Unmasking Financial Crimes: Money Laundering vs. Terrorist Financing

The financial sector continues to evolve, and so do financial crimes, such as money laundering and terrorist financing.

For example, cryptocurrency, a relatively new financial technology that has been on the rise in the past decade, is being used to launder money and facilitate illicit financial activities. Chainalysis data shows that, since 2019, almost $100 billion worth of crypto funds transferred from identified “illicit wallets” have been converted into fiat currency.

According to the United Nations, money laundering through crypto follows the placement-layering-integration pattern but with some innovations aligned with how the platforms are designed, specifically through the misuse of “privacy coins” and “mixers.”

However, despite the innovative tactics employed by criminals to abuse the financial sector, regulatory bodies, financial institutions and market participants can detect modern financial crimes by thoroughly understanding their nature.

This article examines these crimes, their foundations and the potential ways to combat them.

Money Laundering

Criminals – organisations or individuals – launder money to use illicit funds for personal gain or further illegal activities without raising any suspicion. Money laundering often involves multiple transactions and manipulations designed to conceal the source of funds or wealth to avoid detection by authorities.

The general pattern of money laundering

- Placement: This is the initial entry point for dirty money into the regular financial channels, such as depositing small amounts into bank accounts or investing money in legitimate businesses.

- Layering: This stage aims to obscure the money’s origin through a series of complex transactions. This could include investing in other financial instruments like stocks or real estate.

- Integration: The money now appears legitimate as it has been reintegrated into the economy, i.e., purchasing assets.

Terrorist Financing

Funding is essential for terrorist operations — from acquiring weapons and facilitating travel to planning and executing attacks. Terrorist financing, therefore, involves the solicitation, collection or provision of funds with the intent to support such activities. These funds can be derived from both legitimate sources (such as donations, businesses or membership fees) and illicit ones (drug trafficking, smuggling, kidnapping, robbery, etc.).

Notably, the Islamic State (ISIS) reportedly uses a complex web of financial sources as a bloodline for its actions: oil revenues, extortion, foreign donations and cryptocurrencies, for example. This demonstrates the ongoing evolution of modern terrorist financing, which leverages technology.

Money Laundering vs. Terrorist Financing

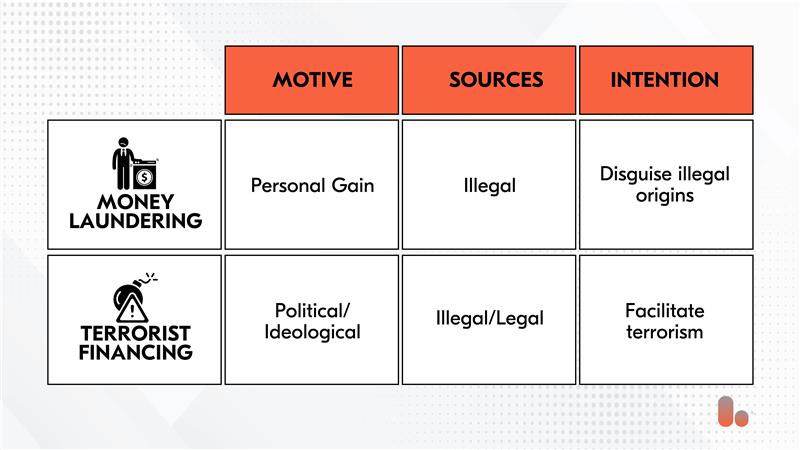

- The motive that governs money laundering is profit. Launderers make their “dirty” money look clean so they can freely spend the proceeds of their crime. Meanwhile, the motive behind terrorist financing is fundamentally ideological and political. It supports a group’s agenda or cause rather than personal financial gain.

- Sources of funds in money laundering are always illegal, encompassing various criminal acts like drug trafficking, robbery, fraud and extortion. Conversely, the funds used for terrorist activities may originate from both illegal and legal sources.

- The underlying intention of money laundering is mainly to disguise the illegal origins of the funds so they can be used without raising suspicion or legal consequences. Terrorist financing, however, solely intends to support, enable and facilitate terrorism financially.

Protecting financial systems and combatting both crimes depends on identifying these activities early on. Knowing the distinction between the two is vital for developing effective countermeasures, establishing appropriate legal frameworks, fostering international cooperation and allocating resources efficiently.

Disrupting the cycle

Money laundering and terrorist financing are characterised by organised and intricate schemes to conceal illegal intent. These put law and order, governance, regulatory effectiveness, foreign investments and international capital flows at risk. Therefore, combatting this global concern requires more vigorous international regulations and enforcement efforts. Financial services providers also play a significant role.

What you should do

Financial service providers can counteract financial crimes through effective customer due diligence efforts, assessing customer identity, source of funds and purpose of transactions. FSPs must also evaluate the risks associated with each customer and transaction. A reporting process should also be in place in cases where an FSP detects irregularities or suspicious transactions.

Moreover, providers must create strong AML/ CFT policies that detail how they should follow regulations, including customer checks, suspicious activity reporting and record-keeping. Through these efforts, FSPs contribute to protecting the financial system.

Still, relevant laws and regulations shift over time and vary across countries. Hence, providers face a challenge in ensuring up-to-date compliance. Here’s how we can help.

Bolder Group Solutions: AML/KYC/CTF services

With our global team present in major jurisdictions, Bolder Group is on top of things with the relevant regulations in various countries around the world. We provide comprehensive KYC and AML compliance solutions (customer verification, EDD, UBO verification, PIP verification, etc.), compliance audits, compliance reporting AMLO, AMLRO, DMLRO services and more.

To learn more about our services, click here.

Bolder Group does not provide financial, tax or legal advice and the information contained herein is meant for general information purposes only. We strongly recommend that before acting on any of the information contained herein, readers should consult with their professional advisers. The Bolder Group accepts no liability for any errors or omissions in the information, or the consequences resulting from any action taken by a reader based on the information provided herein.

Bolder Group refers to the global network of independent subsidiaries of Bolder Group Holding BV. Bolder Group Holding BV provides no client services. Such services are provided solely by the independent companies within the Bolder Group which are each legally distinct and separate entities and have no authority (actual, apparent, implied or otherwise) to obligate or bind Bolder Group Holding BV in any manner whatsoever. The operations of the Bolder Group are conducted independently and have no affiliation with third party financial, tax or legal advisory firms or corporations.