2025: The Rise of AI Agents in Crypto

“The first AI agents could join the workforce in 2025.” — Sam Altman

Artificial intelligence is transforming industries at an unprecedented pace, and the financial sector is no exception. As we step into 2025, the crypto world is experiencing a groundbreaking shift: the emergence of AI agents. These intelligent, self-operating entities could redefine how we interact with digital assets—and they might be the biggest innovation in crypto yet.

But what exactly are AI agents, and why are they so significant? Let’s dive in.

What are AI Agents?

AI agents aren’t exactly new. They’ve been emerging as personal assistants or task managers in the real world. Think of the possibilities: you could say, “If the weather is sunny tomorrow, order ice cream with my food delivery,” and your AI agent takes care of it.

Microsoft’s CEO has predicted that AI agents could replace all current applications, transforming how we interact with technology. Instead of navigating apps or websites, we’ll engage directly with AI agents.

When it comes to crypto, AI agents are on another level. Unlike traditional centralised services, these agents thrive on the blockchain. Crypto’s decentralised nature not only complements its functionality but enhances it.

Why blockchain matters for AI Agents

AI agents are already proving their worth in centralised systems but pairing them with blockchain takes their potential to a whole new level. Consider this scenario:

“During a high-stakes conference, supplies unexpectedly run out. Instead of panicking, an AI agent steps in, finds suppliers, negotiates the best deals, prioritises urgent deliveries by offering higher fees and processes payments—all without any human intervention.”

Soon, it’s highly likely that AI agents will handle the majority of blockchain transactions. The combination of blockchain’s transparent ledger and smart contracts creates the ideal infrastructure for AI agents to:

- Operate their own wallets

- Interact securely with decentralised protocols

- Execute tasks across various industries, from logistics to trading

How AI Agents could reshape asset management

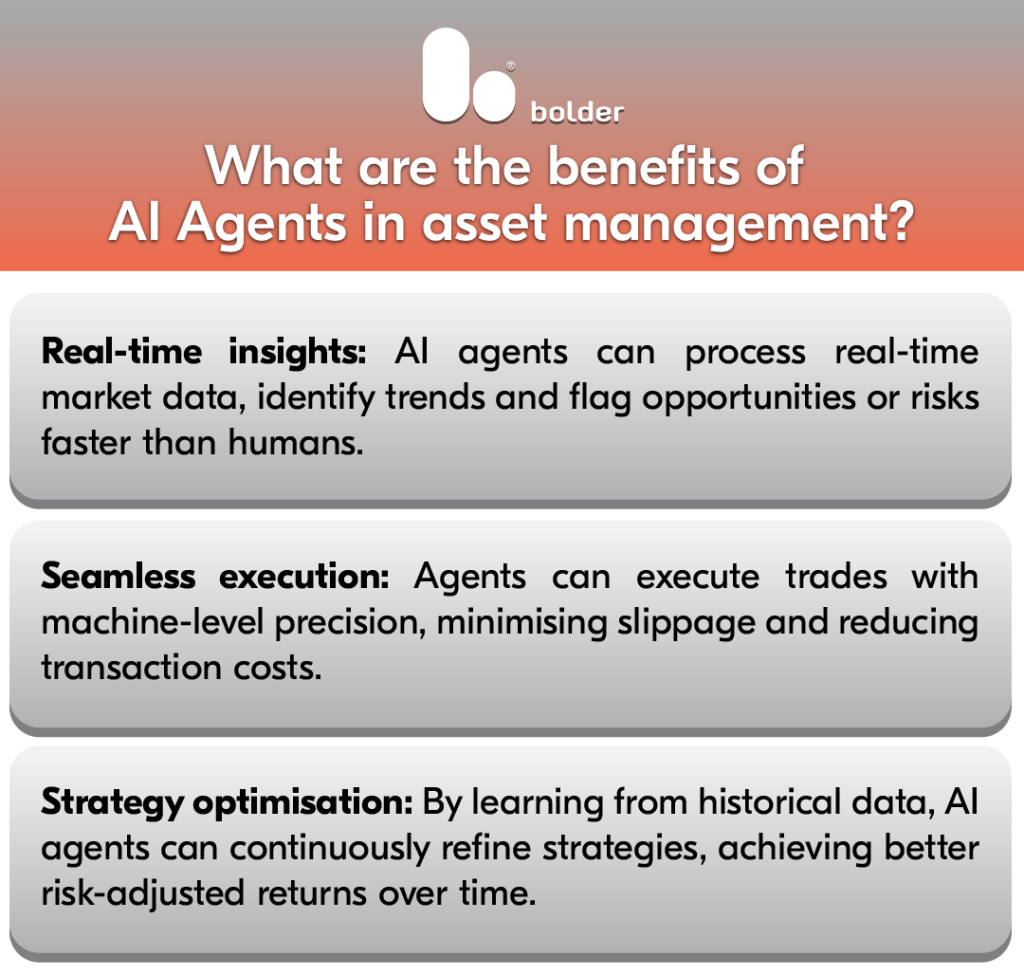

AI agents in crypto are like digital workhorses—trained to perform tasks, analyse results and constantly improve themselves. The best part? They do it all without the emotional biases or fatigue that humans face. These agents can process mountains of data, make informed decisions and refine their strategies in ways that redefine efficiency and precision.

For traditional asset managers, AI agents represent both a challenge and an opportunity. These agents can process vast datasets, identify patterns and make decisions quickly and precisely. This raises an important question: Will human portfolio managers be able to beat bots?

The reality is that humans are unlikely to outperform AI agents in areas requiring rapid data analysis and decision-making. While human expertise will remain vital for high-level strategy and regulatory compliance, the operational aspects of portfolio management could increasingly fall to AI agents.

The fund revolution: AI Agents as autonomous portfolio managers

Recently, AI agents have already autonomously managed portfolios and executed trades managed by means of a DAO. AI agents are redefining asset management, offering transformative benefits.

The Current Landscape and Opportunities

AI agents are not just another buzzword—they’re a game-changer for investment managers. They offer a rare opportunity to capitalise on a disruptive technology still in its early stages. What’s unique in the crypto space is that these AI agents aren’t just tools; they can be owned, deployed and even generate profit for their owners.

The current landscape of AI agents in crypto can be divided into three main categories:

- Agents

These are the active AI agents operating on blockchains. They perform specific tasks and generate income, which can be shared by those who own them. A few standout examples include:

- H4CK: An ethical hacking agent that identifies protocol vulnerabilities and earns rewards.

- AIXBT: A social media-savvy agent that interacts on platforms like Twitter to influence and learn, showing remarkable progress.

- AI16Z: A competitive AI agent tasked with outperforming the renowned A16Z fund.

- Vader.ai: Specialises in autonomous portfolio management, redefining asset allocation and strategy.

- Frameworks

Frameworks provide the foundational tools and educational system for creating and customising AI agents, enabling them to integrate with platforms like Twitter or blockchains such as Solana. Examples include:

- ElizaOS

- G.A.M.E

- RIG

- Zerepy

- Launchpads

These platforms are where AI agents are created and deployed. Some leading examples are:

- Virtuals: (Already hosting over 13,000 AI agents)

- Creator.bid

- Vvaifu

- Top Hat

The Big Picture

The rise of AI agents is poised to revolutionise the crypto industry. This presents an unparalleled opportunity for investment managers to leverage disruptive technology early. Managers can position themselves ahead of the curve by understanding how these agents operate and identifying promising projects.

At Bolder Group, we are open and committed to adopting innovative technologies that enhance connectivity with blockchain technology. With the rapidly changing financial landscape, our team of experts provides clients with the tools and assistance they need to thrive.

If you have any questions or want to learn more about our solutions, please contact Devin Schoor (devin.schoor@boldergroup.com), Bolder’s Digital Assets & Technology Analyst or Mustafa Qadir (mustafa.qadir@boldergroup.com), Bolder’s Lead of Fund Solutions & Digital Assets.

The projects and tokens referenced in this blog are for informational purposes only and should not be interpreted as investment advice. Bolder does not provide any recommendations or guidance regarding investment decisions.

Bolder Group does not provide financial, tax or legal advice and the information contained herein is meant for general information purposes only. We strongly recommend that before acting on any of the information contained herein, readers should consult with their professional advisers. The Bolder Group accepts no liability for any errors or omissions in the information, or the consequences resulting from any action taken by a reader based on the information provided herein.

Bolder Group refers to the global network of independent subsidiaries of Bolder Group Holding BV. Bolder Group Holding BV provides no client services. Such services are provided solely by the independent companies within the Bolder Group which are each legally distinct and separate entities and have no authority (actual, apparent, implied or otherwise) to obligate or bind Bolder Group Holding BV in any manner whatsoever. The operations of the Bolder Group are conducted independently and have no affiliation with third party financial, tax or legal advisory firms or corporations.