Eight questions to ask your new fund or corporate administrator

Amidst the ever-changing world of financial services and constant regulatory developments, operational continuity is crucial, even more so when you’re deciding to switch to a new fund, corporate, compliance or family wealth service provider.

Choosing a new fund or corporate administrator requires meticulous planning and a deep understanding of the change and associated risks. Apart from the pricing or economic aspect, the main concerns when looking for a new partner revolve around compliance, data integrity, technological capabilities and a smooth transition process.

Making the Right Choice: 8 Questions to Ask Your Next Provider

To make an informed choice, it is essential to ask the right questions that move beyond simple fee comparisons and delve into the core of a provider’s capabilities. Here are key questions to ask your potential new financial services provider:

- What is your process for a seamless transition? There should be a clear, documented transition process that provides the specific details of the handover process, timeline, data migration and operational continuity.

- How do you handle data migration and ensure data integrity? In the financial services landscape, data is key—that is why data security and accuracy are non-negotiable. Inquire about their technology and protocols for moving your existing data. At Bolder Group, for example, our proprietary technology is specifically designed to process your existing data into our software smoothly, ensuring a reliable and accurate transfer with minimal disruption.

- What technology will you use for reporting? Tech is an integral part of modern service delivery in the financial services world. If possible, request a demonstration of the provider’s technology, reporting tools, portal and other software that they may use for your data.

- What is your approach to compliance and governance? The regulatory landscape is constantly changing. Ask how they stay ahead of these changes and what specific governance and compliance solutions they offer to help your firm maintain its standing in all jurisdictions. You may also inquire about their internal compliance protocols and governance framework.

- Can you provide a breakdown of all potential costs? Providers with complex or convoluted billing structures usually have hidden fees associated with their solutions. At Bolder Group, our pricing model is always transparent and flexible, allowing our clients to budget and allocate their resources effectively.

- Do you have a presence in all the jurisdictions where my entities operate? A provider with a global presence and local expertise can offer scalable solutions that are tailored to your specific structure, ensuring compliance across different regulatory environments. Bolder has presence in more than 20 cities. Through this international network and experts on the ground with decades of local industry knowledge, we can facilitate seamless cross-border collaboration.

- What is the composition and expertise of my dedicated client service team? The right team gives you confidence. You need to know who you’ll be working with to see if they truly understand your requirements, can meet your needs and provide the support you need.

- How will you add value to my business? A fund or corporate administrator is more than a service provider; they are a partner. Let them discuss how they can help you maximise your revenue and reach your business’s potential through their solutions. Ask how, as a provider, they can help you proactively identify and address any potential challenges. Bolder Group’s boutique-style approach to service delivery, combined with our team’s entrepreneurial mindset, enables us to personalise our solutions and act as our clients’ business partners.

Bolder as your fund or corporate administrator: Making the switch in 2026

Whether you’re searching for a new provider of funds, corporate, governance, compliance or family wealth services, proactive communication is critical.

In the financial services world, most providers would require at least a three-month notice period before they terminate the agreement; otherwise, the service may be automatically renewed.

To make the switch in 2026, you should aim to make your decision by the end of September 2025. By planning and communicating your decision early, you can avoid being locked into a 12-month retainer fee and ensure a smooth, cooperative handover process. This proactive approach sets the stage for a seamless transition to your new provider.

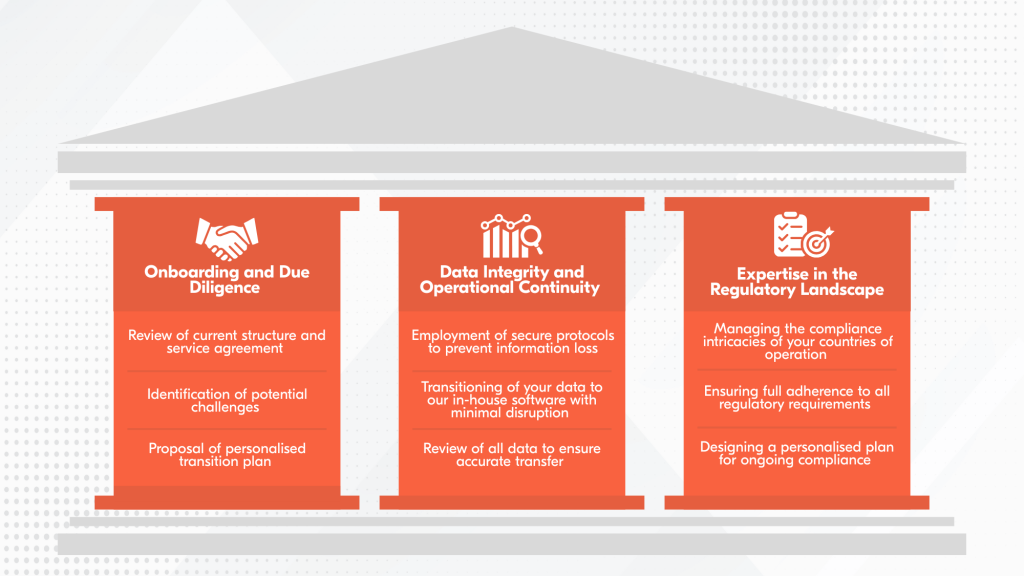

At Bolder Group, we recognise that a provider change is a critical operational decision. But this change doesn’t have to be complicated. Our approach to transition is simple, focusing on three core pillars:

Why Switch to Bolder Group?

Choosing a new service provider is a strategic investment for the future of your business. With Bolder Group, that investment delivers tangible returns through:

- Cost Efficiency and Value: Our clients typically experience a reduction in operational costs of up to 30%, allowing you to reallocate resources more effectively.

- Global Reach with Local Expertise: With a presence in key jurisdictions, we provide scalable solutions tailored to your unique structure, backed by a deep understanding of local market dynamics and regulations.

- Comprehensive Service Offerings: Beyond our core fund and corporate services, we also provide specialised solutions for complex governance and compliance needs, as well as sophisticated family wealth solutions.

- Dedicated and Experienced Client Teams: You will benefit from responsive, senior-level support from professionals with extensive knowledge of regulatory and governance requirements.

- Transparent and Predictable Pricing: We believe in clear and simple pricing models, free of hidden fees or overly complex billing structures.

Making the switch to a new service provider is a critical strategic decision. By asking the right questions, you’re not just comparing fees; you’re vetting a partner for operational excellence, technological capability and true expertise.

With the 30 September 2025 deadline in mind for a 2026 transition, proactive planning is the first step towards a new partnership.

Join our newsletter!

Not ready to commit just yet? No worries! We still want to add value to your business by providing you with valuable insights and information. Join our mailing list to receive guides, insights and news straight to your inbox!