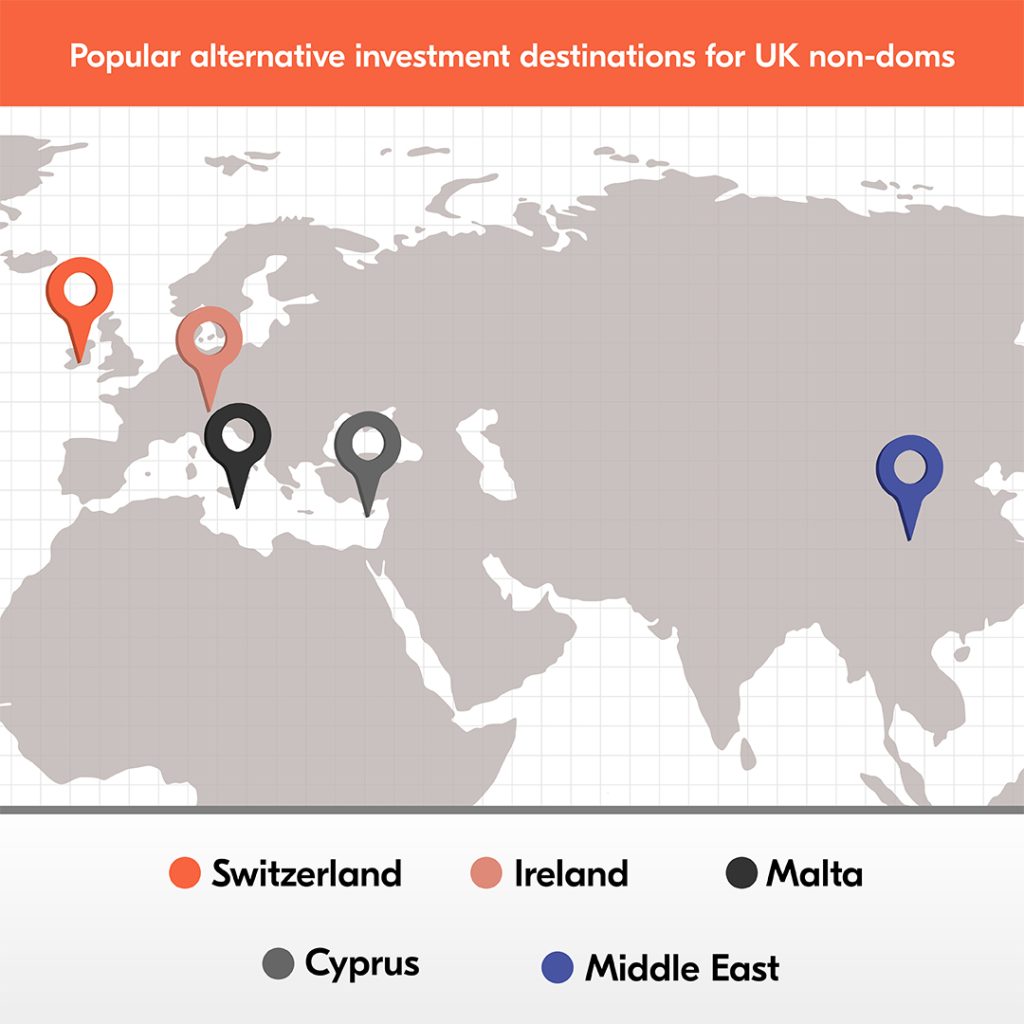

Alternative investment destinations for UK non-doms

DISCLAIMER: This post was last modified on 23 July 2024. Some information in this article may not be updated.

The abolishment of the UK’s non-dom tax regime, along with factors such as fiscal and political instability, have been seen as the reasons for the UK’s downturn of popularity for wealthy individuals and families.

Per the new rule, individuals with non-dom status will only be exempt from paying foreign income taxes for the first four years of their UK residency. Thereafter, they would be obliged to pay the same taxes as UK residents. Additionally, a residence-based regime for inheritance taxes will be implemented.

Effects of the non-dom regime changes

Effective April 2025, non-doms will no longer be able to permanently protect foreign assets held in an offshore trust from inheritance tax. They will also lose access to the remittance-basis system and face a temporary 50% reduction in their personal foreign income for the tax year 2025–2026.

Bolder Group’s Commercial Director for Europe, Tim van Santen, states, “These are significant changes to the tax regime for non-doms, and although there is a suggestion that the regime has been simplified, the rules will still produce a variety of scenarios with several layers of complexity. The transitional provisions provide time for some individuals to arrange their affairs before the new rules take effect.”

Since the announcement of this new rule, wealthy foreigners have been drawn to neighbouring EU countries by their tax policies. For instance, Spain has the Beckham Law.

Meanwhile, according to Jeroen van Zanten, Bolder’s Global Head of Growth, Marketing & Communication, some wealthy foreigners might consider relocating to jurisdictions with more favourable tax regimes, and the UK’s attractiveness as a destination for foreign investment could diminish.

Moreover, there might be a slowdown in the high-end property market as foreign buyers reassess the tax implications of owning a UK property. An increased compliance and administrative burden are also possible, requiring more frequent consultations with tax advisors and legal professionals.

The termination of the non-dom regime is causing around 70,000 non-doms in the UK to consider looking for alternative destinations and financial planning options.

Switzerland

Switzerland is a great option for wealthy individuals looking for stability, tax efficiency and a good setting for financial planning and wealth management in light of the prospective changes to the UK’s non-dom regime.

Switzerland offers favourable corporate tax rates and efficient tax systems. The country has a decentralised tax structure that gives states, or cantons, significant autonomy over how they choose to establish their tax policies. Furthermore, the efficiency and clarity of Switzerland’s tax system allow businesses to easily navigate the tax landscape.

With its established political and economic stability, Switzerland fosters a secure business environment. It is also ideal for conducting business activities due to its effective banking system and transparent regulatory frameworks.

Switzerland also offers a high quality of life, thanks to its excellent standards for healthcare, education and safety. In addition, the country is strategically situated in Europe and boasts a vast transportation network that facilitates both domestic and international travel.

Ireland

Potential changes to the UK tax system could substantially positively impact Ireland as another attractive jurisdiction because of its proximity and similar tax framework for non-doms. With a reliable remittance regime for non-doms, Ireland stands to benefit from attracting wealthy individuals from the UK. No annual fees are required, and there are no time restrictions.

It’s also fairly straightforward to be eligible for non-dom status in Ireland. The basic qualification is that a foreign national must be an Irish tax resident; no application or qualification process is needed. Moreover, Ireland is known for providing tax certainty to foreign investors. Its 12.5% corporate tax rate is a prime example.

Malta

Malta has become a top choice for tax-efficient residency because of its advantageous location in the centre of the Mediterranean. It’s an excellent option for individuals and businesses looking to maximise their tax position because of its robust legal system and attractive tax environment.

One of the key benefits of choosing Malta as an alternative destination due to the changes in the tax laws in the UK is that the country operates on a remittance-based system, meaning that individuals are only taxed on income remitted to Malta. Due to Malta’s broad network of double taxation treaties with more than 70 countries, their income is protected from double taxation.

In addition, Malta offers several residency programmes and various investment structures, such as foundations and trusts, that might offer additional tax advantages and asset protection.

Cyprus

Cyprus’s favourable tax rules, which include a non-domicile system similar to the UK’s previous rule, make it a compelling alternative.

In 2015, Cyprus introduced its own version of the non-dom status, providing tax residents without domicile in the country with a maximum 17-year exemption on international dividends and interest income.

Cyprus offers non-dom benefits and several double taxation treaties. It has one of the lowest business tax rates in the EU, at 12.5%. With its advantageous location, EU membership and excellent standard of living, Cyprus is a desirable place to live and conduct business in.

Middle East

The Middle East region has been a popular destination for wealth managers in recent years. The growing number of HNWIs in the area and the influx of foreign private wealth are two of the main drivers of this development.

Wealthy individuals are flocking to the Middle East due to its tax-free status, ease of doing business, neutral political position and post-COVID economic recovery. A report released by London-based news site CityWire in October 2023 states that major single-family offices headquartered in Hong Kong, Singapore and India are planning to or have opened a shop in the Middle East, making it an ideal alternative destination for the rich in the UK as well. This is because of the region’s potential to develop into a major global financial centre as well as the wide range of real estate, infrastructure and digital asset investment opportunities.

Other characteristics that make the Middle East an appealing wealth hub include its strategic position, a business-friendly environment for foreigners, investment opportunities and a high standard of living.

In a recent article, we discuss the various investment opportunities in the Middle East for foreign investors.

Conclusion

The impending termination of the non-dom regime in the United Kingdom highlights the significance of preemptive tax planning and exploring alternative tax destinations. One of the best alternatives is to relocate to a jurisdiction with more advantageous tax regimes, beneficial policies, robust financial systems and stable political environments to optimise and secure your wealth in the future.

Working with Bolder Group

Potential changes in UK tax laws might prompt investors, entrepreneurs and high-net-worth individuals to reassess their financial strategies. Our global team of experts at Bolder Group stays abreast of these evolving regulations to assist our clients.

To ensure a seamless transition, we can assist you in exploring new markets that will support your long-term financial objectives. We can guide you through the entire process, from business development and market entry to ongoing corporate and compliance solutions.

Our relocation advisory services can provide comparative analyses and recommendations on alternative jurisdictions based on tax benefits, legal frameworks and investment opportunities. We can also help investors establish and manage suitable investment structures, such as corporations, trusts or funds, to maximise benefits and protect assets according to their goals and the regulatory framework of the new jurisdiction.

With our presence in Switzerland, Ireland, and recently in Malta and Cyprus following Athos’ integration into Bolder Group, we have more robust private wealth and family office services for wealthy individuals/families who choose to leave the UK and relocate to these alternative locations.

Additionally, our partnership with Levari Law allows our team to assist entrepreneurs and HNWIs/wealthy families from various jurisdictions in further exploring business opportunities in the Middle East and successfully establishing their businesses in the region.

Ready to enter and explore opportunities in new emerging markets? Contact us today.

Bolder Group does not provide financial, tax or legal advice, and the information contained herein is meant for general information purposes only. We strongly recommend that before acting on any of the information contained herein, readers should consult with their professional advisers. The Bolder Group accepts no liability for any errors or omissions in the information, or the consequences resulting from any action taken by a reader based on the information provided herein.

Bolder Group refers to the global network of independent subsidiaries of Bolder Group Holding BV. Bolder Group Holding BV provides no client services. Such services are provided solely by the independent companies within the Bolder Group, which are each legally distinct and separate entities and have no authority (actual, apparent, implied or otherwise) to obligate or bind Bolder Group Holding BV in any manner whatsoever. The operations of the Bolder Group are conducted independently and have no affiliation with third-party financial, tax or legal advisory firms or corporations.