Exploring the benefits of BVI/Cayman offshore companies in Hong Kong

Hong Kong, one of the world’s freest economies, boasts a competitive tax environment, robust regulatory framework and business-friendly policies, making it a major financial and investment hub. For Hong Kong-based businesses seeking international expansion, the BVI or Cayman Islands can offer significant benefits. Using a BVI or Cayman Islands offshore company in Hong Kong can be advantageous by leveraging these jurisdictions’ tax-neutral status and ease of company formation.

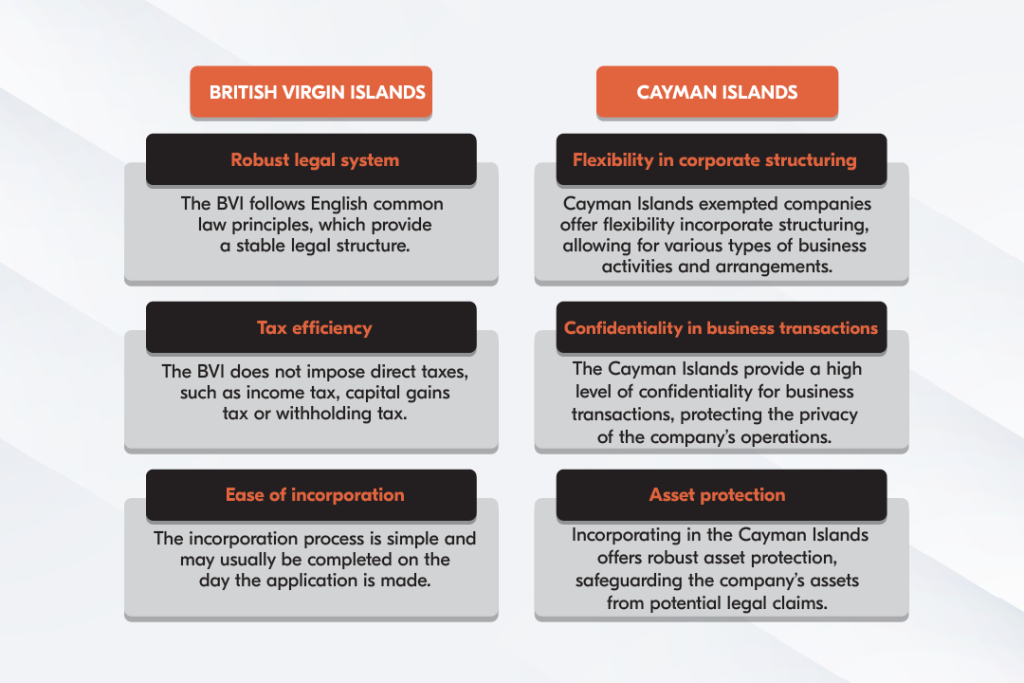

The BVI and Cayman offshore companies in Hong Kong are attractive due to their flexible corporate structures, tax advantages and enhanced privacy features. In this article, we will explore more on the reasons why these jurisdictions are the best options for anyone planning to conduct business in Hong Kong through a corporate structure.

Understanding offshore companies in Hong Kong

A Hong Kong offshore company is established in Hong Kong but mainly operates its business activities abroad. It offers businesses access to new markets, investment opportunities and tax efficiency. Hong Kong’s status as a global financial hub, fast registration and robust financial infrastructure make it an attractive location for offshore company setup.

Moreover, the Hong Kong government fully recognises these offshore companies. Individuals aged 18 and above can set up an offshore company in Hong Kong. Directors or shareholders have no residency requirements, making it accessible to global entrepreneurs.

What make the BVI and Cayman popular choices for offshore companies in HK

The BVI and Cayman Islands are preferred choices for structuring international transactions in Hong Kong. Below, we will explore the key reasons behind this preference and how Hong Kong clients can leverage the BVI and Cayman-registered companies to enhance their business operations in the region.

Furthermore, Stella Yeung, Executive Director, Head of Corporate and Private for Bolder Hong Kong, explained that one of the primary advantages for the Hong Kong market in using BVI and Cayman-registered companies for their business is that the filings with governments are all private. Only the authorised parties and Registered Agents can see the documents in some circumstances, and the information is limited and directly accessible to the public.

She also stated, “The robust legal system in both jurisdictions indeed confidently attracts quite a lot of investors, and the legal support is sufficient for clients’ projects with offshore corporate structures. The process of company registration takes about 3-5 working days, which is efficient for the founders; resident directors are not required, and the appointment of a nominee director is not required. This enhances the cost-effective advantage of hiring the local service provider for directorship service.”

The tax benefits of BVI/Cayman-registered companies impact the Asian market’s tax liability as both jurisdictions impose no corporate tax, capital gain tax, gift tax, inheritance tax, sales tax or value-added tax. “The dividends, interests and royalties are tax-exempt if the business activities are conducted outside the jurisdictions. Tax neutrality entitles investors to maximise profits and minimise tax liabilities in general. Companies are not required to file tax returns every year; compared with Hong Kong companies, administrative work is somehow minimised,” Yeung said.

Overall, entrepreneurs and investors may opt to use BVI or Cayman Islands companies rather than Hong Kong entities for domestic transactions due to various corporate benefits. However, Hong Kong clients must ensure compliance with local regulations and carefully consider the potential tax implications when using these offshore structures for their business operations to avoid any unforeseen liabilities or legal issues.

Considerations

According to Ryan Cheng, Corporate Manager for Bolder Hong Kong, the future looks good for BVI and Cayman companies working with clients in Hong Kong. As businesses keep expanding globally, they’ll need more tax-efficient and flexible company structures. Technology will also make it easier to set up and manage offshore companies. However, clients should stay aware of changing regulations to ensure compliance.

“There are a few important challenges. First, clients have to stick to local laws, including anti-money laundering regulations. Another big hurdle is the economic substance requirement, which means companies need to prove they’re actually doing business where they’re registered, not just existing as an offshore entity. Also, with the global push for more transparency, we might see stricter reporting rules for offshore companies,” he added.

Why choose to work with us

Bolder Group has a team of local fund and corporate administrators, managers and entrepreneurs who can easily navigate the market in multiple jurisdictions. We offer tailored corporate solutions for Hong Kong clients seeking to use a BVI or Cayman Islands company as their preferred corporate vehicle for undertaking business transactions in the region. We also provide expert guidance to streamline operations and meet their unique business needs.

To discuss how to get started, contact our Bolder Hong Kong team.

Bolder Group does not provide financial, tax or legal advice and the information contained herein is meant for general information purposes only. We strongly recommend that before acting on any of the information contained herein, readers should consult with their professional advisers. The Bolder Group accepts no liability for any errors or omissions in the information, or the consequences resulting from any action taken by a reader based on the information provided herein.

Bolder Group refers to the global network of independent subsidiaries of Bolder Group Holding BV. Bolder Group Holding BV provides no client services. Such services are provided solely by the independent companies within the Bolder Group which are each legally distinct and separate entities and have no authority (actual, apparent, implied or otherwise) to obligate or bind Bolder Group Holding BV in any manner whatsoever. The operations of the Bolder Group are conducted independently and have no affiliation with third party financial, tax or legal advisory firms or corporations.