What you need to know about the new Swiss Limited Qualified Investor Fund (“L-QIF”)

DISCLAIMER: This post was last modified on 5 March 2024. Some information in this article may not be updated.

In December 2021, the Swiss parliament voted to adopt the draft law amending the Swiss Collective Investment Schemes Act (“CISA”) and introducing a new fund category, named the Limited Qualified Investor Fund (“L-QIF”).

The Swiss Federal Council recently put these changes into effect on 1 March 2024 and launched the new fund category. The L-QIF is a collective investment scheme offered solely to qualified investors and managed by entities supervised by the Financial Market Supervisory Authority (“FINMA”).

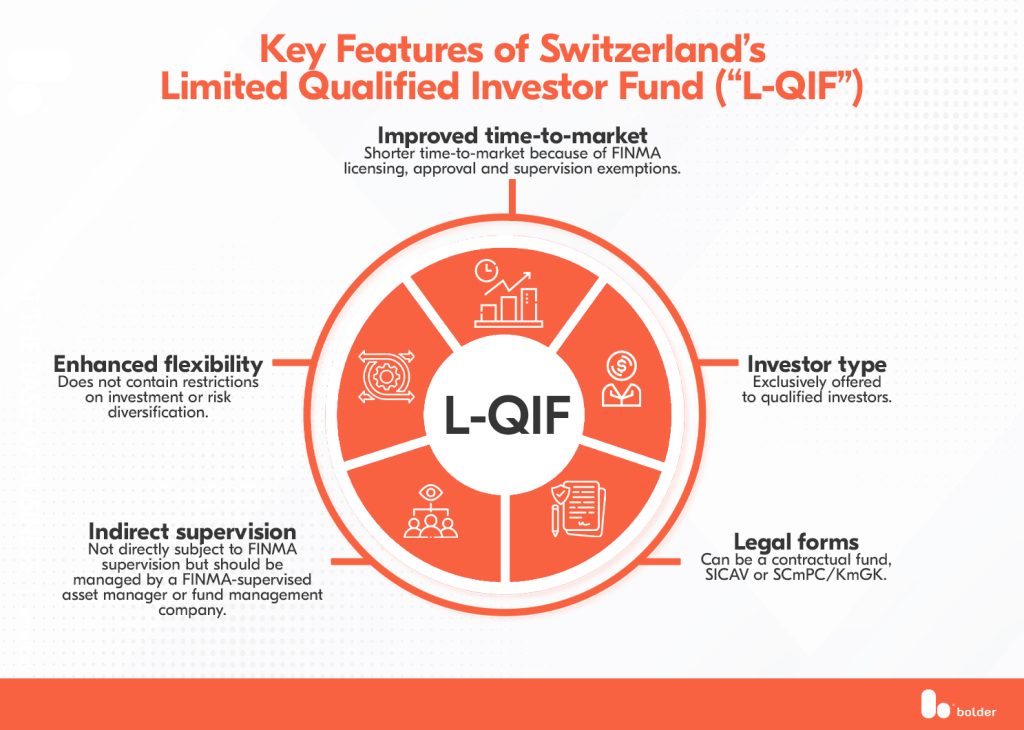

What are the key features of the L-QIF?

The L-QIF aims to bring significant developments into the Swiss fund landscape and further strengthen the jurisdiction’s competitiveness as a fund and asset management centre. Moreover, this new fund structure encourages investors to launch their funds onshore or repatriate their offshore funds back to Switzerland.

Improved time-to-market

Compared to other popular fund structures in Switzerland, L-QIFs are exempted from FINMA licensing, approval and supervision. For instance, an L-QIF and its documents (e.g., collective investment agreement, articles of association) are not required to be authorised by FINMA. Setting up an L-QIF, as a result, allows for fewer fees and faster time-to-market.

Enhanced flexibility

The revised CISA does not set out investment or risk diversification requirements for L-QIFs. This allows funds structured as an L-QIF to have freedom in choosing the fund’s investment products (e.g., securities, real estate, cryptocurrencies, art) and strategies.

In addition, the revised CISA does not provide any documentation obligations (i.e., preparation of a prospectus). However, an L-QIF must still provide information and documents about the fund’s advertisements and associated risks.

‘Indirect’ supervision

As previously mentioned, an L-QIF must have a FINMA-supervised asset manager or fund management company. This is to ensure client protection and security even without the direct supervision of FINMA.

Investor type

L-QIFs are solely offered to qualified investors, as its name implies. According to the CISA, qualified investors pertain to:

- Regulated financial intermediaries (e.g., banks, securities dealers, fund management companies);

- Regulated insurance companies;

- Public entities and insurance companies with professional treasury departments;

- Companies with professional treasury departments;

- High-net-worth individuals; and

- Investors who have entered into a written asset management agreement with a supervised financial intermediary.

This requirement is imposed to compensate for the simplifications made to the fund set-up time and procedures, as qualified investors can accomplish their own due diligence.

Legal forms available

The launch of the L-QIF does not include the introduction of a new legal structure. Thus, an L-QIF can be launched as a contractual fund or take the form of existing Swiss fund legal forms:

- Investment Company with Variable Capital (Société d’Investissement à Capital Variable or “SICAV”); and

- Limited Partnership for Collective Investment (Société en Commandite de Placements Collectifs or “SCmPC”/ “KmGK”)

The Investment Company with Fixed Capital (Société d’Investissement à Capital Fixe or “SICAF”) is not available to the L-QIF.

Bolder Group as your partner in the Swiss market

The developments in the Swiss funds market are aimed to encourage investors to set up onshore funds. With the introduction of the L-QIF, market players can benefit from an innovative, cost-effective and swift setup process in the jurisdiction.

Navigate the funds market with Bolder Group, a global fund, corporate, governance and private solutions provider. Launch and administer your fund with a team of experts knowledgeable in the complexities involved in effectively and efficiently administering your fund’s needs.

Contact a Bolder representative now and learn how we can assist you.

Disclaimer. Bolder Group does not provide financial, tax or legal advice and the information contained herein is meant for general information purposes only. We strongly recommend that before acting on any of the information contained herein, readers should consult with their professional advisers. The Bolder Group accepts no liability for any errors or omissions in the information, or the consequences resulting from any action taken by a reader based on the information provided herein.

Bolder Group refers to the global network of independent subsidiaries of Bolder Group Holding BV. Bolder Group Holding BV provides no client services. Such services are provided solely by the independent companies within the Bolder Group which are each legally distinct and separate entities and have no authority (actual, apparent, implied or otherwise) to obligate or bind Bolder Group Holding BV in any manner whatsoever. The operations of the Bolder Group are conducted independently and have no affiliation with third party financial, tax or legal advisory firms or corporations.

Featured image from Envato.