Bolder Insights: FAQs on the AIFMD II

DISCLAIMER: This post was last modified on 31 October 2024. Some information in this article may not be updated.

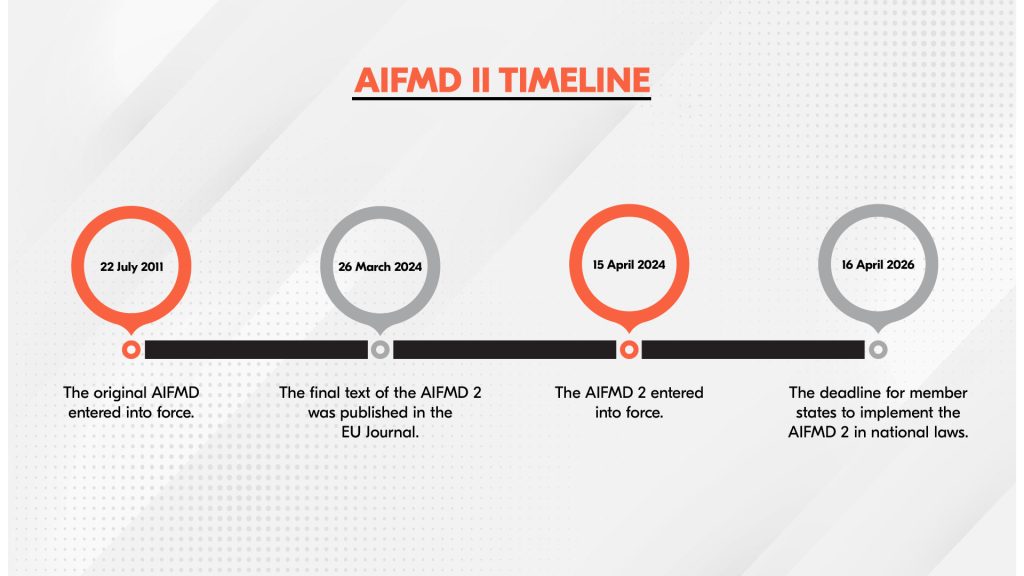

On 26 March 2024, the European Union (EU) published the final text of the AIFMD II. It entered into force on 15 April 2024 and member states will have until 16 April 2026 to implement the rules into national law.

To recall, the original AIFMD became effective in July 2011. It provides a comprehensive legislative framework for managing and marketing alternative investment funds (AIFs) in the EU. AIFMD II includes significant amendments to specific AIFMD provisions, and managers should consider how these changes could affect their AIFMD II compliance. The directive will primarily impact funds managed by EU alternative investment fund managers (AIFMs).

Preparing for AIFMD II: FAQs

Bolder Group’s Global Head of Funds, Neco Dusseldorp, answers frequently asked questions about the AIFMD II and how the requirements and compliance will affect funds, managers and their business or operations.

Who will be affected by AIFMD II?

Neco: AIFMD and its sequel, AIFMD II, applies to AIFs managed or marketed by EU AIFMs or AIFs managed or marketed by non-EU AIFMs in the EU. The total assets under management and certain other features of the investment schemes determine the applicable regime for the manager (license regime/registration regime).

Will AIFMD II require additional reporting to regulators?

Neco: The key amendments are:

- Substance and management board requirements

- Outsourcing requirements

- Loan origination

- ESG

Under AIFMD II, AIFMs must demonstrate that they have sufficient and appropriate technical and human resources to carry out their functions and supervise their delegates, if applicable. Detailed descriptions of these resources must be submitted with the license application.

For the management board, the persons who effectively conduct the business of the AIFM shall be of sufficiently good repute and sufficiently experienced in relation to the investment strategies pursued by the AIF managed by the AIFM.

Moreover, the conduct of the business of the AIFM shall be decided by at least two natural persons who are employed full-time by the AIFM or who are executive members or members of the management body of the AIFM who are committed full-time to conduct the business of the AIFM and who are resident in the EU.

However, according to the AIFMD II, these minimum requirements may not be sufficient depending on the size and complexity of the AIF. With the requirement of additional board members and key function holders, Bolder Group’s Governance Services can help to ensure effective operations.

Meanwhile, loan origination by AIFs will be subject to several new rules, including:

- A ban on ‘originate-to-distribute strategies’

- Risk diversification requirements

- Risk-retention requirements

- A requirement to have specific loan origination policies and procedures

- Conflict of interest provisions

- Article 23 AIFMD disclosure requirements specific to loan origination and related fees and costs

Will there be stricter delegation requirements/more scrutiny on outsourcing partners?

Neco: AIFMD II introduces several changes to outsourcing requirements for AIFMs, such as clarification of delegation rules, enhanced oversight of outsourced functions, substance requirements and MiFID-related outsourcing rules.

Overall, AIFMD II aims to strengthen the oversight of outsourced functions and ensure that AIFMs maintain adequate control over their activities. AIFMs should carefully review their outsourcing arrangements and ensure compliance with the new regulations.

It is important to note that the specific impact of AIFMD II on outsourcing requirements will vary depending on the specific circumstances of each AIFM. AIFMs should consult with legal and regulatory experts to assess the implications of the new rules on their business operations.

What is the impact on non-EU AIFMs & EU AIFMs?

Neco: Non-EU AIFMs marketing under the NPPR are required to provide an AIFMD prospectus (sometimes referred to as an AIFMD wrapper) in addition to the global or local prospectus already made available.

- The name of the AIF must not be deemed unfair, unclear or misleading

- Further descriptions of the AIF’s liquidity risk management and the possibility of using LMTs

- A list of fees, charges and expenses that are borne by the AIFM in connection with the operation of the AIF which are directly or indirectly attributable to the AIF.

With regard to periodic investor disclosure requirements, AIFMD II extends its scope by including:

- The composition of the originated loan portfolio

- On an annual basis: all fees, charges and expenses that were directly or indirectly borne by investors

- On an annual basis: any parent undertaking, subsidiary or special purpose vehicle utilised in relation to the AIF’s investments by or on behalf of the AIFM

The enhanced transparency requirements for non-EU AIFMs active under the NPPR also apply to EU AIFMs active under the full AIFMD regime. This means that the AIFMD prospectuses will need to be updated and that more elaborate Annex IV and ongoing reporting requirements will apply.

Ensuring AIFMD II compliance with Bolder Group

Since the implementation period is underway, AIFMs must adapt to the new regulations and take measures to guarantee compliance with AIFMD II and avoid any potential risks.

Bolder Group understands the challenges of the ever-changing funds environment. Our extensive services and bespoke solutions can assist AIFMs in all phases of AIFMD II implementation and staying compliant with the outsourcing requirements while meeting the substance requirements. Bolder provides the expertise to effectively manage regulatory changes, from fund administration to professional legal compliance support.

Contact our team to learn more about our fund solutions and how we can help you.

Bolder Group does not provide financial, tax or legal advice and the information contained herein is meant for general information purposes only. We strongly recommend that before acting on any of the information contained herein, readers should consult with their professional advisers. The Bolder Group accepts no liability for any errors or omissions in the information, or the consequences resulting from any action taken by a reader based on the information provided herein.

Bolder Group refers to the global network of independent subsidiaries of Bolder Group Holding BV. Bolder Group Holding BV provides no client services. Such services are provided solely by the independent companies within the Bolder Group which are each legally distinct and separate entities and have no authority (actual, apparent, implied or otherwise) to obligate or bind Bolder Group Holding BV in any manner whatsoever. The operations of the Bolder Group are conducted independently and have no affiliation with third party financial, tax or legal advisory firms or corporations.