A Breakdown of Key Global Crypto Regulations in 2025

In 2025, global discussions surrounding digital assets have evolved into concrete regulations. In a report published on 26 June 2025, the Financial Action Task Force (FATF) noted that 99 jurisdictions have passed or are in the process of passing legislation to implement the Travel Rule, which requires Virtual Asset Service Providers (VASPs) to collect and share identity data for crypto transfers. Although the report does not include a comprehensive public list of all 99 jurisdictions, countries with regulations in place or have made notable progress on this front include the United States, EU Member States, the United Kingdom and Singapore.

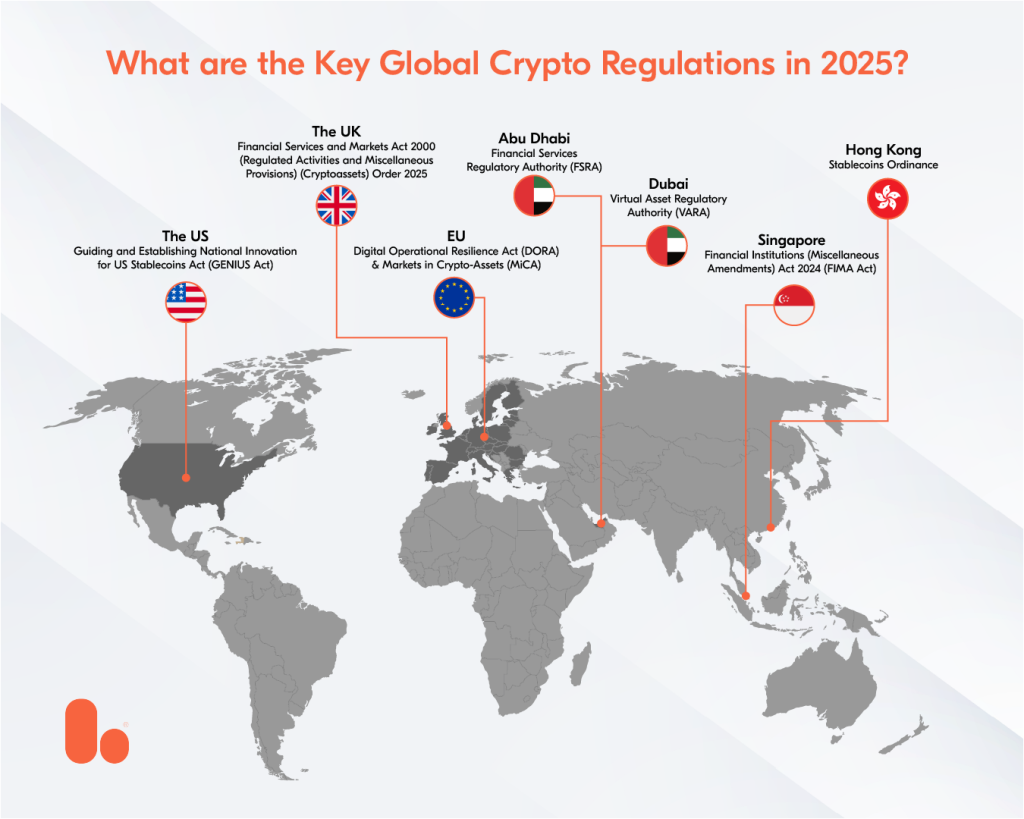

As digital assets gain prominence in mainstream portfolios, regulatory frameworks are also intensifying. The result? Early adopters are positioned to gain a competitive edge in shaping the next chapter of digital finance. From the European MiCA to the US GENIUS Act, this year has witnessed the maturation of crypto regulation and the transformation of strategic compliance into a competitive advantage.

Below is an overview of the key crypto legislations or frameworks in various financial centres, passed or published in 2025:

European Union

Markets in Crypto-Assets (MiCA)

Although adopted in June 2023, the Markets in Crypto-Assets (MiCA) regulation, the first EU regulation to trace crypto-asset transfers, is being implemented in a phased approach to give the industry and regulators time to prepare for the new rules.

While some regulations, particularly for stablecoins and Crypto-Asset Service Providers, became applicable in 2024, many existing firms are operating under a transitional or “grandfathering” period that allows them to continue providing services under pre-MiCA national law while they apply for a MiCA licence. The length of this transitional period varies by EU member state, and it can last until mid-2026.

A recent report indicates that the EU has granted a total of 53 licenses under the MiCA regulation. Of these, 14 were granted to stablecoin issuers (e-money tokens or EMTs), while the 39 licenses were issued to Crypto-Asset Service Providers (CASPs). Germany has emerged as a leader in issuing MiCA licenses, followed by the Netherlands and Malta.

As the transitional periods for many firms close, 2025 is essentially the year of active implementation for MiCA, with a significant emphasis on licensing, compliance and enforcement.

Digital Operational Resilience Act (DORA)

As of 17 January 2025, the Digital Operational Resilience Act (DORA) is in force across the EU. This framework oversees the risks associated with the financial sector’s reliance on information and communication technology (ICT) third-party service providers. It strengthens cybersecurity and operational resilience for financial institutions, including newer sectors like crypto, by requiring robust ICT defenses and streamlining the incident reporting systems.

The DORA covers most of the regulated financial institutions in the EU, including banks, insurance companies and intermediaries, investment companies, pension funds, fund managers and Crypto-Asset Service Providers (CASPs).

Asia

Financial hubs in Asia, including Singapore and Hong Kong, are leading the way with improved crypto regulations by implementing crypto exchange licensing regimes and stablecoin frameworks that protect investor interest while promoting the growth of the sector.

Hong Kong’s Stablecoins Ordinance

Hong Kong’s Stablecoins Ordinance introduces a regulatory framework for fiat-referenced stablecoins, with the licensing regime, which became effective on 1 August 2025. The new law mandates that entities that issue stablecoins in or from Hong Kong obtain a licence from the Hong Kong Monetary Authority. Issuers must maintain full asset-backed reserves, and stablecoin holders must guarantee redemption of their stablecoins at par value. Licensed stablecoin issuers must also adhere to strict anti-money laundering and counter-terrorist financing obligations.

The ordinance aims to establish a robust and transparent regulatory environment for the digital asset sector in Hong Kong. Licensing is expected to start early 2026 with a limited number of issuers.

Singapore’s FIMA Act

Singapore’s Financial Institutions (Miscellaneous Amendments) Act 2024 (FIMA Act) came into force in two phases: The first phase of provisions took effect on 30 August 2024, while the second and final phase came into force on 24 January 2025.

The Act enhances the regulatory authority of the Monetary Authority of Singapore (MAS) across multiple financial laws, including the Securities and Futures Act (SFA), Payment Services Act (PS Act) and others. It also expands powers for inspections and tighter oversight of financial instruments known as crypto-derivatives, whose value is derived from digital tokens such as Ethereum, Bitcoin and other cryptocurrencies. MAS now has the authority to conduct on-site inspections and off-site reviews of entities dealing in crypto-derivatives, even if they are not officially licensed or regulated under existing laws.

USA

The crypto regulations in the United States continue to be among the most complex and ambiguous globally due to a lack of clear federal standards. However, in 2025, lawmakers are shifting toward a more crypto-friendly stance by reassessing a range of crypto bills. These include the Digital Asset Market Clarity Act (the CLARITY Act), which aims to create a clearer regulatory framework for digital assets, primarily by distinguishing between “digital commodities” and “securities”, and the Anti-Central Bank Digital Currency Surveillance State Act, designed to prevent the Federal Reserve from creating and issuing Central Bank Digital Currency (CBDC) in the US without explicit congressional authorisation. Both of these bills are yet to be fully enacted. Meanwhile, the Guiding and Establishing National Innovation for US Stablecoins Act, known as the GENIUS Act, has now been signed into law.

The GENIUS Act

On 18 July 2025, the Guiding and Establishing National Innovation for U.S. Stablecoins Act (GENIUS Act) was signed into law. This marked the first significant legislation in the United States to oversee digital currency, establishing the first comprehensive regulatory framework for payment stablecoins—digital assets tied to a fixed value, such as the dollar, and used for transactions.

The GENIUS Act sets regulatory safeguards and consumer protection policies for stablecoins by creating an official category and clearly defining which digital assets qualify. Additionally, the Act officially recognised stablecoins as payment tools rather than securities or national currencies. It mandates 1:1 backing by liquid assets such as US dollars or Treasury bills. The law also pushes transparency through regular audits and monthly transparency reports for issuers.

United Kingdom

The Cryptoassets Order

The Financial Services and Markets Act 2000 (Regulated Activities and Miscellaneous Provisions) (Cryptoassets) Order 2025 is set to establish the UK’s new Cryptoasset Regulatory Regime as part of the government’s plan to make the country a global hub for crypto. It aims to provide a clear and robust regulatory framework for the cryptoasset sector and grant the Financial Conduct Authority (FCA) with powers to regulate cryptoasset activities like operating a trading platform, custody of cryptoassets and stablecoin issuance.

The draft legislation was published by HM Treasury on 29 April 2025, and the full regime is expected to roll out by Q2 2026.

United Arab Emirates

The UAE has established comprehensive legal frameworks for regulating cryptocurrency assets through authorities like the Virtual Asset Regulatory Authority (VARA) in Dubai and the Financial Services Regulatory Authority (FSRA) of the Abu Dhabi Global Market (ADGM).

Dubai’s Virtual Asset Regulatory Authority (VARA)

The Virtual Assets Regulatory Authority (VARA) was established under Law No. 4 of 2022 to oversee and regulate virtual asset activities across Dubai, excluding the Dubai International Financial Centre (DIFC), which has its own regulatory body. VARA is the world’s first independent regulator dedicated solely to overseeing virtual assets, creating a secure and transparent environment for digital finance. It aims to position Dubai as a global hub for virtual assets and blockchain innovation.

With the release of Rulebook Version 2.0 in 2025, VARA made significant changes to improve oversight of digital assets. This version included new rules for virtual asset issuance, tighter controls on margin trading and token distribution controls, as well as clarified collateral wallet standards, with which all licensed providers must comply.

Abu Dhabi’s Financial Services Regulatory Authority (FSRA)

The Financial Services Regulatory Authority (FSRA) of the Abu Dhabi Global Market (ADGM) has developed a full regulatory framework for virtual assets, including the licensing for regulated activities. It is also responsible for implementing the updates to ADGM’s digital asset regulations in 2025. Key points in the updated framework include a streamlined Accepted Virtual Assets (AVA) process, revised method for calculating a firm’s minimum capital, expanded regulatory scope, intervention powers in high-risk product offerings and prohibition of privacy tokens and algorithmic stablecoins.

Conclusion

These developments indicate a significant shift toward improved structure and accountability across the digital assets industry globally, specifically the cryptocurrency sector. As a result, staying up to date on regulatory changes will be critical for investors, firms, crypto fund managers, other market participants and regulators navigating the future of digital finance.

Working with Bolder

As the regulatory environment in the digital asset space continues to evolve and the demand for accountability and transparency grows, robust compliance frameworks and governance protocols are becoming increasingly vital to meet rising standards and safeguard investor interests.

At Bolder, we work to ensure your framework is future-proof in a rapidly changing landscape. Through our specialised crypto fund governance and compliance solutions, we help maintain operational reliability and regulatory alignment, giving fund managers the confidence to thrive securely in this complex environment.

Additionally, we deliver bespoke administration solutions for digital asset funds. Our end-to-end crypto fund solutions empower clients to launch fully compliant funds from day one.

If you’re looking to explore digital asset funds or stay compliant with these developing crypto regulations, please contact our team today to stay ahead of the digital assets space.

Bolder Group does not provide financial, tax or legal advice and the information contained herein is meant for general information purposes only. We strongly recommend that before acting on any of the information contained herein, readers should consult with their professional advisers. The Bolder Group accepts no liability for any errors or omissions in the information, or the consequences resulting from any action taken by a reader based on the information provided herein.

Bolder Group refers to the global network of independent subsidiaries of Bolder Group Holding BV. Bolder Group Holding BV provides no client services. Such services are provided solely by the independent companies within the Bolder Group which are each legally distinct and separate entities and have no authority (actual, apparent, implied or otherwise) to obligate or bind Bolder Group Holding BV in any manner whatsoever. The operations of the Bolder Group are conducted independently and have no affiliation with third party financial, tax or legal advisory firms or corporations.