Mauritius: A Business Gateway for North African Market Expansion

The Middle East and North Africa (MENA) region is experiencing significant economic growth, driven by emerging markets that fuel investment and innovation. Through 2026, its GDP is expected to increase by more than 3.5 per cent annually, primarily due to initiatives in digital transformation and diversification.

For businesses looking to enter the broader North African market, choosing the right point of entry is crucial. With its business-friendly policies, tax incentives and robust financial systems, Mauritius has established itself as the perfect gateway. It offers businesses a low-risk, high-reward route into the region’s growing markets, supported by 46 double taxation treaties and 29 active Investment Promotion and Protection Agreements (IPPAs), many of which are with African nations. These agreements provide investors with greater certainty and security across various jurisdictions, further strengthening Mauritius’s position as a trusted investment hub.

In the first part of this blog series, we’ll explore the growth potential of emerging markets in MENA, highlighting Mauritius as a strategic gateway for businesses looking to expand and establish a presence across MENA, especially in North Africa.

Emerging markets in MENA: What are the opportunities?

The MENA region’s emerging markets—including Saudi Arabia, Egypt and the UAE—share several key characteristics, such as economic diversification, infrastructure investment and digital innovation. Meanwhile, North African countries like Morocco and Tunisia are establishing themselves as entry points to the Arab world, Sub-Saharan Africa and Europe.

Despite their historical reliance on oil exports, several economies in the MENA region are now increasingly focusing on financial services, renewable energy and technology to spur growth. Beyond the oil sector recovery, key factors propelling the MENA market’s development include major giga-investment initiatives like Saudi Arabia’s Vision 2030, which drives the region’s economic transformation. Meanwhile, as part of the energy sector expansion, Qatar plans to increase its liquefied natural gas (LNG) capacity to 110 million tons annually by 2026. Egypt, on the other hand, has seen a 300 per cent surge in fintech startups in the last five years, primarily due to digital banking and mobile payments. Overall, these opportunities indicate an innovative shift throughout the MENA region.

Mauritius as a strategic gateway to North Africa

Mauritius has become a key entry point to North Africa—and more broadly, to the African continent, providing companies with a stable and favourable business environment to enter expanding markets. It is ideally situated for trade and investment, serving as a bridge between Africa, Asia and the Middle East, facilitating smooth business operations.

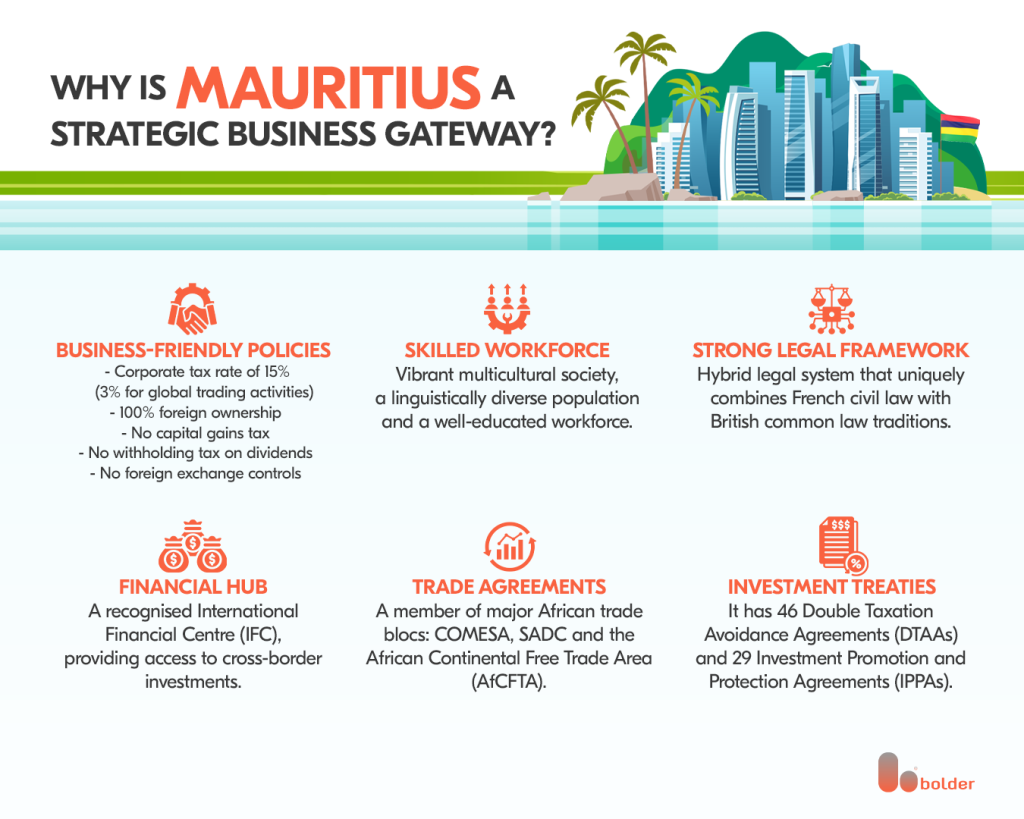

Some of the major advantages of Mauritius as a strategic business gateway include:

- Business-friendly Policies: Mauritius offers a low corporate tax rate of 15% and a wide range of investment incentives, including (a) 100% foreign ownership, (b) no capital gains tax and (c) no withholding tax on dividends. In addition, the country imposes no foreign exchange controls.

- Skilled Workforce: Mauritius is home to a vibrant multicultural society, a linguistically diverse population and a well-educated workforce.

- Strong Legal Framework: Mauritius offers a hybrid legal system that uniquely combines French civil law with British common law traditions.

- Financial Hub: As a recognised International Financial Centre (IFC), Mauritius provides access to cross-border investments, particularly in Africa and Asia. It also offers tax-efficient structures that allow businesses to maximise their financial strategies while pursuing expansion in the African market.

- Trade Agreements: Mauritius is a member of all three major African trade blocs—COMESA, SADC and the African Continental Free Trade Area (AfCFTA)—allowing businesses access to more than 70 per cent of the global population. The country’s participation in these blocs can benefit companies by ensuring more streamlined exports and reduced trade barriers.

According to Herman Redelinghuys, Bolder’s Business Development Manager for EMEA, there are several key sectors that benefit from using Mauritius as a strategic entry point into Africa. “The financial services industry—particularly private equity, venture capital and investment funds—leverages Mauritius’s strong regulatory framework and extensive tax treaty network to structure efficient, cross-border operations. Infrastructure and energy investors benefit from legal certainty and ease of capital deployment, while ICT and fintech companies take advantage of Mauritius’s robust digital infrastructure and supportive innovation ecosystem,” he said.

Aside from the financial services industry, Redelinghuys noted that the manufacturing and trade sectors also benefit from a preferential tax rate of just 3 per cent for qualifying global trading activities, particularly for export-oriented businesses and Freeport operators that meet specific conditions. High-net-worth individuals are increasingly utilising Mauritian trusts, foundations, and family offices for wealth protection and succession planning. Combined, these factors make Mauritius a compelling base for regional expansion across multiple high-growth African industries.

Entering North African Markets through Mauritius

Leveraging Mauritius as a launchpad to North Africa calls for a clear and strategic plan that aligns with the country’s financial framework, favourable trade agreements and advantageous policies. To successfully enter African markets through Mauritius, Redelinghuys further explained that businesses should adopt a structured, multi-layered approach:

“First, leveraging on Mauritius’s structures enables tax-efficient structuring and access to investment treaties. Second, aligning operations with the regulatory expectations of the Financial Services Commission (FSC) ensures credibility and compliance, specially vis-à-vis investors. Third, using Mauritius as a holding jurisdiction allows companies to centralise governance, manage risks and consolidate regional investments. Strategic partnerships with local African firms, combined with robust due diligence and market-specific research, further support sustainable growth. Finally, businesses should tap into Mauritius’s extensive trade network—including AfCFTA, SADC and COMESA—to optimise logistics, reduce barriers and fast-track regional expansion.“

Why partner with Bolder Group

Breaking into the MENA region—particularly into the North African market—may pose challenges, but partnering with a qualified service provider specialising in incorporation and global expansion can help you navigate the complexities. Our team of experts at Bolder is equipped to provide tailored strategies to ensure successful market entry.

For investors and entrepreneurs looking to expand in North Africa via Mauritius, our expertise in regional markets, regulatory guidance and investment strategies can help ensure a seamless entry into these emerging economies.

Through our partnership with Levari Law, we also offer asset managers, investors, corporations, and individuals worldwide—especially those in the MENA region—a customised and comprehensive range of corporate, fund and legal services.

Ready to explore the economic landscape of the African markets? Reach out to our Bolder representatives in Mauritius or our dedicated MENA desk:

Bolder Group does not provide financial, tax or legal advice and the information contained herein is meant for general information purposes only. We strongly recommend that before acting on any of the information contained herein, readers should consult with their professional advisers. The Bolder Group accepts no liability for any errors or omissions in the information, or the consequences resulting from any action taken by a reader based on the information provided herein.

Bolder Group refers to the global network of independent subsidiaries of Bolder Group Holding BV. Bolder Group Holding BV provides no client services. Such services are provided solely by the independent companies within the Bolder Group which are each legally distinct and separate entities and have no authority (actual, apparent, implied or otherwise) to obligate or bind Bolder Group Holding BV in any manner whatsoever. The operations of the Bolder Group are conducted independently and have no affiliation with third party financial, tax or legal advisory firms or corporations.