A summary of the recently published political agreement on AIFMD II (FINAL TEXT)

DISCLAIMER: This post was last modified on 20 November 2023. Some information in this article may not be updated.

BY THE NUMBERS: The Alternative Funds Industry of the EU

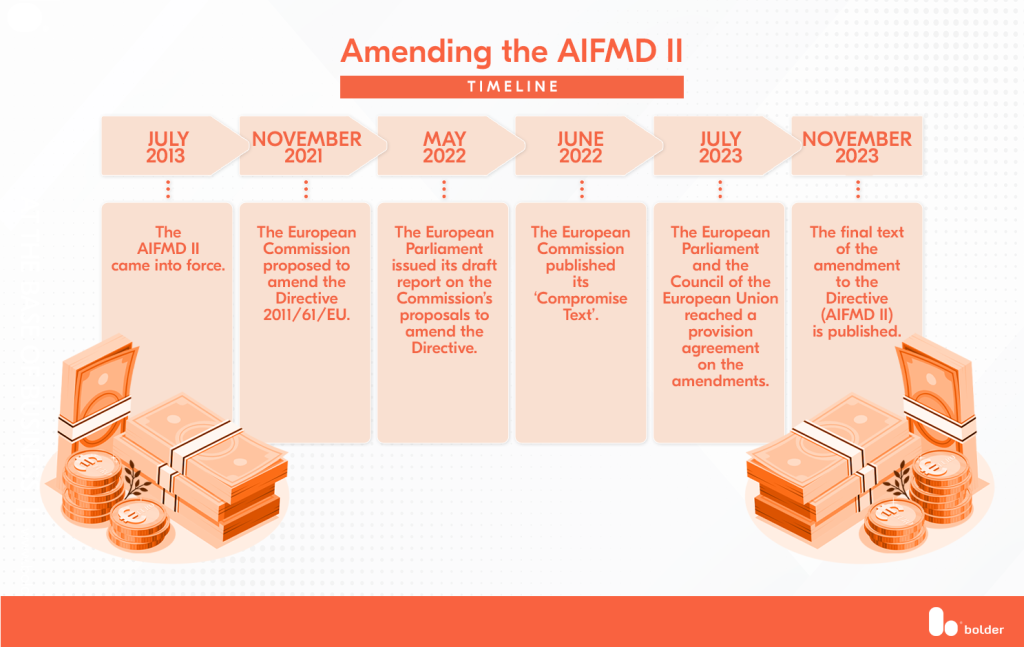

TIMELINE: Amending the AIFMD II

Why did the Commission propose to amend the AIFMD II?

- The Commission sees a need to streamline the regulations governing managers of AIFS that originate loans.

- The Commission wants clarity on the standards of AIFMs that outsource some of their functions to third-party service providers.

- The Commission wants to set policies that improve access to cross-border depositary services within the EU.

- The Commission is looking to enhance the supervision of data collection involving alternative investment funds.

- The Commission wants to utilize liquidity management tools across the Union.

HIGHLIGHTS: The amendments of the AIFMD II

The following text is the key points found in the final text of the AIFMD II as amended. Some information about the Directive may not be found below. If you wish to read the entire text (including the annexes), please access this file.

Investor Classification

- “Professional investor” is defined as an investor that is considered a professional client.

Loan Origination

- “Loan origination” is the loan directly granted by an AIF as the original lender or indirectly through a third party or SPV, which originates a loan on behalf of the AIF or AIFM.

- “Shareholder loan” is defined as a loan granted by an AIF to an undertaking. The AIF holds (directly or indirectly) a minimum of 5% of the capital or voting rights.

AIFM Authorisation

- EU Member States must require the following to an AIFM who wish to apply for an authorisation:

- Information about parties conducting the business of the AIFM (role description, title, level of seniority)

- Information about the reporting lines and responsibilities within the scope of the AIFM and otherwise

- An overview of time spent by a person for their responsibilities

- Description of the technical and human resources that support their activities

AIFM Reporting

- Quarterly, the competent authorities of the Member States must inform the European Securities and Markets Authority (ESMA), which shall keep a central public register (available electronically) regarding the same, of the following:

- Authorisations granted and/or withdrawn

- Changes in the list of AIFs managed and/or marketed in the Union

ESMA Report on AIFM Charges

- 18 months after the amendments have entered into force, the ESMA shall submit a report to the Parliament, Council and the Commission assessing and explaining the charges by the AIFMs to their investors.

AIFM Management

- AIFM managers intending to manage an AIF through a third party must submit detailed explanations of compliance to the Directive and disclose any conflicts of interest to protect the interests of the AIF they manage and the investors.

Loan Origination Risk Management

- For loan-originating activities, AIFMs must implement effective policies, procedures and processes for credit granting and risk assessment for engagement in loan exposure through third parties. There should also be at least an annual review of these policies.

Loan Concentration Limits

- When an AIF originates a loan, the AIFM shall ensure that the notional value of the loan to a single borrower by that AIF must be a maximum aggregate of 20% of the AIF capital, where the borrower is an AIF, UCITS or a financial undertaking as stated in the Article 13(25) of Directive 2009/138/EC

Loan Origination Leverage

- The AIFM shall ensure that the leverage of a loan-originating AIF must represent no more than 175% (for open-ended AIFs) or 300% (for closed-ended AIFs).

AIFM Prohibited Loan Relationships

- AIFMs shall ensure that the AIF it manages does not grant loans to the following:

- The AIFM and its staff

- Depositaries and entities to which the depositary has delegated functions

- An entity within the same group as the AIFM (as defined in Article 2(11) of Directive 2013/34/EU)

- Liquidity Management Tools

- The AIFM must implement detailed policies and procedures for activating and deactivating selected liquidity management tools and the operational and administrative arrangements for using the same. Without delay, the activation and deactivation shall be communicated to the competent authorities of the home member state of the AIFM.

Suspension of Repurchase/Redemption

- In the interest of the investors and in cases that require so, an AIFM may temporarily suspend the repurchase or redemption of the units or shares of open-ended AIFs.

Delegation of AIFM Functions

- The delegation of the functions of an AIFM to a third-party service provider shall not affect its liability towards its clients and investors. The AIFM shall not delegate functions to a third-party service provider to the extent that they are essentially no longer considered the manager of the AIF.

Appointment of Depositary in Another Member State

- When requesting an appointment of a depositary in another Member State that is not of the AIF’s, the request shall demonstrate the lack of the relevant depositary services in the home Member State of the AIF. Upon request, the depositary shall provide information obtained while performing its duties to the competent authorities of the AIF and AIFM.

AIFM Reporting to Competent Authorities

- On behalf of the AIFM, an AIFM must regularly report the following information to the competent authorities of its home Member State:

- Trade instruments

- Markets in which it actively trades

- Exposures and assets of the AIF

Exchange of Information between Competent Authorities

- The competent authorities of the home Member State of the AIFM shall ensure that all information provided to them is available to other relevant competent authorities, the ESMA, ESAs, and the ESRB.

Marketing of Non-EU AIFs

- A non-EU country where the AIF is established must sign an agreement with the home Member State of the AIFM and other Member States where the units or shares of the non-EU AIF shall be marketed. The agreement must comply with the OECD Model Tax Convention on Income and on Capital, Automatic Exchange of Information standards and multilateral tax agreements. The non-EU country must not be included in the revised EU list of non-cooperative jurisdictions for tax purposes.

ESMA Regulatory Technical Standards

- The ESMA must draft implementing technical standards for the procedures of exchange of information between:

- Relevant authorities

- ESMA

- ESRB

- EBA

- EIPO

- Members of ESCB

UCITS Cost Data

- Regarding UCITS, competent authorities shall provide ESMA, on a one-time basis, with data on costs (fees, charges and expenses) shouldered (directly or indirectly) by the investors or management companies in relation to the UCITS operations.

UCITS Liquidity Tools

- Liquidity tools (at least two) shall also be available to the UCITS (at least those listed in Annex IIA of the Directive). The ESMA shall develop regulatory technical standards specifying the characteristics of these liquidity management tools, taking into account the diversity of investments, underlying assets and the condition of the market of the UCITS.

Suspension of UCITS Repurchase/Redemption and Liquidity Management Tools

- In the interest of the unit holders, the UCITS may temporarily suspend the repurchase or redemption of its unit, as well as activate or deactivate its liquidity management tools. Additionally, it may activate its side pockets in cases where it is necessary to do so.

UCITS Notification of Activation/Deactivation of Liquidity Management Tools

- The UCITS shall immediately notify the competent authorities of its home Member State when it activates or deactivates the liquidity management tool.

On the 20th day after the publication of this amended directive in the Official Journal of the European Union, the amendments shall enter into force.

For any questions regarding this development, please reach out to your usual Bolder representative in the EU.

Featured image by Antonio Filigno

Bolder Group does not provide financial, tax or legal advice and the information contained herein is meant for general information purposes only. We strongly recommend that before acting on any of the information contained herein, readers should consult with their professional advisers. The Bolder Group accepts no liability for any errors or omissions in the information, or the consequences resulting from any action taken by a reader based on the information provided herein.

Bolder Group refers to the global network of independent subsidiaries of Bolder Group Holding BV. Bolder Group Holding BV provides no client services. Such services are provided solely by the independent companies within the Bolder Group which are each legally distinct and separate entities and have no authority (actual, apparent, implied or otherwise) to obligate or bind Bolder Group Holding BV in any manner whatsoever. The operations of the Bolder Group are conducted independently and have no affiliation with third party financial, tax or legal advisory firms or corporations.