What you should know about EU’s DAC 7

DISCLAIMER: This post was last modified on 28 April 2023. Some information in this article may not be updated.

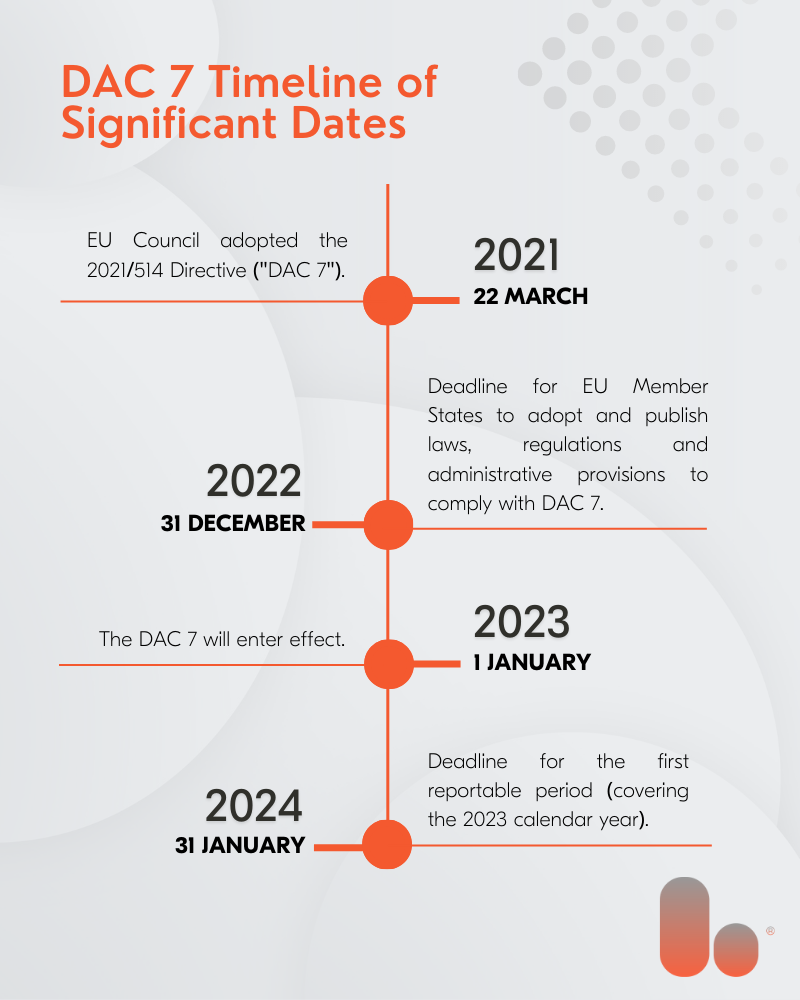

With a more digitalised economy over the recent years, the DAC 7 (or 2021/514 Directive) extended the scope of the automatic exchange of information (EOI) between the tax authorities of member states. Moreover, the DAC 7 introduced a new and standardised reporting requirement for digital platform operators.

Here’s a refresher on the directive.

The objectives

DAC 7 aims to provide the necessary tools to detect and tackle tax fraud, tax evasion and tax avoidance. The standardisation of reporting requirements addresses the administrative and compliance costs imposed on platform operators due to frequent requests for information, individual tax administration requirements and unilateral reporting obligations from some member states.

Meanwhile, the cross-border services offered through platform operators prompted a complex environment where enforcing tax rules and compliance can be challenging. Consequently, the EU Council adopted DAC 7 to tackle the issue of lost tax revenues derived from significant unreported income due to lack of or non-compliance.

The directive ultimately safeguards tax revenues and promotes fair taxation, which, according to the DAC 7, “strengthen opportunities for social, political and economic inclusion in Member States.”

DAC 7 obligations and requirements

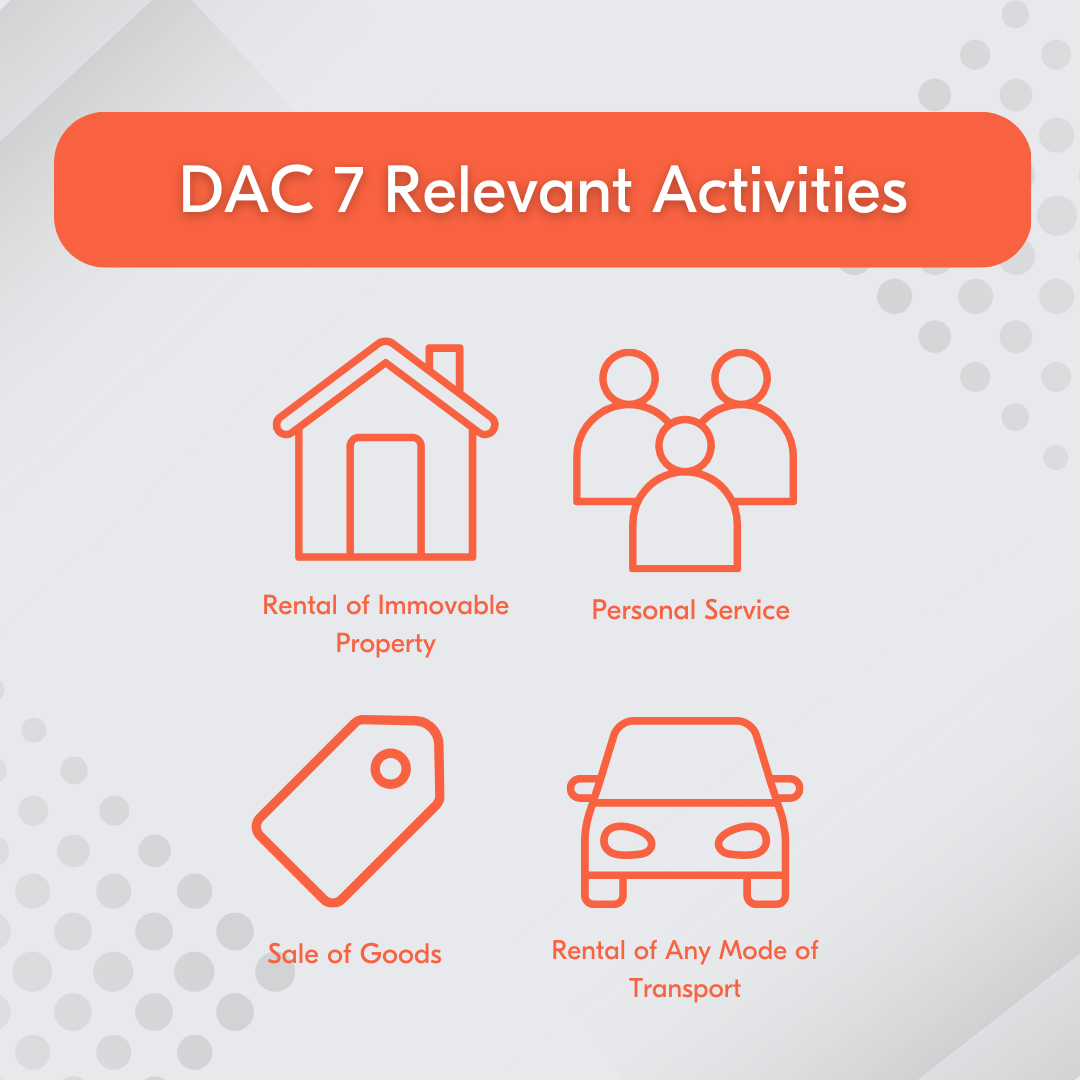

Under DAC 7, a digital platform operator provides a platform or software (i.e., website, applications) accessible to users and allows sellers to carry out “relevant activities”. Such activities include vacation apartment rentals, video live-streaming, ride-hailing, and food delivery services.

The reporting obligations of the directive only apply to digital platform operators who are:

- resident for tax purposes in a Member State;

- not tax-resident but is incorporated, has its place of management or has a permanent establishment in a Member State); and

- foreign platform operator that facilitates the execution of relevant activities in the EU but does not have any legal or tax presence in the region.

With that, digital platform operators must collect information from reportable sellers that use their platforms. These reportable sellers can either be a natural person or a legal entity, excluding (i) government entities, (ii) entities that have regularly traded stocks on an established securities market, (iii) large providers of high-frequency hotel accommodation (with more than 2,000 activities within the reporting period) and (iv) small sellers of goods (with less than 30 activities and revenues not exceeding EUR 2,000 within the reporting period).

According to DAC 7, reporting digital platform operators would need to collect the following information for each reportable seller:

| Reportable Seller | Information to Collect |

|---|---|

| Seller who is an individual | – First and last name – Primary address – Tax Identification Numbers (TIN) issued to the seller including each Member State of issuance (in the – absence of a TIN, the place of birth of the Seller) – VAT identification number – Date of birth |

| Seller that is an entity | – Legal name – Primary address – TIN issued to the seller including each Member State of issuance – VAT identification number – Business registration number – Existence of any permanent establishment through which relevant activities are carried out in the EU (if applicable, each Member State where a permanent establishment is located should also be indicated) |

The reporting digital platform operators must collect and verify this information on account of due diligence procedures by 31 December of the reporting period. If a seller will be registered on the platform on 1 January 2023, DAC 7 introduced a transitional period wherein platform operators can carry out due diligence procedures by 31 December 2024.

Aside from this, operators must provide a copy of the collected information to each reportable seller before submission to the relevant authorities.

What to keep in mind

Significant dates and deadlines

EU Member States were required to transpose the DAC 7 into law by 31 December 2022. Accordingly, platform operators must submit their reports for 2023, which will be the first reportable period, by 31 January 2024.

Penalties and sanctions for non-compliance will be at the discretion of the Member States.

Setting up a process

Reporting digital platform operators should establish a standard procedure to collect and store information from reportable sellers; for example: updating internal systems and contractual relationships (terms and conditions) with sellers to streamline and ensure compliance with DAC 7.

DAC 7 and data

Platform operators must keep in mind the data protection rules and restrictions under DAC 7 concerning information collection and storage. Article 25 of the directive states all exchange of information will be subject to Regulation (EU) 2016/679 or the general data protection regulation (GDPR).

On the other hand, any processing of personal data under the DAC 7 will be subject to Regulation (EU) 2018/1725, which lays down the data protection obligations of EU institutions and agencies. For instance, the regulation ensures that EU bodies provide transparent and accessible information on personal data usage.

Bolder compliance solutions

DAC 7 and numerous directives recently adopted in the EU aim to advance and better regulate the region’s financial markets. However, this also challenges market players to keep up with their compliance and legal obligations.

Bolder Group ensures that your company is informed, involved and in control of all the local and international regulations and requirements relevant to your business. Our legal and governance experts work with you to create an efficient and effective system for your compliance and due diligence needs with the following services:

- Automatic Exchange of Information (AEOI) Reporting Services;

- Regulatory Services;

- AML/KYC Compliance;

- other AML Services (e.g., provision of AMLCO, MLRO, DMLRO); and

- Directorship & Office Services.

Contact a Bolder representative to know more about our bespoke compliance solutions.

Bolder Group does not provide financial, tax or legal advice and the information contained herein is meant for general information purposes only. We strongly recommend that before acting on any of the information contained herein, readers should consult with their professional advisers. The Bolder Group accepts no liability for any errors or omissions in the information, or the consequences resulting from any action taken by a reader based on the information provided herein.

Bolder Group refers to the global network of independent subsidiaries of Bolder Group Holding BV. Bolder Group Holding BV provides no client services. Such services are provided solely by the independent companies within the Bolder Group which are each legally distinct and separate entities and have no authority (actual, apparent, implied or otherwise) to obligate or bind Bolder Group Holding BV in any manner whatsoever. The operations of the Bolder Group are conducted independently and have no affiliation with third party financial, tax or legal advisory firms or corporations.