Wealth Transfer Services

Silver Lining: Our Solution for Navigating the Great Wealth Transfer

We stand at the threshold of the most significant wealth transfer in human history.

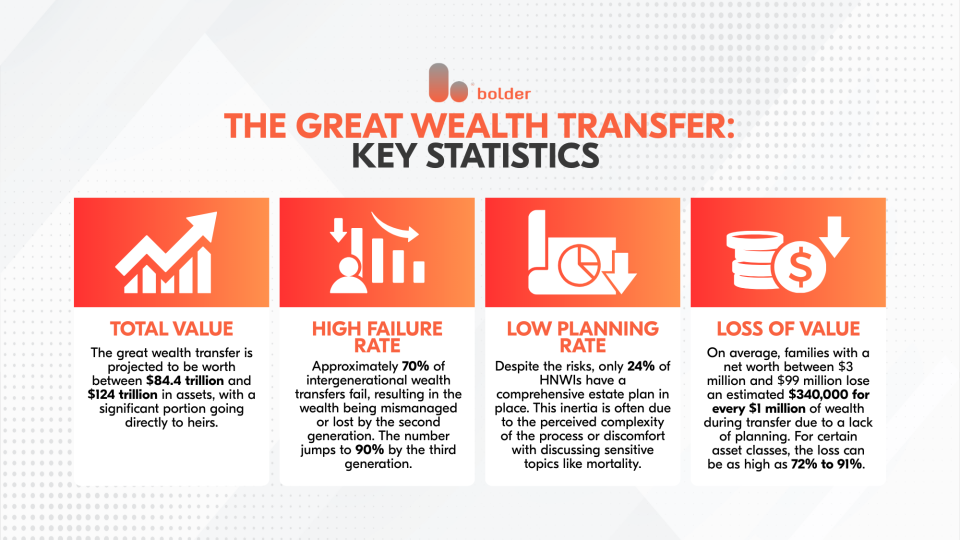

A study by research firm Cerulli Associates estimates that $124 trillion will change hands between 2018 and 2048 as Baby Boomers and Gen X transfer their accumulated wealth to younger generations. This monumental shift represents more than a financial transaction. This transfer will transform economic power, family dynamics, and societal structures in the years to come.

INFOGRAPHICS: $124 Trillion The scale of wealth transfer projected through 2048, reshaping global financial landscapes and family legacies across generations.

Apart from liquid assets, the transfer encompasses business interests, real estate portfolios, investment holdings and the intangible yet invaluable elements of family values and institutional knowledge.

For ultra-high-net-worth families, the stakes are particularly high, as the complexity of their wealth structures demands sophisticated planning and execution.

The Cost of Inadequate Planning

History demonstrates that wealth preservation across generations is far from guaranteed. Without strategic intervention, family wealth faces systematic erosion through taxation, poor investment decisions, family conflicts and inadequate governance structures.

The challenges extend beyond taxation. Modern wealth transfer plans must address asset protection from creditors and litigation, navigate the complexities arising from global asset diversification across multiple jurisdictions, and manage the psychological and emotional dimensions of family wealth.

The importance of open communication cannot be overstated; families that fail to discuss wealth transfer plans openly often experience conflicts that compromise both relationships and financial objectives.

Luckily, there is a silver lining…

The Silver Lining Service: Preserving Your Legacy

Recognising the complexity of modern wealth transfer, Bolder Group has developed The Silver Lining Service—a bespoke, holistic solution designed specifically for ultra-high-net-worth families navigating the challenges of wealth transfer.

Built upon specialised estate planning expertise, responsive client service and transparent communication, our wealth transfer services deliver comprehensive value:

- Wealth preservation through sophisticated tax optimisation

- Family alignment through structured governance and councils

- Legacy protection through strategic portfolio management

We don’t believe in one-size-fits-all solutions, especially when designing and implementing a wealth transfer plan. We understand that effective wealth transfer services require a deep understanding of both technical expertise and family dynamics.

Each engagement is highly personalised, reflecting the unique complexity of your family structure, business interests, philanthropic objectives and cross-border considerations.

Our Comprehensive Offering

Our silver lining service touches every aspect of strategic wealth transfer planning, delivered through integrated expertise across multiple disciplines:

- Wealth Transfer & Asset Protection Advanced estate planning structures, trust formation and asset protection strategies designed to preserve wealth across generations while minimising tax exposure and creditor risk.

- Succession Planning: Comprehensive business succession strategies ensuring seamless leadership transitions and continuity of family enterprises through structured governance and heir preparation programs.

- Foundation & Philanthropy Advisory: Strategic philanthropic structuring that aligns charitable objectives with tax optimisation while creating family engagement opportunities and lasting social impact.

- Investment & Corporate Management: Sophisticated fund structuring, family office administration, and investment oversight, ensuring professional management of complex multi-generational wealth portfolios.

- Lifestyle & Global Mobility: International mobility solutions, including residency and citizenship planning, cross-border pension optimisation and lifestyle transition management for globally diversified families.

Silver Lining: The Blueprint for Your Wealth Transfer Plan

The Silver Lining Value: All About Your Legacy

The transfer of wealth is not a transaction, but a way to preserve your family values and create a lasting legacy.

Bolder Group’s Silver Lining Service clears the path forward. You can rely on our expertise in complex, multi-jurisdictional tax and asset structuring to build a secure wealth transfer plan. Beyond the books and numbers, we help address the crucial human element of legacy: providing a governance framework to facilitate family councils and prepare your next generation to carry on what you have worked hard to build.

Your dedicated team operates with the utmost discretion to manage the intricate details of your wealth transfer plan, from investment oversight to philanthropic advisory and lifestyle management. We give you the space and peace of mind to focus on what truly matters: living your life.

Ultimately, our goal is to ensure that your legacy is not only protected but also thrives and endures.