Singapore to implement mandatory climate reporting from FY2025

DISCLAIMER: This post was last modified on 28 May 2024. Some information in this article may not be updated.

In February 2024, the Accounting and Corporate Regulatory Authority (ACRA) and Singapore Exchange Regulation (SGX RegCo) issued additional details on mandatory climate reporting for listed and large non-listed entities in line with the International Sustainability Standards Board (ISSB), a global accounting standards body.

- From FY2025, all listed issuers must report and file annual climate-related disclosure (CRD) using requirements aligned with the International Sustainability Standards Board (ISSB) standards.

- From FY2027, large non-listed companies (NLCos) with annual revenue of at least $1 billion and total assets of at least $500 million must provide CRDs, which will be filed with ACRA.

In addition, the Singapore government announced a Sustainability Reporting grant, which will cover up to 30 per cent of the costs for certain companies in producing their first sustainability reports.

Timeline for Singapore’s new climate reporting

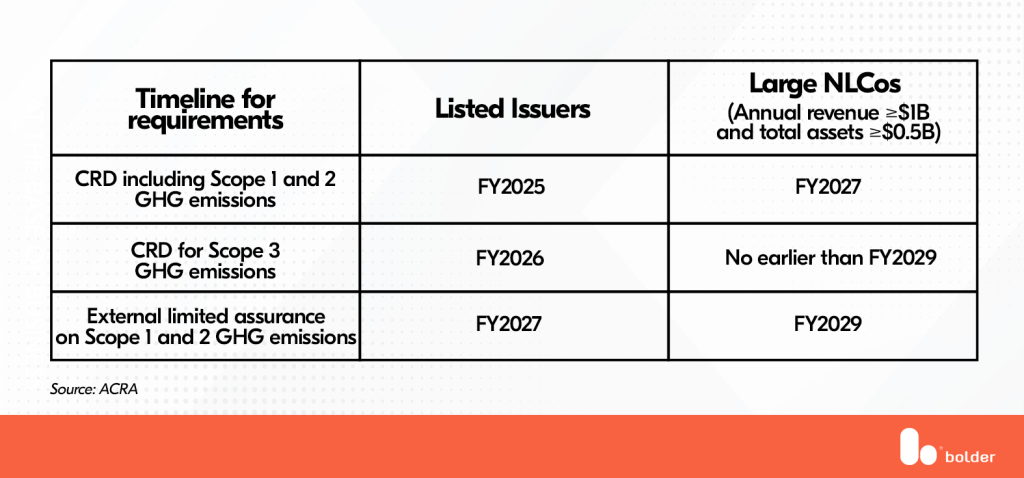

The mandatory climate reporting will be implemented in phases:

The greenhouse gas (GHG) emissions of a company will be among the many significant environmental impact factors that will be the subject of the mandatory disclosures. Companies must report on their Scope 1 and 2 emissions, which are direct emissions from sources that owned or controlled the company, and indirect emissions from the use of energy purchased by the company, respectively. Scope 3 emissions are indirect emissions that are not owned or controlled by the reporting company and must be reported in the second year. Companies will need to have external limited assurance on Scope 1 and 2 greenhouse gas emissions two years after they start reporting.

The Sustainability Reporting Advisory Committee, jointly formed by the Accounting and Corporate Regulatory Authority (ACRA) and the Singapore Exchange Regulation, had a public consultation last year, leading to this phased implementation of sustainability reporting for companies. This requirement aligns with the European regulatory framework, which mandates companies to disclose their GHG emissions so that the data may be accessed by all and compared annually.

Exemptions for large non-listed companies from CRD reporting

ACRA will exempt large non-listed companies:

- with parent companies that are reporting CRDs using local reporting standards in line with the ISSB; and

- with parent companies that are reporting these disclosures using other international standards and frameworks for a transitional period of three years, from FY2027 to FY2029.

What’s next

To implement the recommendation related to listed issuers, SGX RegCo is looking to hold a consultation on the detailed rule amendments separately. One of the amendments is the requirement for climate-related disclosures based on the ISSB Standards from FY2025. Furthermore, ACRA will conduct a review around 2027 to determine whether other non-listed companies should also be subject to mandatory CRD.

How we can help

Due to rapidly evolving ESG regulations and regulatory agencies’ heightened vigilance, businesses will face challenges adhering to various ESG regulations. “It is important to understand that all these sustainability and ESG requirements are here to stay. Therefore, there will be more regulatory scrutiny on these issues every year, and the regulations will become more demanding over time. As a result, stakeholders such as investors and consumers will also take these parameters into account when deciding where to invest or what products to buy. In this sense, we recommend that you take a step ahead and start working on your ESG plan, as it will be critical to your business,” said Ana Prada, Bolder Group’s ESG Specialist.

We invite you to conduct your own self-assessment questionnaire to identify the most relevant aspects of an ESG strategy and contact us if you have any questions.

Bolder is a leading service provider, particularly in ESG compliance. With a global team in the Americas, EMEA and Asia, we provide clients with a comprehensive approach to the ESG sector. Our commitment remains unapparelled when it comes to assisting our clients in establishing effective solutions in this rapidly changing regulatory landscape. Contact our team to learn more about our services.

Bolder Group does not provide financial, tax or legal advice and the information contained herein is meant for general information purposes only. We strongly recommend that before acting on any of the information contained herein, readers should consult with their professional advisers. The Bolder Group accepts no liability for any errors or omissions in the information, or the consequences resulting from any action taken by a reader based on the information provided herein.

Bolder Group refers to the global network of independent subsidiaries of Bolder Group Holding BV. Bolder Group Holding BV provides no client services. Such services are provided solely by the independent companies within the Bolder Group which are each legally distinct and separate entities and have no authority (actual, apparent, implied or otherwise) to obligate or bind Bolder Group Holding BV in any manner whatsoever. The operations of the Bolder Group are conducted independently and have no affiliation with third party financial, tax or legal advisory firms or corporations.