Step-by-Step Guide to Offshore Company Formation

An offshore company refers to a legal business entity registered outside its primary jurisdiction, where its main operations or owners are based. Entrepreneurs and firms establish offshore companies to benefit from tax breaks, asset protection, business privacy, etc. Add to these, the jurisdiction’s investment-friendly programs and flexible laws make these locations a popular choice for international business venture.

Setting up an offshore company can be a complex and challenging process, requiring extensive planning and deep understanding of legal, financial and regulatory requirements. From choosing a jurisdiction to maintaining ongoing regulatory compliance, business owners must navigate numerous hurdles to ensure efficiency and security of their offshore operations. Mistakes during the setup process can lead to issues later on, prompting careful analysis and expert guidance.

To explore the steps in detail, this article breaks down the process of setting up an offshore company while also exploring its benefits and ideal jurisdictions for incorporation.

What are the most common types of offshore companies?

Each offshore jurisdiction offers a range of business structures to suit different needs. The most widely utilised by entrepreneurs are the International Business Company (IBC) or Business Company (BC), Limited Liability Company (LLC) and Private Limited Company (Pte. Ltd.).

- IBC or BC: Often used in jurisdictions like the BVI, Belize and Seychelles. This structure enables international trade and investment with minimal reporting requirements. It also offers privacy in banking and benefits from low or no local corporate taxes if operating outside the country of incorporation.

- LLC: A flexible business structure, common in Nevis, Delaware and Anguilla. LLCs offer tax exemptions on foreign income and strong liability protection for members.

- Pte Ltd: Commonly found in Singapore, Hong Kong and the UK. This private business structure provides limited liability and tax advantages but requires stricter reporting.

What are the best destinations for offshore company formation?

Different jurisdictions provide attractive offshore benefits, and selecting the right one depends on what aligns with your business goals.

- BVI: Streamlined regulations and cost-effective company formation process.

- Cayman Islands: No corporate taxation, strong financial privacy and a stable economic environment.

- Singapore: Low tax rates, a stable banking industry and a global business hub.

- Hong Kong: Streamlined taxation with enhanced benefits for global trade.

- Dubai: No taxation, a resilient banking system and globally competitive business policies.

What are the benefits of setting up an offshore company?

| Tax Efficiency A major advantage of offshore companies is reduced tax burdens. With low or zero corporate taxes offered by many offshore countries, businesses can maximise profits while still adhering to legal tax requirements. | Enhanced Financial Privacy and Asset Protection Offshore companies protect business owners’ financial information from public access. This results in more robust banking confidentiality and asset protection against creditors or legal challenges. |

| Efficient Business Regulations Many offshore jurisdictions provide simplified business regulations, enabling swift company registration, simplified reporting and simplified compliance processes. | Liability Protection Offshore company owners benefit from liability protection, which keeps their personal assets distinct from the business, minimising exposure to financial and legal risks. |

| Global Banking Access Access to international banking gives businesses the ability to conduct safe financial operations, offshore investments, and multi-currency transactions, making it ideal for companies with global operations. | Expanding Global Reach Offshore companies allow seamless expansion into global markets, connect with foreign investors and establish strategic partnerships globally. |

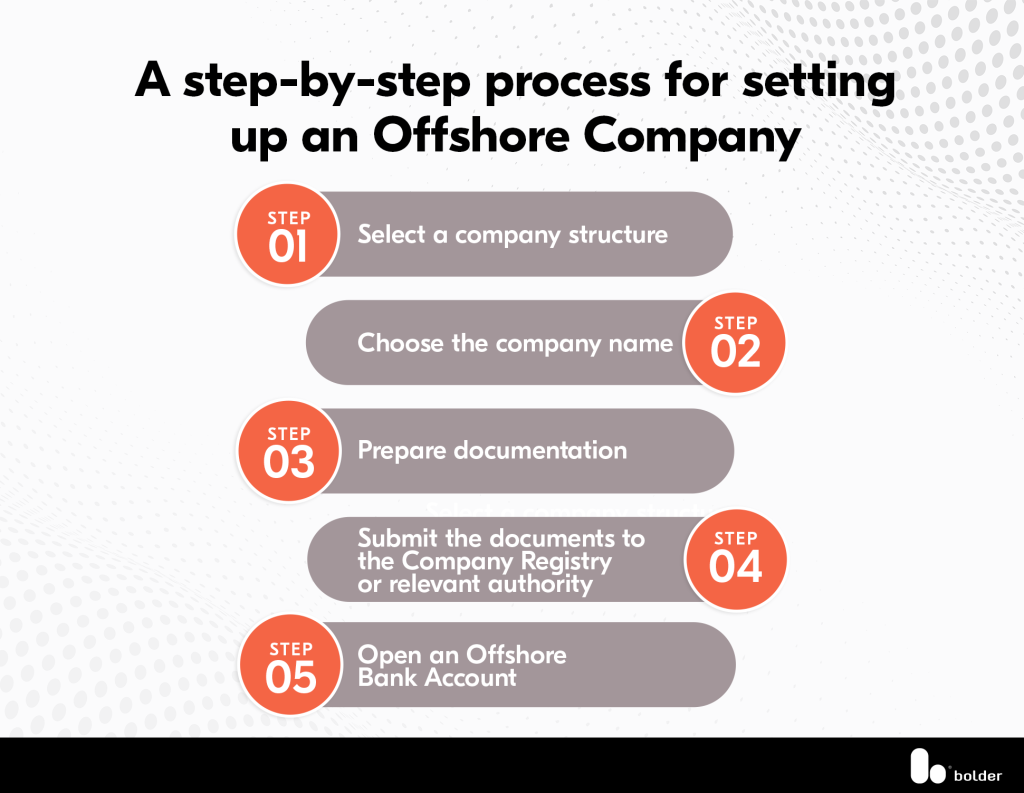

How to set up an offshore company

An offshore company formation process involves several key steps to ensure compliance and successful incorporation. Below is an overview of the process:

Step 1: Select a company structure

The initial step in incorporation is to select a business structure that suits your needs. Factors like jurisdiction, operational flexibility, strategic goals and other key considerations will shape the best incorporation choice.

Step 2: Choose the company name

Your company name must meet specific requirements to gain approval from the relevant authority overseeing company name selection and approval in each offshore jurisdiction. For example, the name should be unique and not identical or similar to any existing or previously registered name in the jurisdiction’s Company Registry or its equivalent authority.

Step 3: Prepare documentation

Make sure to obtain the necessary business permits and licenses. Registering an offshore company usually requires (a) identification documents, such as proof of address or passport, (b) a business plan detailing operations and (c) Know Your Customer (KYC) forms for compliance.

Step 4: Submit the documents to the Company Registry or relevant authority

After completing all the necessary documents, it is critical to submit them to the Company Registry or the relevant authorities in the chosen offshore location to officially complete the company registration process. The processing time for your company registration will vary based on several factors, including the type of selected business structure, the complexity of operations and the specific legal and compliance regulations in the chosen offshore jurisdiction.

Step 5: Open an Offshore Bank Account

Set up a corporate bank account in your chosen offshore jurisdiction and ensure compliance with international banking regulations.

Set up your offshore company with Bolder

While setting up an offshore company can be completed in a few steps, choosing the best structure and location for your business takes careful analysis and requires professional guidance to ensure compliance and maximise benefits.

Our skilled professionals at Bolder are experienced in incorporation and can help you identify and effectively outline your business objectives and requirements. We will assist you with every step of completing the registration and incorporation of your offshore company. Our post-registration services are also available to get your company ready for doing business.

Are you interested in discussing your offshore company setup needs? Contact us today to get started.

Bolder Group does not provide financial, tax or legal advice and the information contained herein is meant for general information purposes only. We strongly recommend that before acting on any of the information contained herein, readers should consult with their professional advisers. The Bolder Group accepts no liability for any errors or omissions in the information, or the consequences resulting from any action taken by a reader based on the information provided herein.

Bolder Group refers to the global network of independent subsidiaries of Bolder Group Holding BV. Bolder Group Holding BV provides no client services. Such services are provided solely by the independent companies within the Bolder Group which are each legally distinct and separate entities and have no authority (actual, apparent, implied or otherwise) to obligate or bind Bolder Group Holding BV in any manner whatsoever. The operations of the Bolder Group are conducted independently and have no affiliation with third party financial, tax or legal advisory firms or corporations.