compliance partner

The new EU AML regulations pose significant challenges for luxury market participants. Navigating the intricacies of these requirements, like UBO verification and HNWI due diligence, requires more than procedural checklists. You will need the help of a specialist with a deep understanding of the new rules.

Our global team of compliance and governance specialists delivers comprehensive due diligence solutions, tailored to the unique complexities of the luxury market. As your trusted compliance partner for luxury businesses in the EU, we offer efficient and reliable verification of UBOs and HNWIs for complex, high-value transactions.

Get in touch with our Bolder representatives today to ensure a robust compliance framework and discuss how we can enhance your due diligence protocols.

Bolder Group does not provide financial, tax or legal advice and the information contained herein is meant for general information purposes only. We strongly recommend that before acting on any of the information contained herein, readers should consult with their professional advisers. The Bolder Group accepts no liability for any errors or omissions in the information, or the consequences resulting from any action taken by a reader based on the information provided herein.

Bolder Group refers to the global network of independent subsidiaries of Bolder Group Holding BV. Bolder Group Holding BV provides no client services. Such services are provided solely by the independent companies within the Bolder Group which are each legally distinct and separate entities and have no authority (actual, apparent, implied or otherwise) to obligate or bind Bolder Group Holding BV in any manner whatsoever. The operations of the Bolder Group are conducted independently and have no affiliation with third party financial, tax or legal advisory firms or corporations.